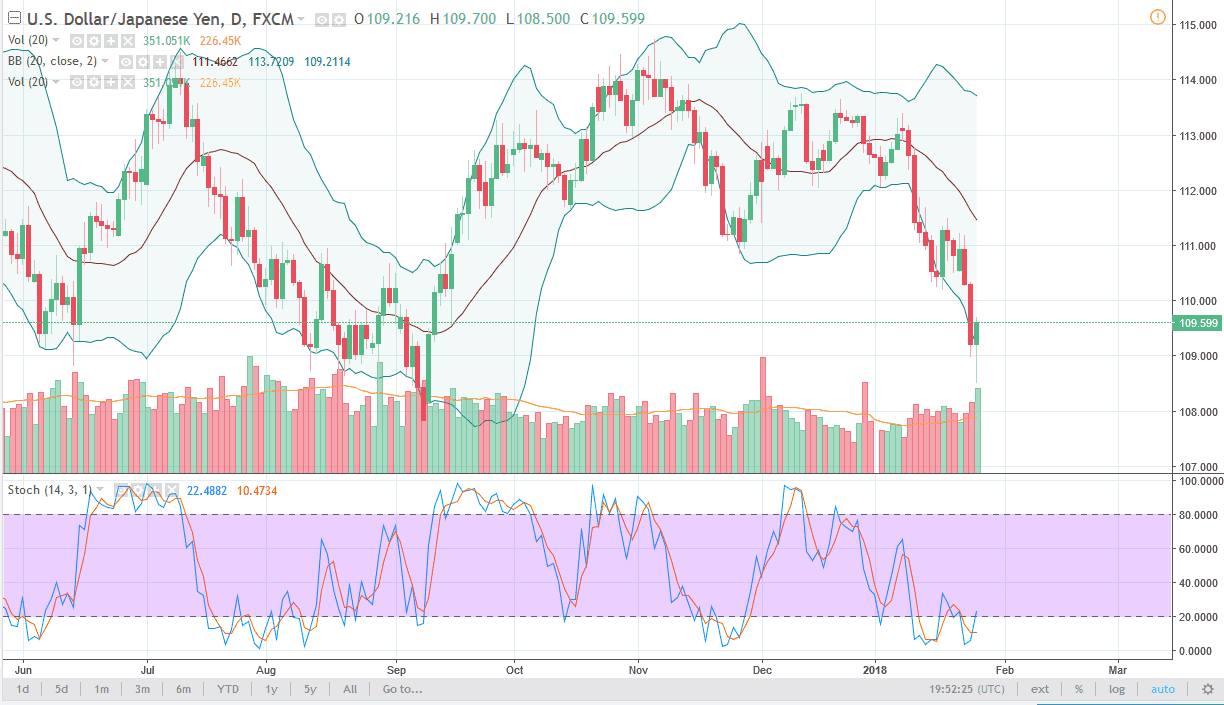

USD/JPY

The US dollar initially fell against the Japanese yen during the trading session on Thursday but turned around to form a hammer. The hammer of course is a bullish sign and I think it shows that we are getting into and oversold condition. We were selling off quite stringently, but Donald Trump suggested that the US prefers a stronger dollar, and then the next thing you know everything turned around. We’ve heard the story for decades, and we know it’s not true, yet for some reason the FX markets continue to buy the story. Regardless, the market was a bit oversold, so this was the reason we needed. I still expect to see a significant amount of resistance above, especially near the 110 handle. Because of this, this rally should be a selling opportunity on signs of exhaustion.

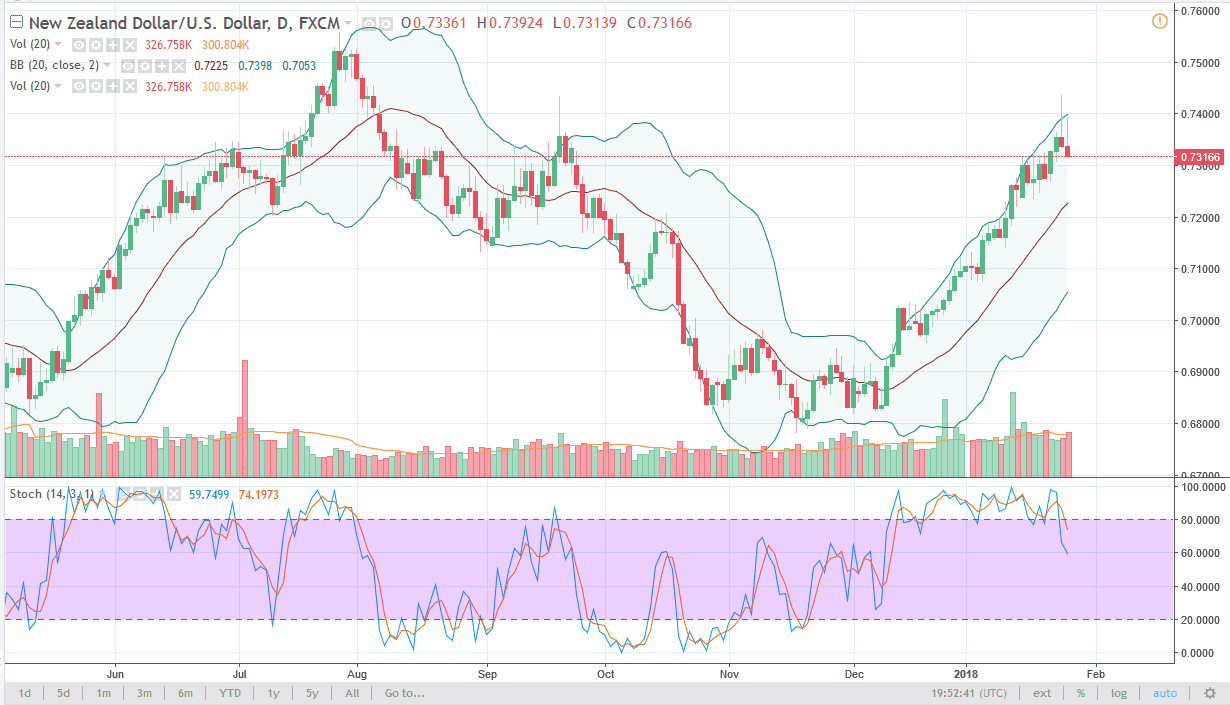

NZD/USD

The New Zealand dollar was by almost all accounts overstretched. We had formed to shooting stars in a row, and that’s a significant signal. I think we will probably pull back a bit from here, but I would anticipate seeing buyers coming back near the 0.72 handle. If we break above the top of these candles, then we will be knocking on the door to the 0.75, a major resistance barrier. I believe that the market should continue to be aggressive above there, and it becomes more of a “buy-and-hold” market. In the meantime, I like buying dips, I think we are about to get one that we can take advantage of. It’s not until we break down below the 0.70 level that I think things will have changed. Remember, most of this is simple noise coming out of the mouths of politicians, which you can take seriously for any length of time.