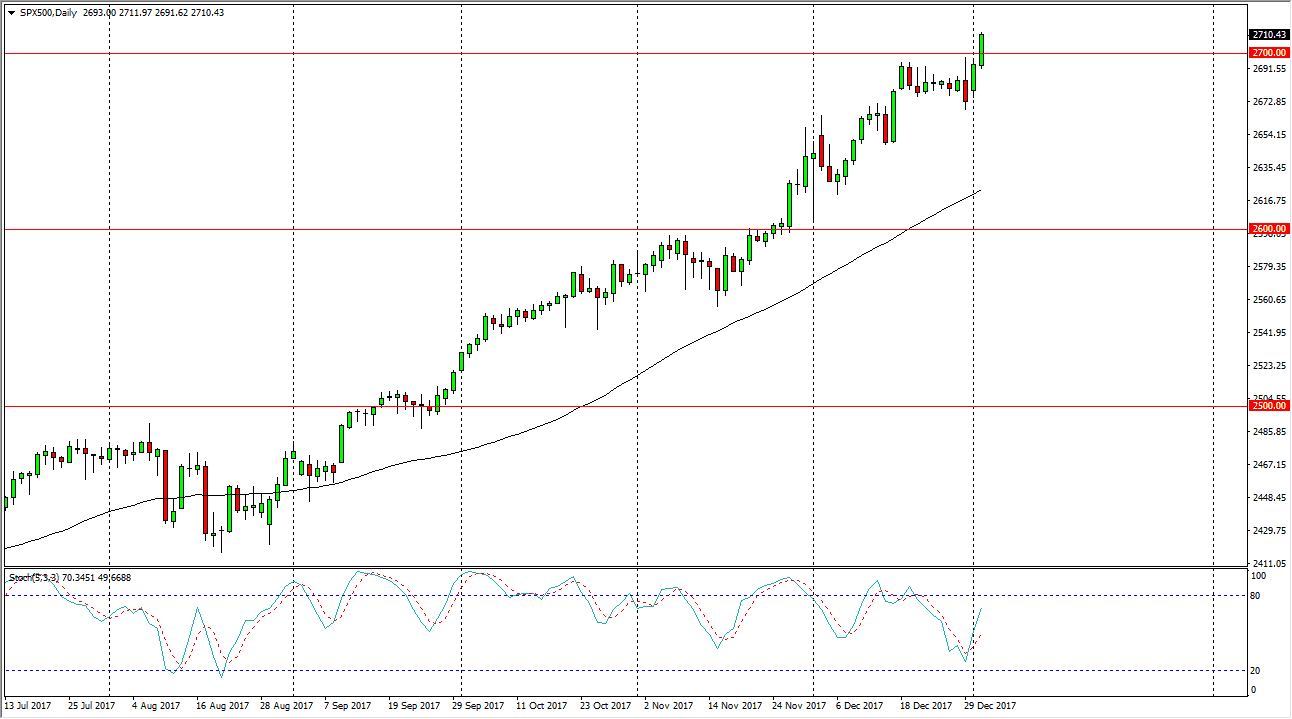

S&P 500

The S&P 500 had rallied significantly during the trading session on Wednesday, slicing through the 2700 level. By doing so, it looks very likely that we are going to continue to see buyers jump into this market place, and I think that short-term pullbacks are buying opportunities. By closing towards the top of the range for the day, it looks like we are going to continue to see plenty of buying pressure. I think that the market should see support down to the 2675 handle, and with that being the case this is a “buy only” and “buy on the dips” type of situation. Longer-term, I think that we go to the 2800 level, but we have the jobs number coming out on Friday and it’s likely that we will continue to be a bit cautious because of it.

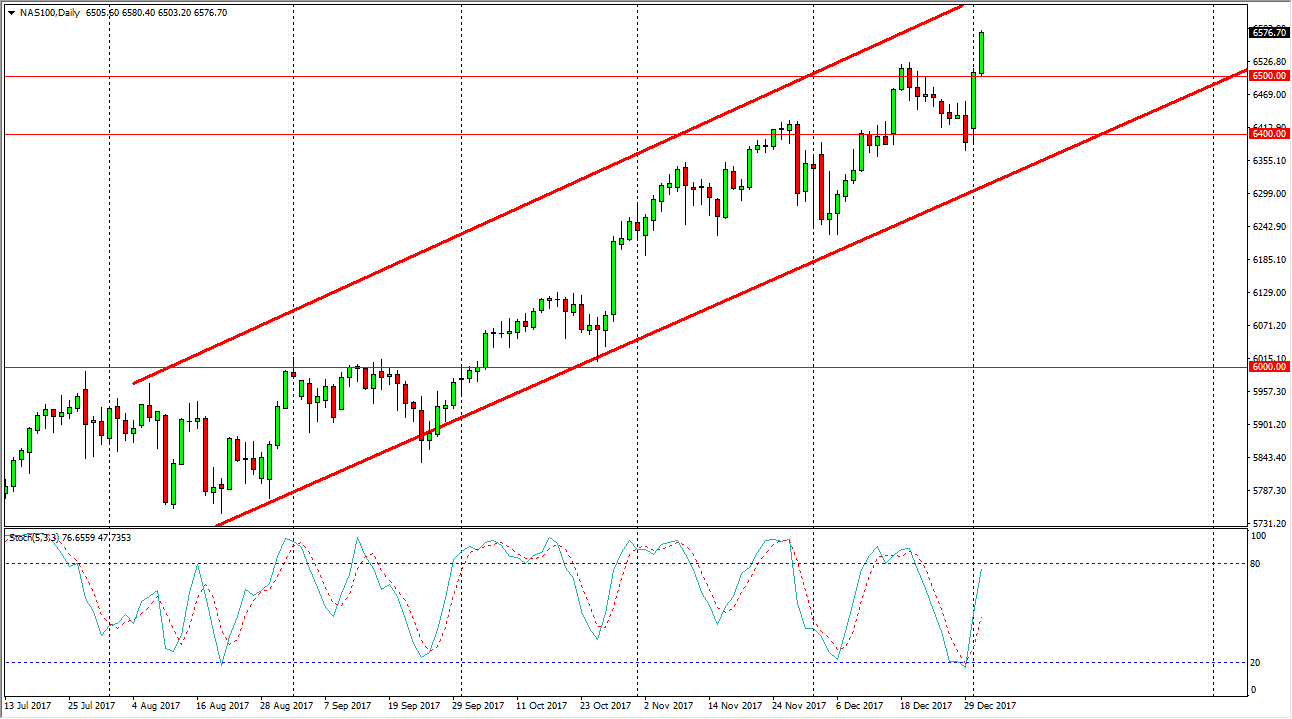

NASDAQ 100

The NASDAQ 100 has rallied significantly during the session on Wednesday, slicing through the 6500 level, reaching toward 6575. The NASDAQ 100 is in a nice uptrend, and in the middle of a nice up trending channel. Because of this, I think that pullbacks offer buying opportunities, and the 6500 level should be supportive. Ultimately, I believe that the market will eventually go looking towards the 6600 level above. With the jobs number coming out on Friday, it could be a bit choppy, but in the end, I believe that the bullish pressure continues. Quite frankly, the US economy is strengthening overall, but at the same time if we were to get some type of miss in the figures coming out of the jobs report, that would have people thinking that perhaps the Federal Reserve will continue to keep interest rates low. Either way, it’s a win-win situation for stocks of the next several days.