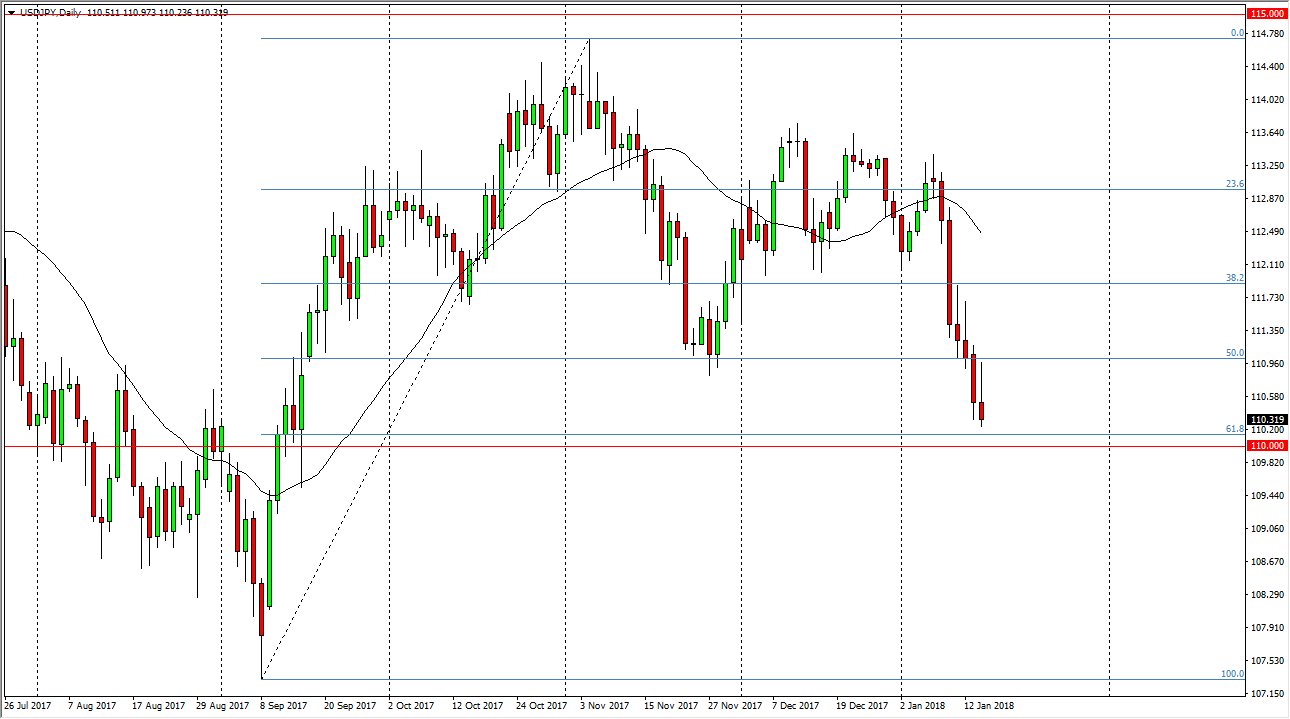

USD/JPY

The US dollar initially tried to rally during the trading session on Tuesday, but turned around to form a shooting star. The shooting star is a negative sign, and I think that a breakdown below the bottom of the candle has the market looking towards the 110-level underneath. This is an area that should be supportive, as it is not only be 61.8% Fibonacci retracement level, but also a large, round, psychologically significant number. I believe that rallies at this point in time are going to have a lot of resistance between here and the 112 level. A breakdown below the 110-level census market much lower, perhaps down to the 108 handle after that, maybe even the 107.50 level which would be a complete wipeout of the move higher.

AUD/USD

The Australian dollar had a volatile session going back and forth during the Tuesday trading hours, ultimately settling on a hammer. A break above the top of the hammer should send the market looking to the 0.80 level, which is an area that has been important for decades. Pullbacks should find plenty of support at the 0.79 level, as it is an area that was previous resistance. I recognize that there will probably be noise to the 0.81 handle, so once we get above there I think that it becomes more of a “buy-and-hold” scenario that people can take advantage of.

If we were to break down below the 0.78 level, I think that would change a lot of things and send this market down towards the 0.7675 level, and perhaps even lower. However, if we break out to the upside in the gold markets, the market should follow right along with the precious metals.