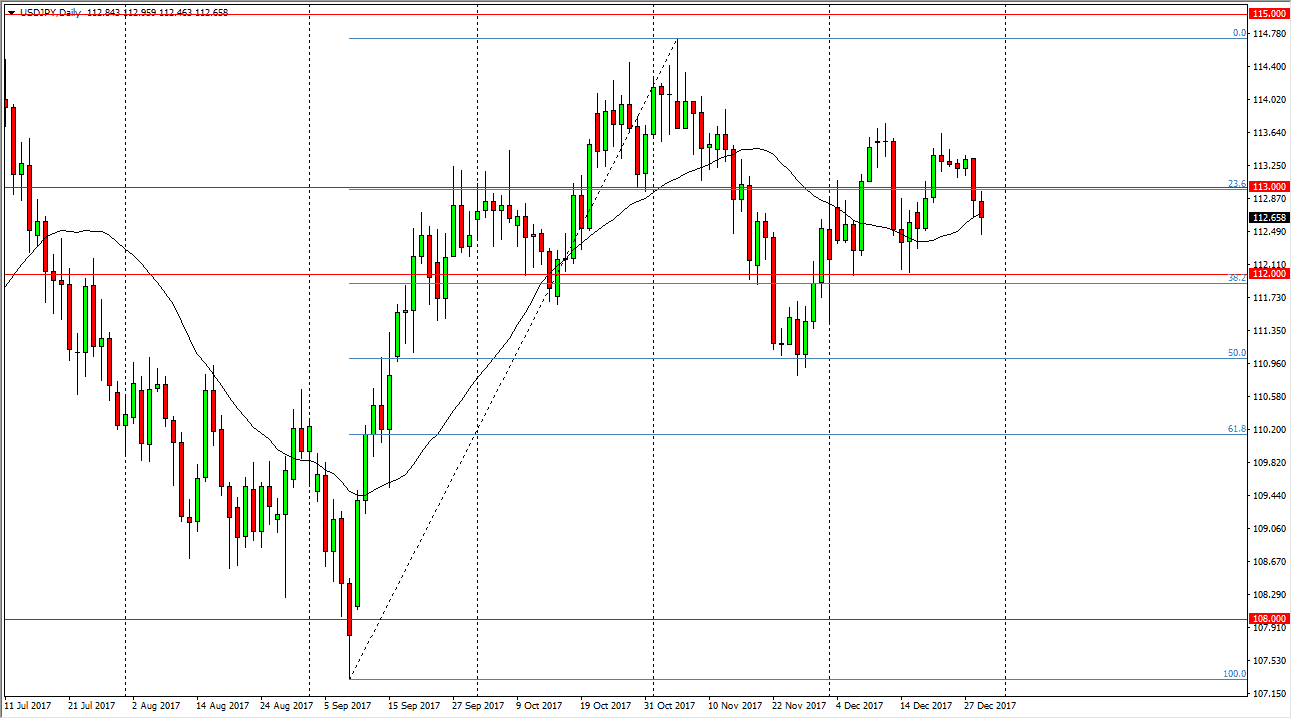

USD/JPY

The US dollar fell against the Japanese yen during the trading session on Friday, and what would have been very thin trading. I believe that this market is trying to find some type of bullish pressure to go higher, but were probably going to drift lower over the next couple of sessions as we await the December jobs numbers. That announcement almost always has a massive influence on where this pair goes next, so keep that in mind. I believe that the market will eventually break out to the upside, and reach towards the 115 level. However, that could take some time though. The 112-level underneath it should offer support, so I’m waiting for a bullish signal to start going long. If we break down below the 112 level, we should then see this market try to reach towards the 111 handle.

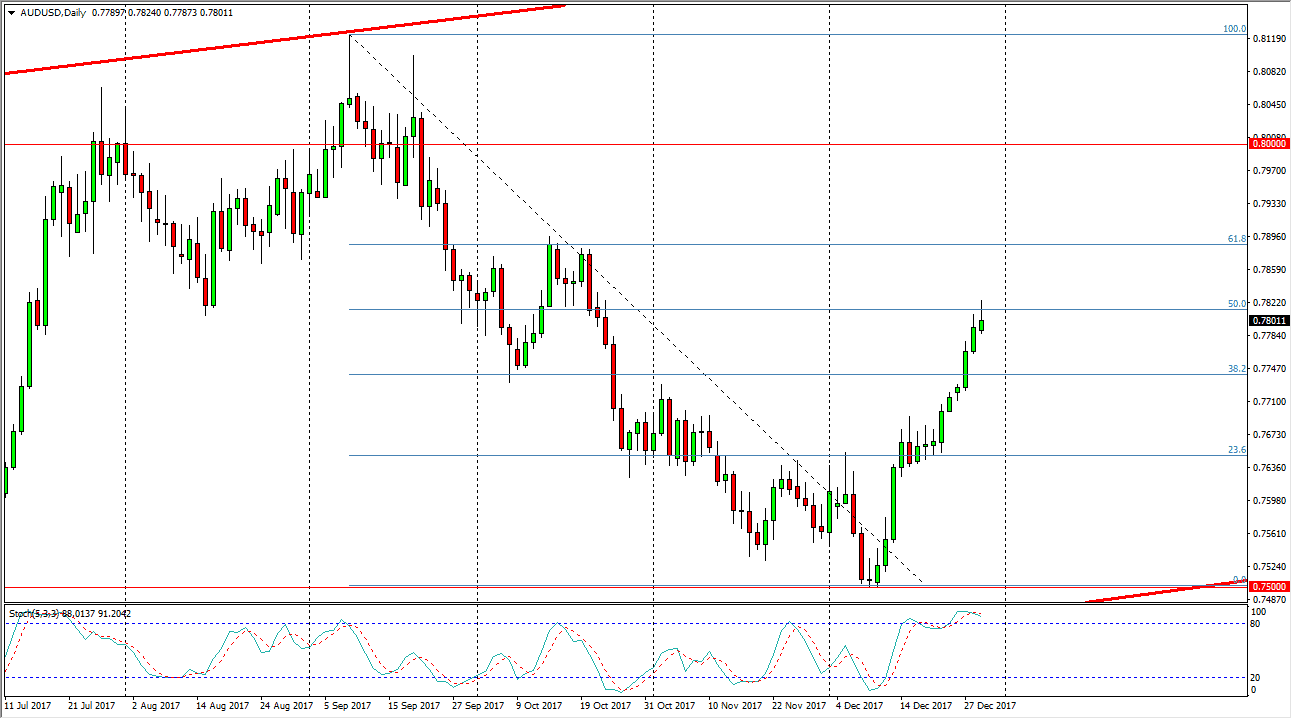

AUD/USD

The Australian dollar rallied during the trading session on Friday but gave back about half of the gains. We ended up forming a shooting star, and it is also at the 50% Fibonacci retracement from the most recent move lower. However, we are in a longer-term uptrend channel, so I think it’s only a matter of time before the buyers get back involved. Gold markets rallying will help of course, and we did break above the $1300 level during the day, which of course is very bullish. The US dollar seems to be struggling overall, and that will help send this market higher also. Once we break above the top of the shooting star from the Friday session, I believe we will then go looking towards the 0.79 handle above. If we do pull back, look for short-term bounces or supportive candles to get involved as I think the 0.77 level underneath will be very supportive.