AUD/USD

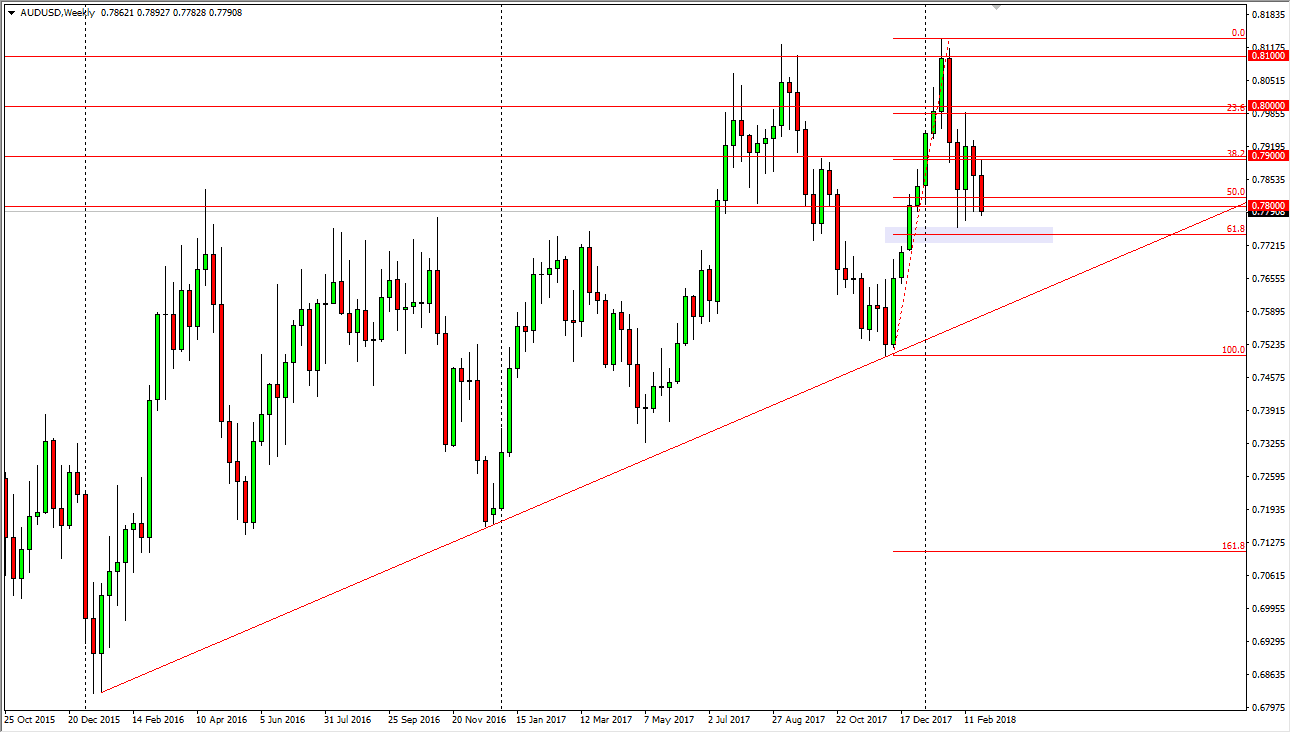

The Australian dollar initially rally during the month, but as you can see has rolled over several times during February trading. As I write this article, we are rolling over into March and I think this could be a crucial month for this pair. You can see that I have a lavender rectangle at the 61.8% Fibonacci retracement level of the most recent move, and I think there is where we are going to see real fighting for the future direction of this market. I recognize that gold has its usual influence, and I think that if gold markets roll over, that will probably send this market lower. I believe that this will be signified by a move below the 61.8% Fibonacci retracement level, which would be a breakdown and significant support. At that point, I think we would go looking towards the uptrend line underneath, which I think will be rather stringent support based upon the last 2 years.

I think that the market will offer value eventually, so if you are patient enough, you should get the opportunity to pick up the Australian dollar “on the cheap.” The first area to pay attention to is the previously mentioned 61.8% Fibonacci retracement level, at roughly 0.77. A breakdown below there will then of course send this market looking for that uptrend line, an area that on a weekly hammer or some other such bullish candle, I believe could send this market looking for bullish pressure over the next several months. I do believe the 2018 is going to be good for the Aussie dollar, but I believe that the action will be choppy as the region around the 0.80 level continues to be majorly resistive and of course is very important longer term. Eventually, I do think that we get more of a buy-and-hold situation.