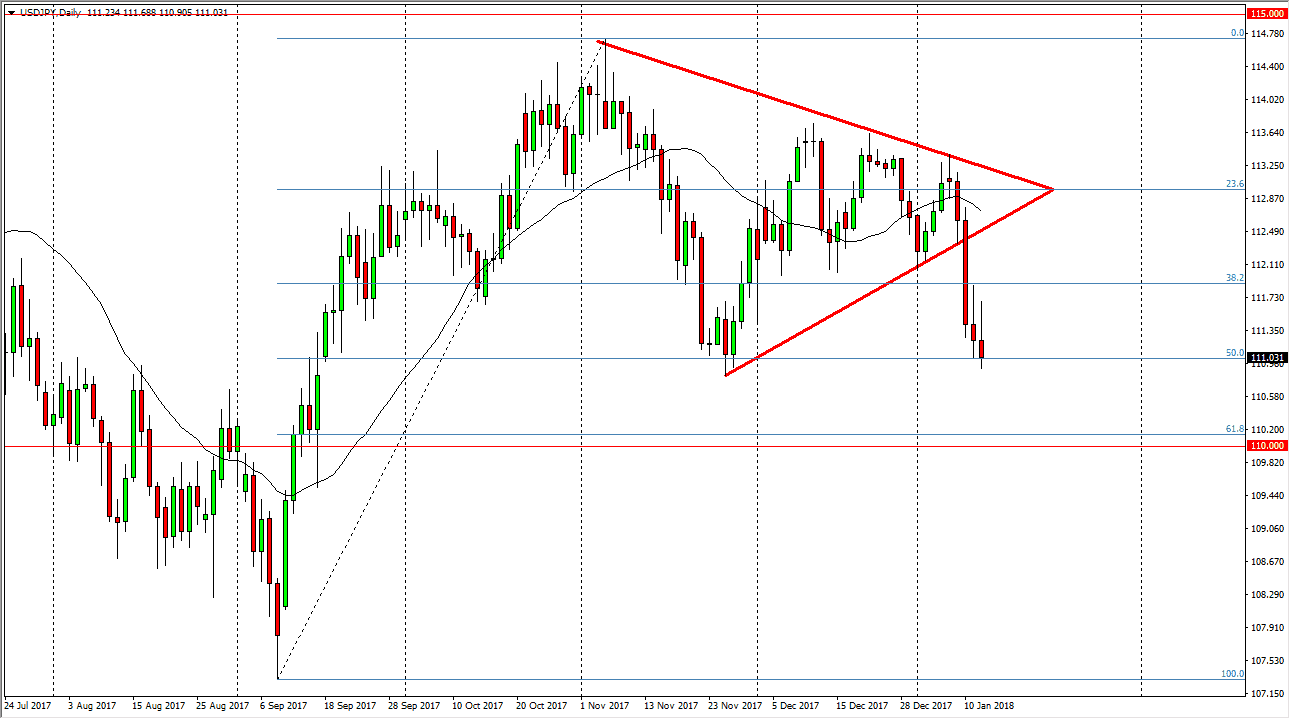

USD/JPY

The US dollar has rallied initially during the trading session on Friday, but turned around to form a shooting star, just as we did on Thursday. The US dollar seems to be in serious trouble, as we are testing the 111 level. If we can break down below there, and it looks like we can, the market will probably go looking towards the 61.8% Fibonacci retracement level, just above the 110 handle. That’s an area that is significantly supportive based not only upon the large, round, psychologically significant number, and of course the Fibonacci retracement level itself. Of the short-term sellers are going to come in and punish this market, as the US dollar simply cannot hold on to gains against anything at this point. Short-term rallies that show signs of exhaustion should be selling opportunities based upon what we have seen over the last couple of sessions.

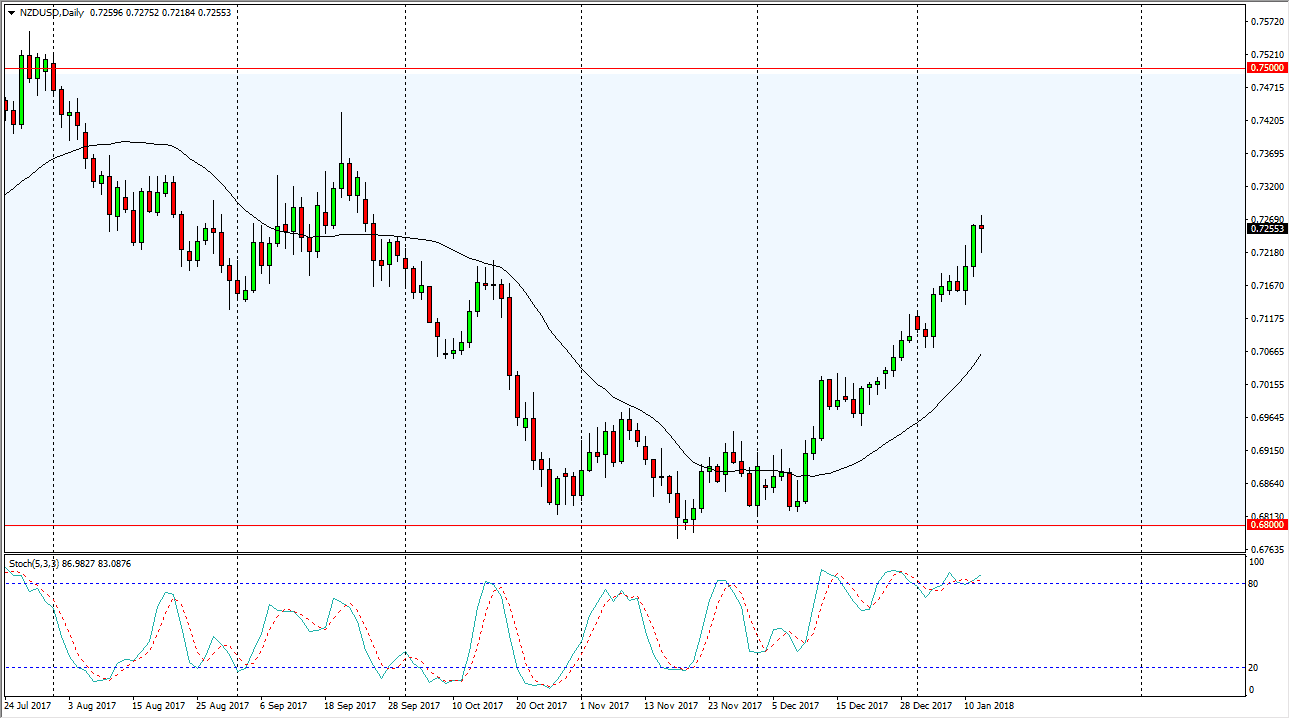

NZD/USD

The New Zealand dollar traders initially sold during the day on Friday, but turned around to form a hammer. The hammer sits just above the 0.7250 level, an area that should offer support, just as the 0.72 level well. I think the market eventually goes looking towards the 0.75 level, but it is going to be very noisy between now and then. The occasional pullback could happen, but that pullbacks should be thought of as value, as the US dollar is selling off so aggressively worldwide.

If the commodity markets rally, that should be a reason to go long as well, as the New Zealand dollar typically follows the overall attitude of commodities in general. If we can break above the 0.75 level, the market can go much higher, perhaps reaching towards the 0.7750 level. I have no plans to short this market in the near term.