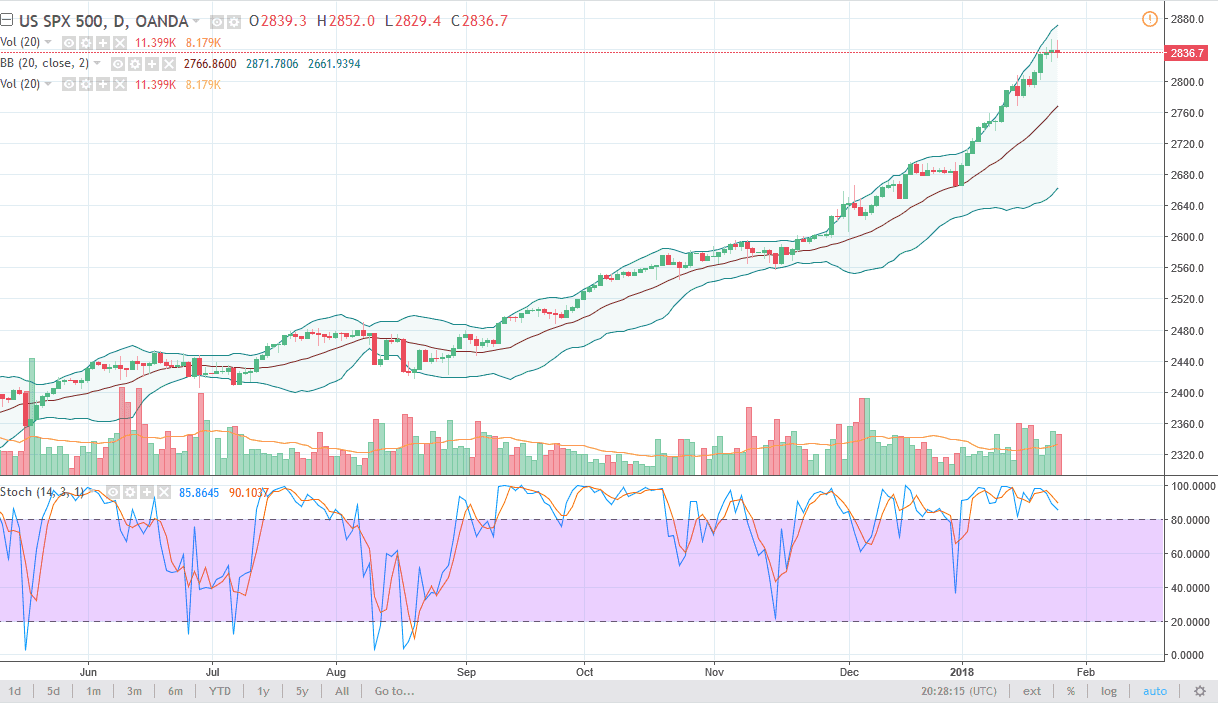

S&P 500

The S&P 500 has gone back and forth during the trading session again on Thursday, as it seems as if we are running into a bit of a brick wall. This is a market that is a bit overextended, so I would not be surprised to see a pullback. The US dollar started to gain strength later in the day, so it makes sense that we would get a pullback as well. Quite frankly, I believe that the 2800 level should be supportive, and I would be surprised to see the market break down much beyond that level. I think some type of bounce would be expected, and that’s exactly how I’m going to approach this market, looking for value on short-term dips. Longer-term, I still believe that this market goes to the 3000 handle, and possibly even further than that.

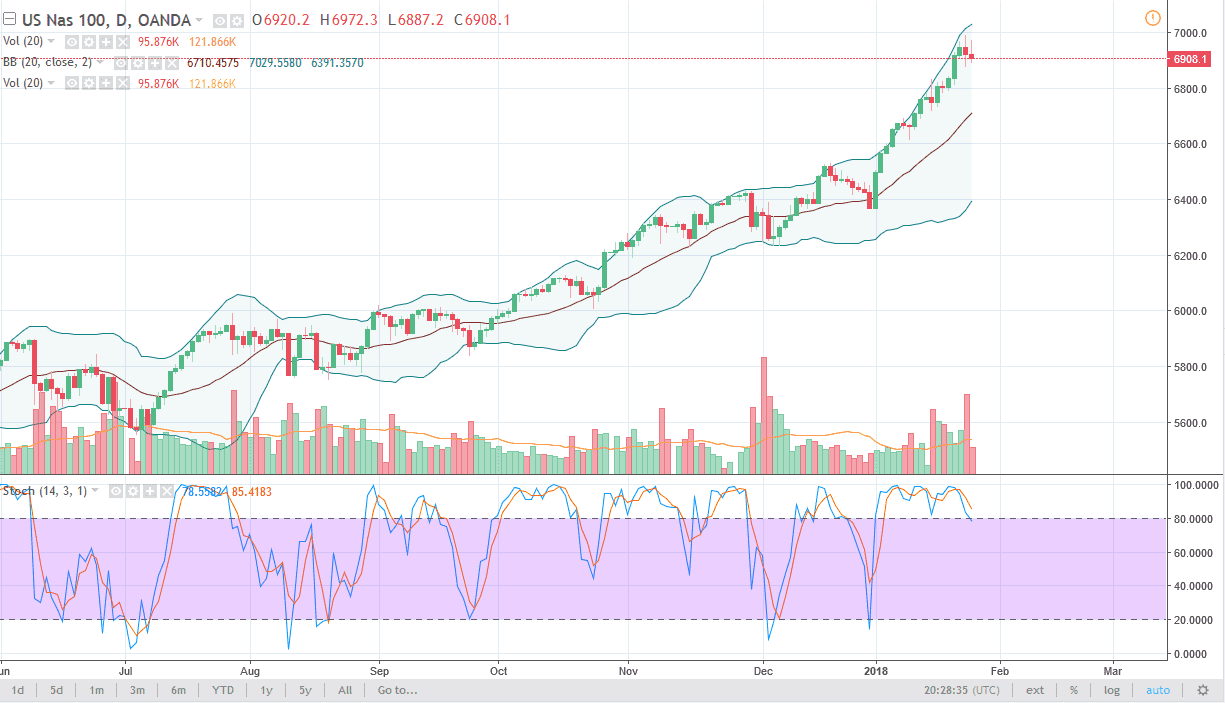

NASDAQ 100

The NASDAQ 100 initially tried to rally as well, but also rolled over just below the 7000 handle. It’s a large, round, psychologically significant number, so it makes sense that we struggled a bit. I think that if we pull back from here, and we probably will, the 6800 level should be supportive. Ultimately, this is a market that I think will eventually give us an opportunity to pick up value, and even if we broke below there, I would be looking towards the 6600 level as well. This is a strong uptrend, and it could be a leader for the other US stock indices. I’m looking for a bounce, or some type of stabilization at lower levels. Alternately, if we break above the 7000 handle, I think that gives us an opportunity to go long yet again, as it would be the next leg higher.