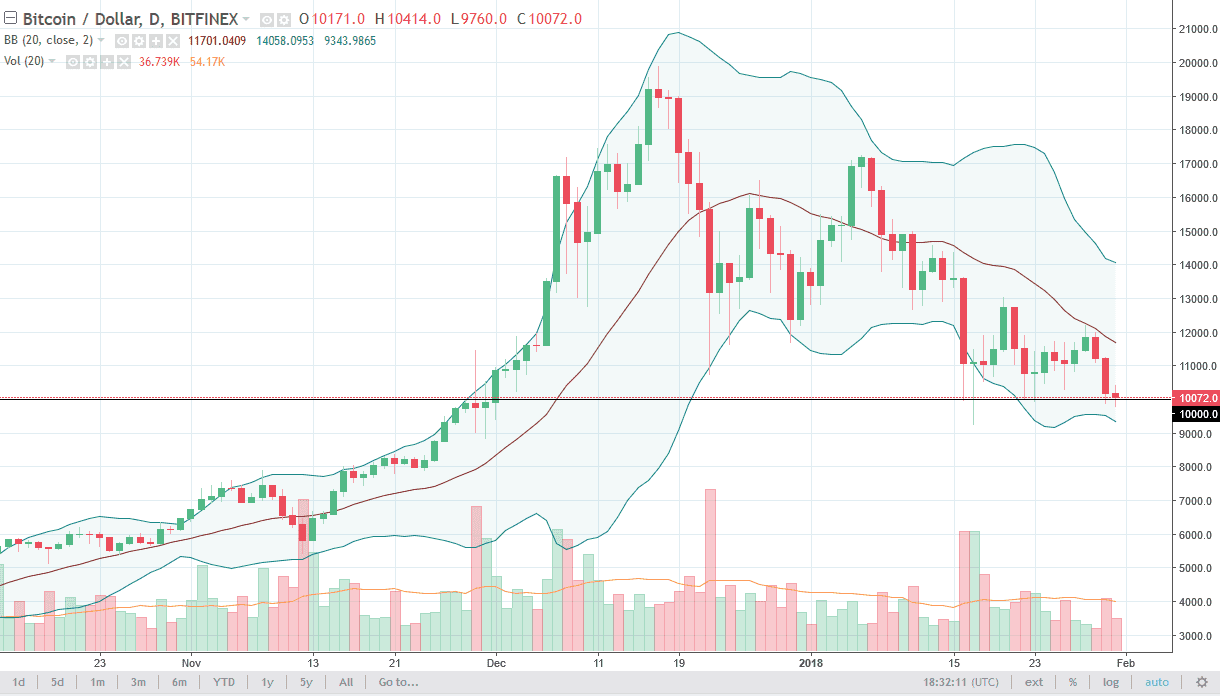

BTC/USD

Bitcoin fell slightly against the US dollar during trading on Wednesday, in shrinking volume. We continue to see the $10,000 level show signs of support, but at the end of the day we are not gaining. This is a market that looks very likely to break down, and I believe that sooner rather than later we should see selling come back into play. However, if we were to break above the $12,000 level and had a significant amount of volume, then I could be convinced to start buying. I believe that Bitcoin will continue to struggle, at least in the short term. Longer-term, it’s hard to tell how this plays out, but certainly most retail traders have either left, or are in a very negative position. As usual, we saw a massive influx of new traders come into the marketplace at the absolute highs.

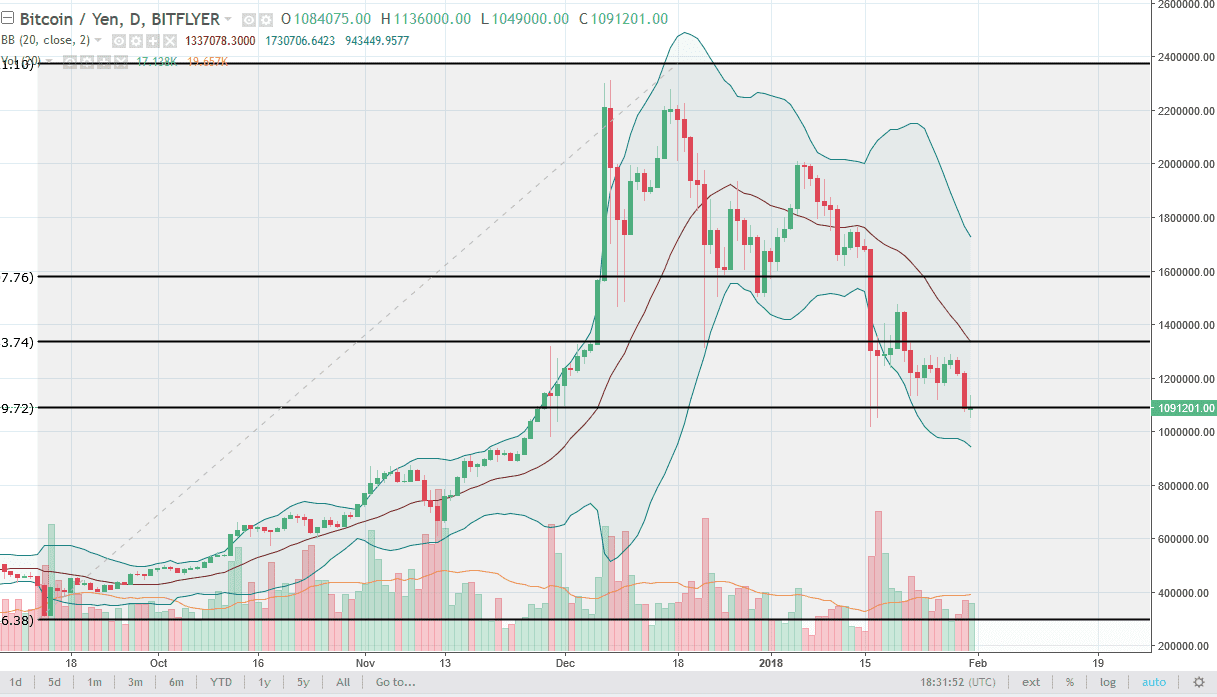

BTC/JPY

Bitcoin traders did almost nothing against the Japanese yen as well, as we continue to see a lot of interest rate around the 61.8% Fibonacci retracement level. I believe that there is a zone of support that extends down to the ¥1 million level, so I think that there is plenty of support, but if we were to break down below the ¥1 million level, the market will unravel significantly, perhaps reaching down to the ¥800,000 level. I believe that does happen, but right now we are essentially hovering around the market, trying to figure out where to go next. The Japanese yen has a very significant effect on what happens to Bitcoin around the world, because 40% of the trading is in Japan. Right now, it does not look like we are ready to bounce, and it’s not until we get a bullish candle along with strong volume that I consider buying this market.