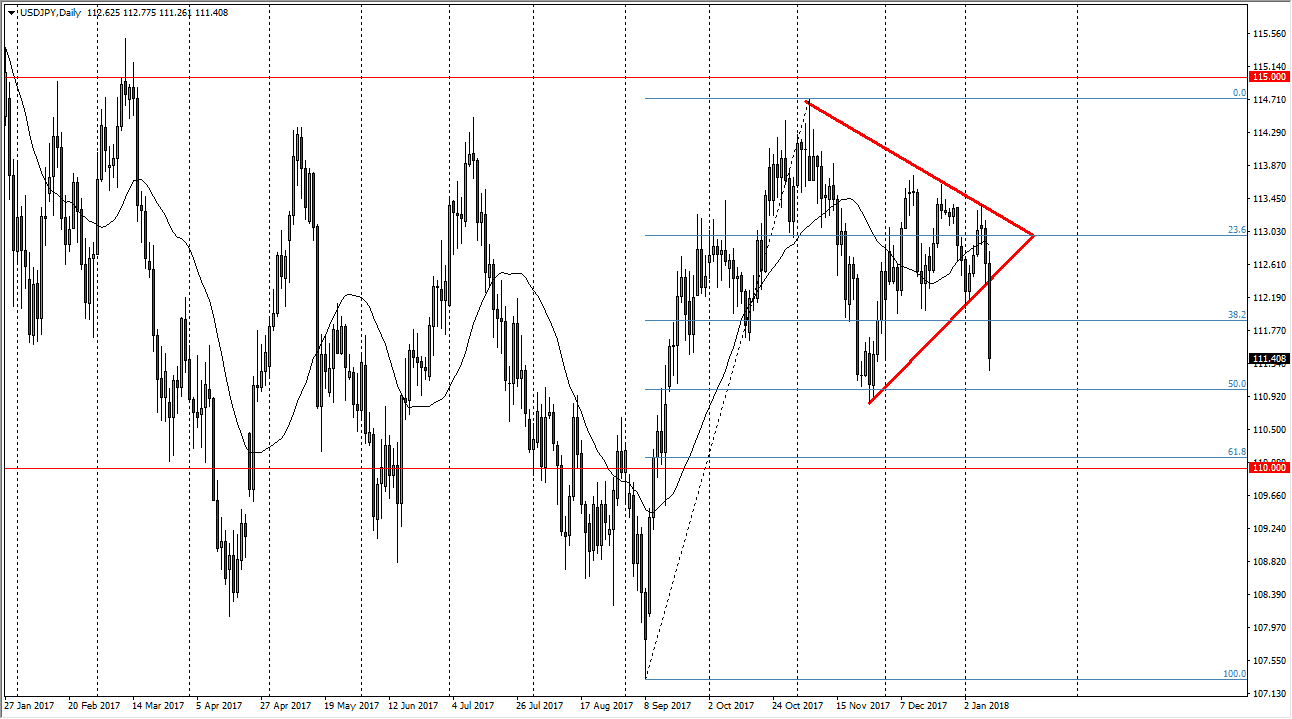

USD/JPY

The US dollar fell significantly against the Japanese yen during the trading session on Wednesday, slicing through an uptrend line, breaking down below the bottom of that line and suggesting that we are going to continue to see bearish pressure. Quite frankly, this is a very negative candle, and this suggests that we are going to continue to see a bit of negative pressure. I believe that the 111-level underneath is supportive, and a breakdown below there I would anticipate that the market would go to the 110 level which is the 61.8% Fibonacci retracement level. Market participants continue to be very back and forth in this market, as this pair tends to be volatile. The very suggestion that the Bank of Japan may be looking to step away from quantitative easing has had a very detrimental effect. However, I think it’s only a matter of time for the buyers return, so I’m looking for an opportunity to go long, but don’t see it yet.

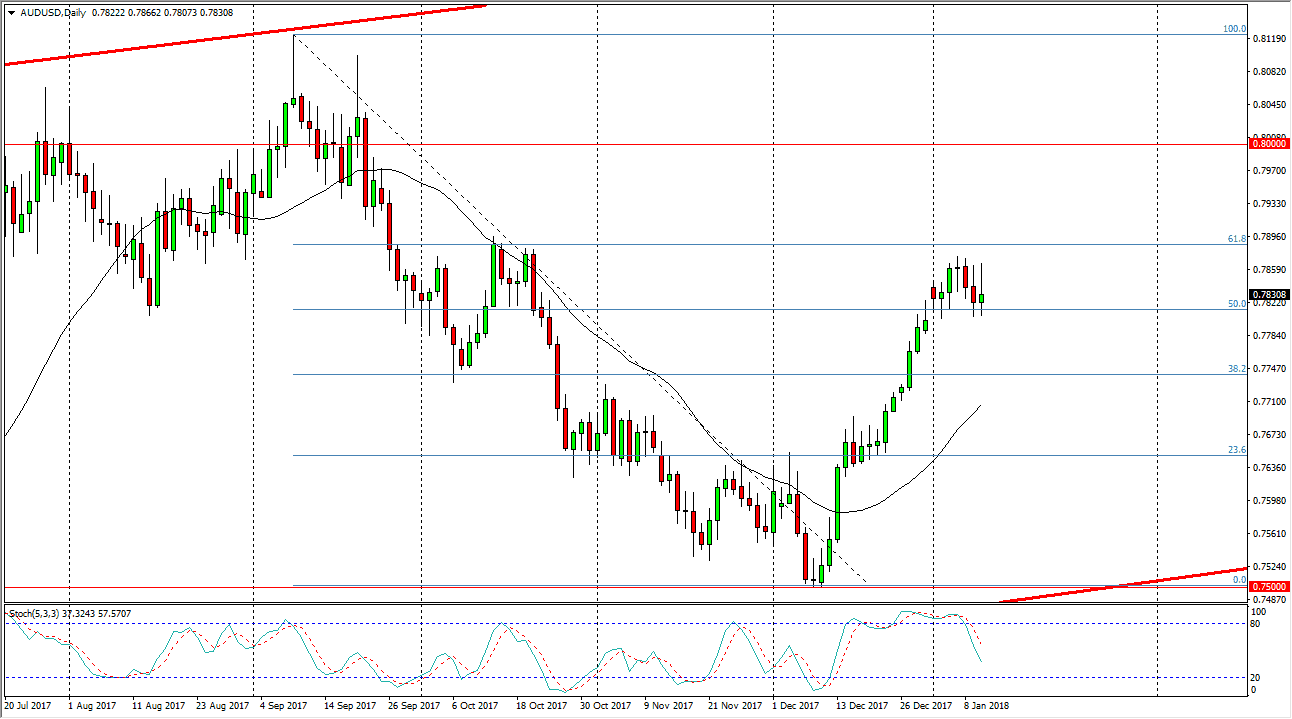

AUD/USD

The Australian dollar tried to rally during the trading session on Wednesday, but gave back most of the gains to form a bit of a shooting star. It sits on top of the 0.78 handle, and that’s an area that could be supportive. If we break down below that area though, I think will go down to the 0.77 handle underneath, which was an area that has been resistance in the past. I believe that if we can break above the 0.79 level above is a gateway to the 0.80 level which is longer-term in its importance, and I believe that a break above that level will probably send this market to much higher levels, perhaps giving us an opportunity to be more “buy-and-hold.” In the meantime, if we do get a pullback it might be a short-term selling opportunity at best.