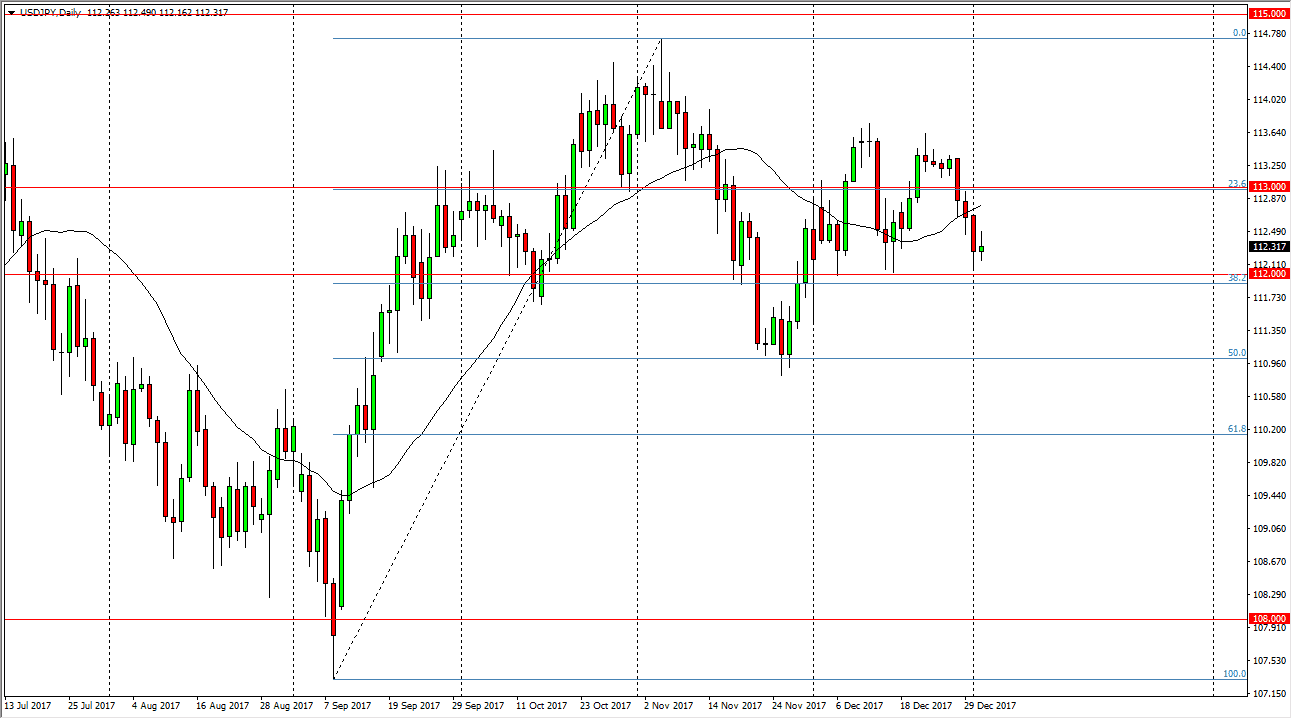

USD/JPY

The USD/JPY pair went back and forth during the trading session on Wednesday, as we continue to see support just below at the 112 handle. I think that the market is more than likely going to try to reach to the upside, as the 112 level has been massively supportive. That doesn’t necessarily mean that I am willing to jump into this market with both feet, but given enough time I think that we will see the buyers return. This market is very sensitive to the jobs number, so Friday will be a big day for this pair. Until then, I suspect it will be reasonably quiet, but if we break down below the 112 handle, the market should then go looking towards the 111 level. Between now and then, I think there is a significant amount of resistance at the 113 handle.

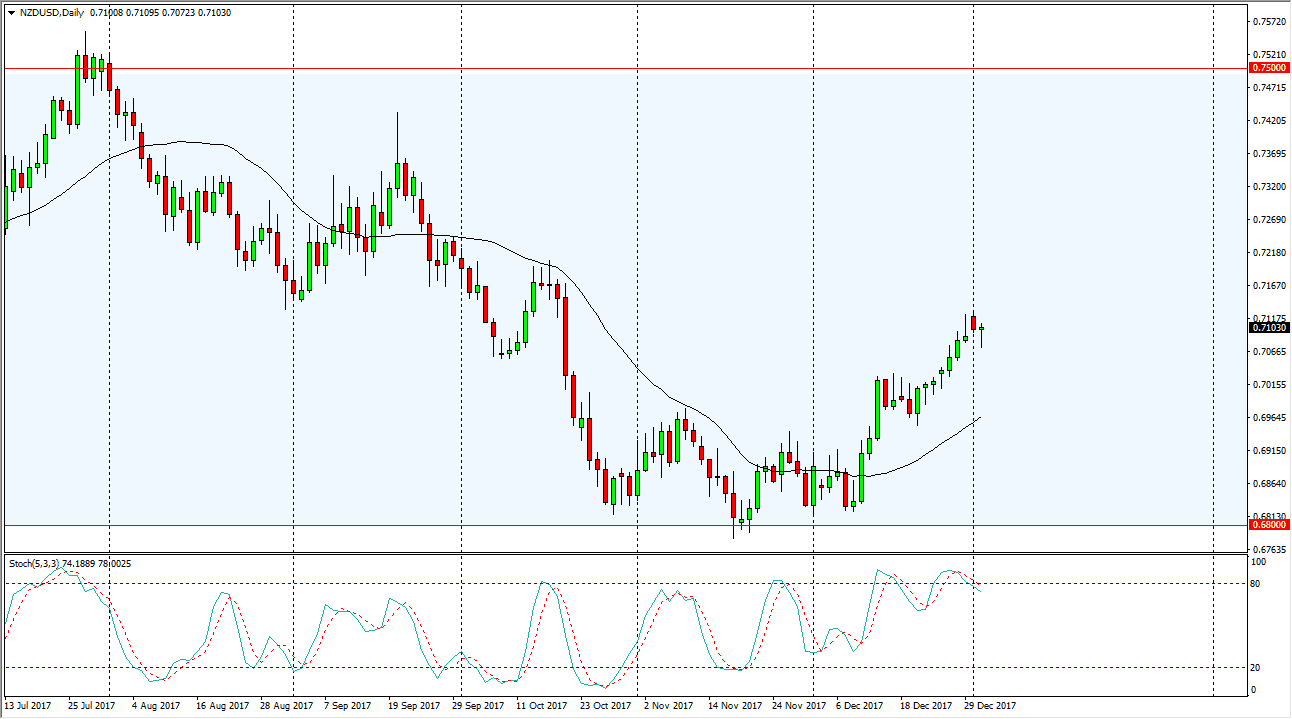

NZD/USD

The New Zealand dollar fell initially during the trading session on Wednesday, but then turned around to form a hammer. The hammer is a very bullish sign, as we sit at the psychologically important 0.71 handle. I believe that the New Zealand dollar should continue to go higher, perhaps towards the top of the overall consolidation area. The 0.75 level above is the “ceiling” in the market, just as the 0.68 level underneath is the “floor.” So, having said this, I believe that even if we do pull back a bit, it will only offer a buying opportunity given enough time. Remember that the New Zealand dollar is highly sensitive to the overall attitude of stock markets in commodities around the world, so pay attention to risk appetite, it should give us an idea as to where the market is ready to go next. In general, the US dollar continues to suffer.