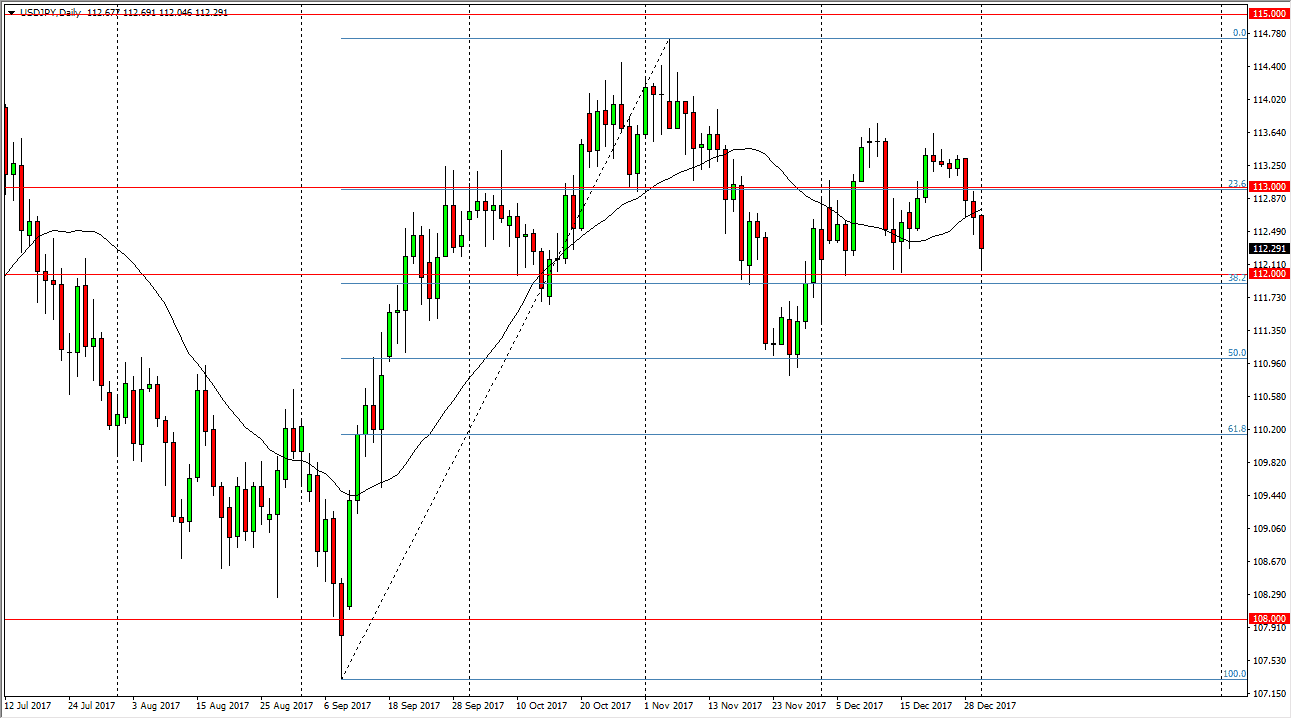

USD/JPY

The US dollar fell significantly during the trading session on Tuesday, reaching down to the 112 level. This is an area that has been supportive several times over the last month, so it’s not surprising to see that we rallied a bit. I think that the market could bounce from here, perhaps looking towards the 113-handle next. However, we have the jobs number coming out later this week, and that of course is the largest influence on this pair. Once that number comes out, I think we will get more clarity in a market that is winding up for a move. If we were to break down below the 112 handle, then I think we go to the 111 level. Volatility should continue, but given enough time I think that the move will be obvious and worth following. In the short term, you could play a range bound strategy.

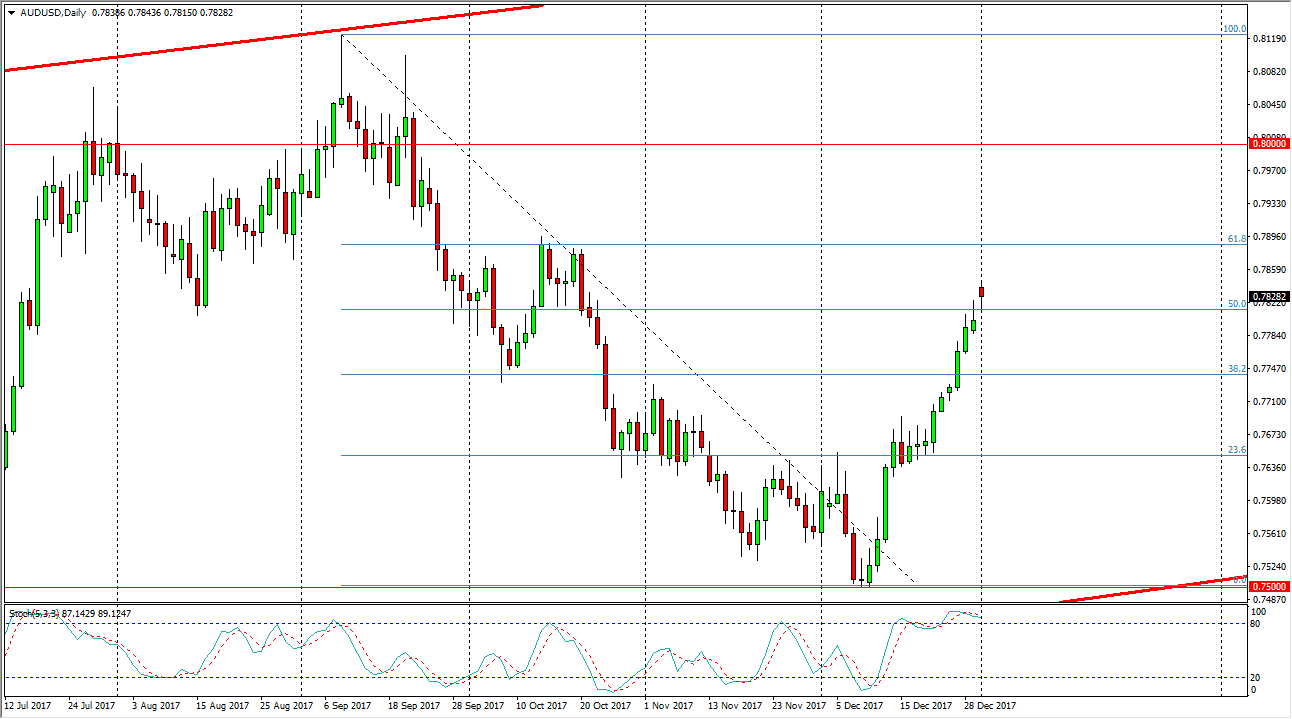

AUD/USD

The Australian dollar gapped higher at the open on Tuesday, but then pulled back to fill that gap, before rallying. This hammer is a very bullish sign, especially considering that it has formed above the shooting star from the Friday session. If gold markets continue to rally, it’s likely that the Australian dollar will as well. I think that the 0.79 level above will be a target, and eventually the 0.80 level after that will be. That is a significant level on the longer-term charts, and if we can break above there I think it becomes more of a “buy-and-hold” scenario. In the meantime, I look at pullbacks as value, at least until we would break down below the 0.76 handle underneath, which I don’t think it is going to be likely over the next several sessions, at least not until the jobs release.