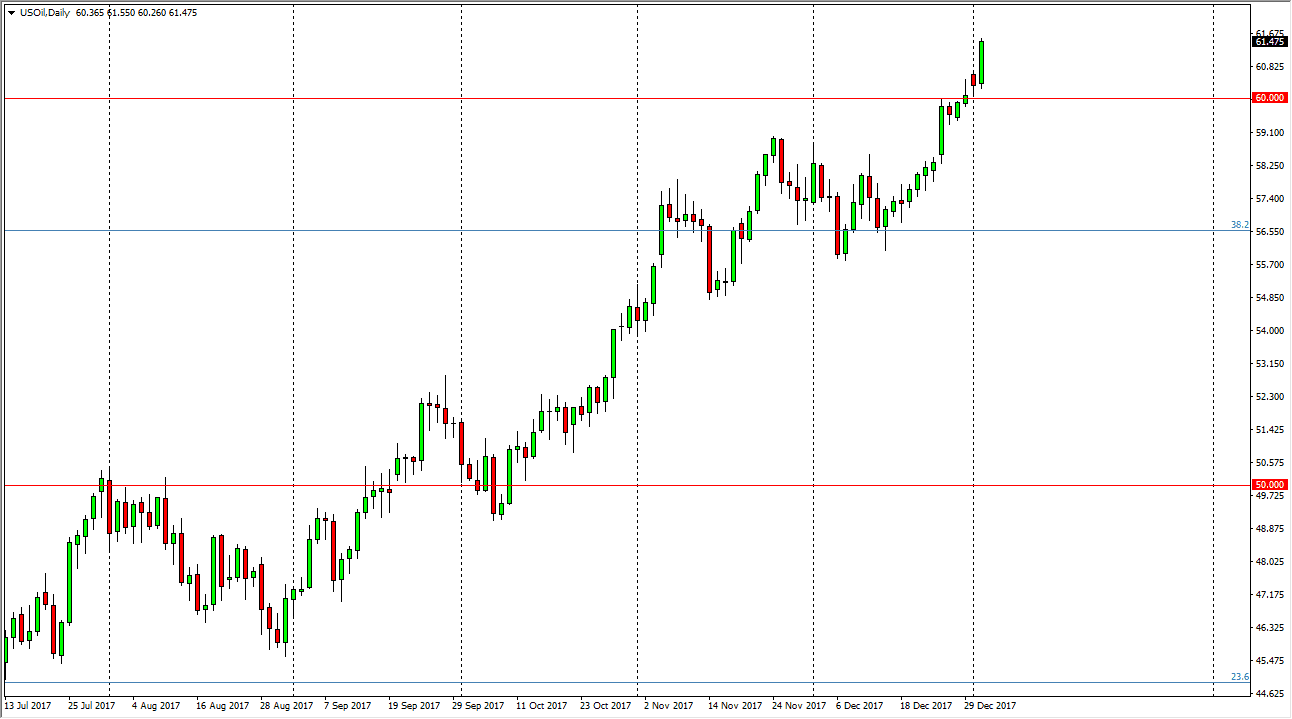

WTI Crude Oil

The WTI Crude Oil market rallied significantly during the trading session on Wednesday, slicing through the $61.50 level. The market looks likely to continue to go higher, so I think that the pullbacks give us an opportunity to pick up value. By breaking above the $60 handle a few sessions ago, it looks as if that could be the “floor” in the market, and I think that given enough time we should go to the $62.50 level after that. The $60 level should be massively supportive, and therefore it’s not until we break down below the $59 level that I would be concerned about the uptrend. The US dollar has been falling, and that of course helps oil markets as well. But beyond that, we have a lot of concerns coming out of the Middle East as far as riots in Iran, and that of course has got some people a bit nervous about oil supply.

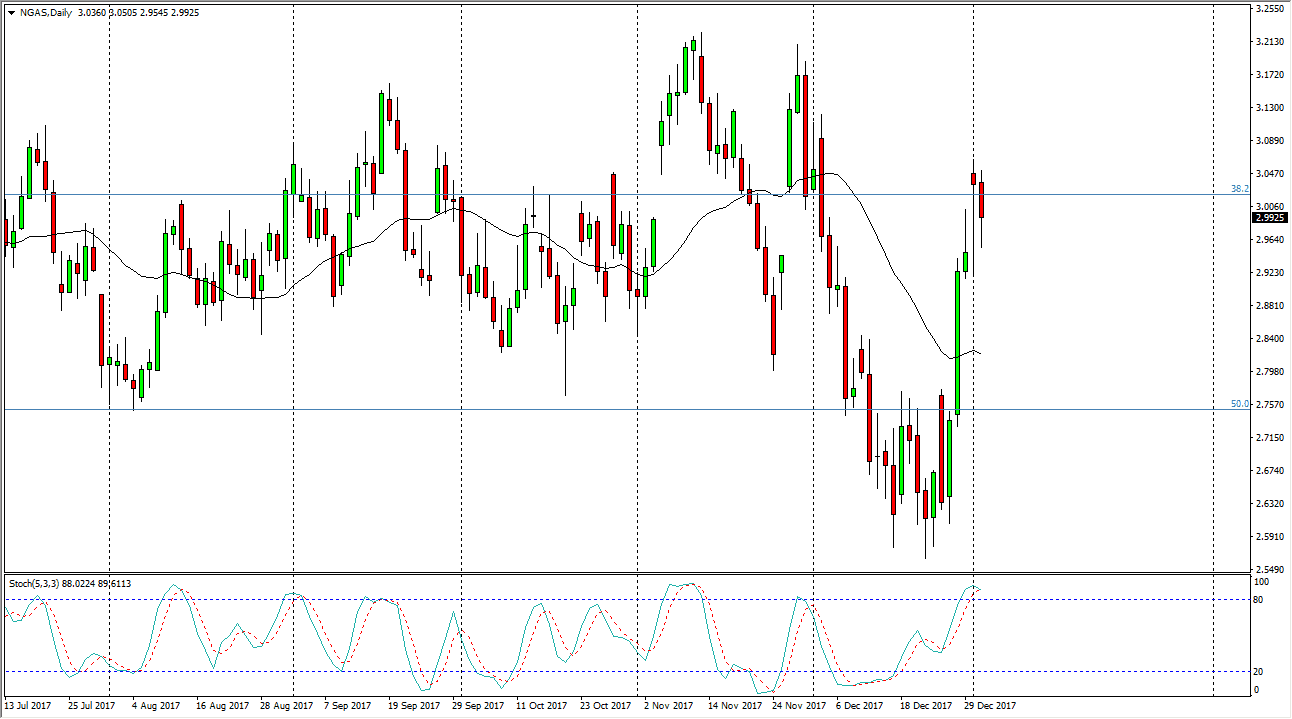

Natural Gas

The natural gas markets fell during most of the session on Wednesday, but then bounced from the gap to turn around and reach towards the $3 level. I think there is plenty of support at the $2.95 level, so as likely that we could continue to go to the upside, but I think it’s only a matter of time before the sellers return, because we are not only overextended, but we also have such massive amounts of resistance above. We cannot keep gains for any length of time, so it makes sense that eventually the exhaustion gets back into the marketplace, and that has me thinking that the markets will eventually roll over. By waiting for a negative daily candle, we then can take advantage of the overall proclivity of the sellers to step in above the $3 handle.