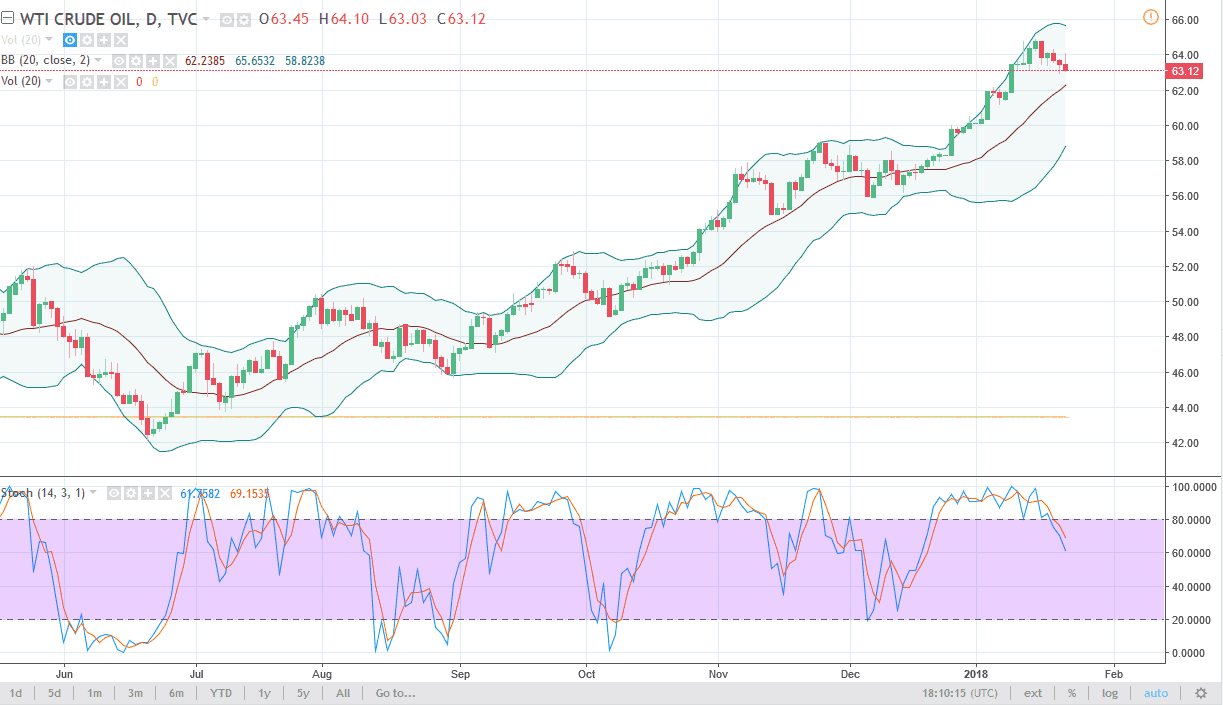

WTI Crude Oil

The WTI Crude Oil market initially tried to rally on Monday, reaching towards the $64 level and finding significant resistance. We rolled over, and at this point it looks as if we may continue to struggle. That’s not to say that I think we should be selling this market, rather than I think that we are getting a pullback so that we can build a bit of momentum to the upside again. I believe that the $62 level underneath is going to offer support, and I suspect that the $60 level underneath is going to offer a bit of a “floor.” I think that the market should find buyers underneath, so being patient and waiting for that to occur is probably the best way to go. If we break down below the $60 level, then we could go looking towards the $56 level next.

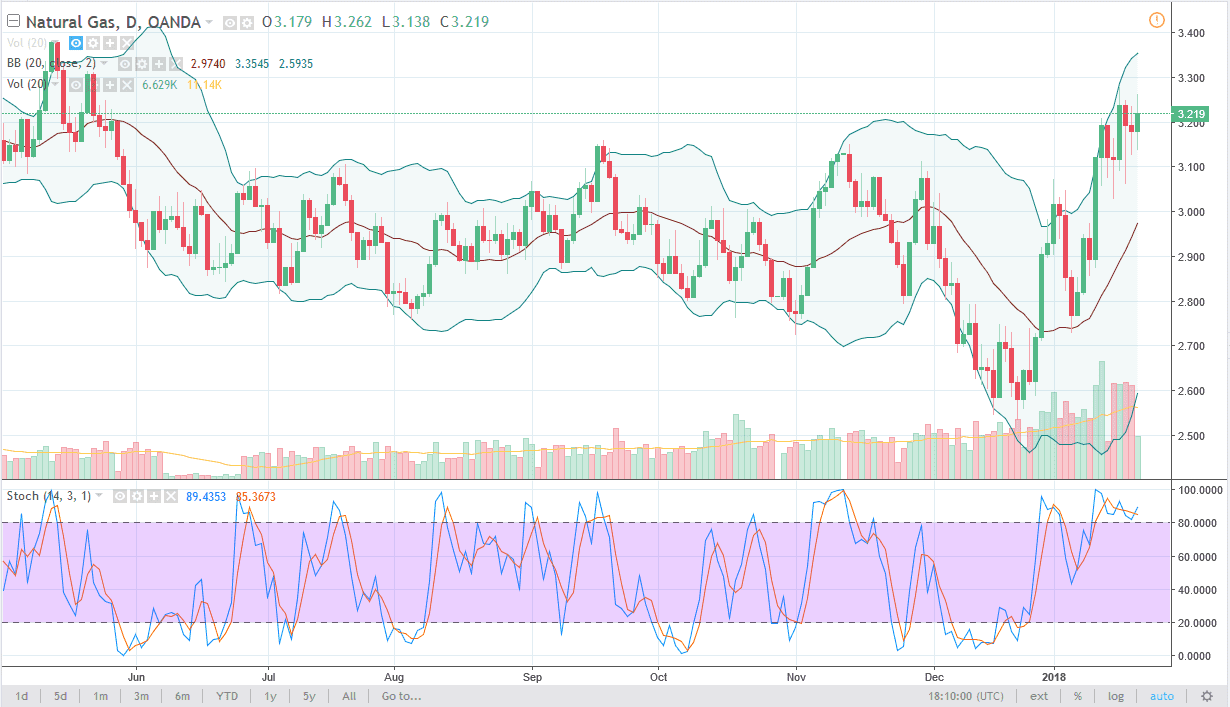

Natural Gas

Natural gas markets have gone back and forth during the day on Monday, showing volatility in both directions. We continue to consolidate after a recent breakout, and it is a significant area that we should continue to go towards the $3.40 level. I think that given enough time, the sellers will probably return, but right now we are too busy grinding around. Volume dropped on Monday, so that suggests that we may eventually have a lot of profit-taking, followed by yet another pull back in this market. We’ve gone a bit too far in the short amount of time, so at the very least we need to consolidate the gains. I believe that the market will eventually form an exhaustive candle that we concert selling. The $3 level underneath should be support, but a breakdown below there opens the floodgates a much lower levels. We have far too much in the way of supply for this rally to continue much higher.