S&P 500

The S&P 500 went back and forth during the trading session on Wednesday, showing signs of volatility near the 2025 level. The market is obviously very bullish, but I don’t have any interest in trying to go long quite yet, because there is so much in the way of overextension. I think that a pullback is likely, and quite frankly it is opportunity just waiting to happen. I believe that the 2700 level underneath is massively supportive, but the 2800 level between here and there could offer support as well. Longer-term, I think we will go looking towards the 3000 handle, but it’s going take a while to get there. Volatility continues to be an issue, but with a falling US dollar I feel it’s only a matter of time before people start looking to the stock markets for returns.

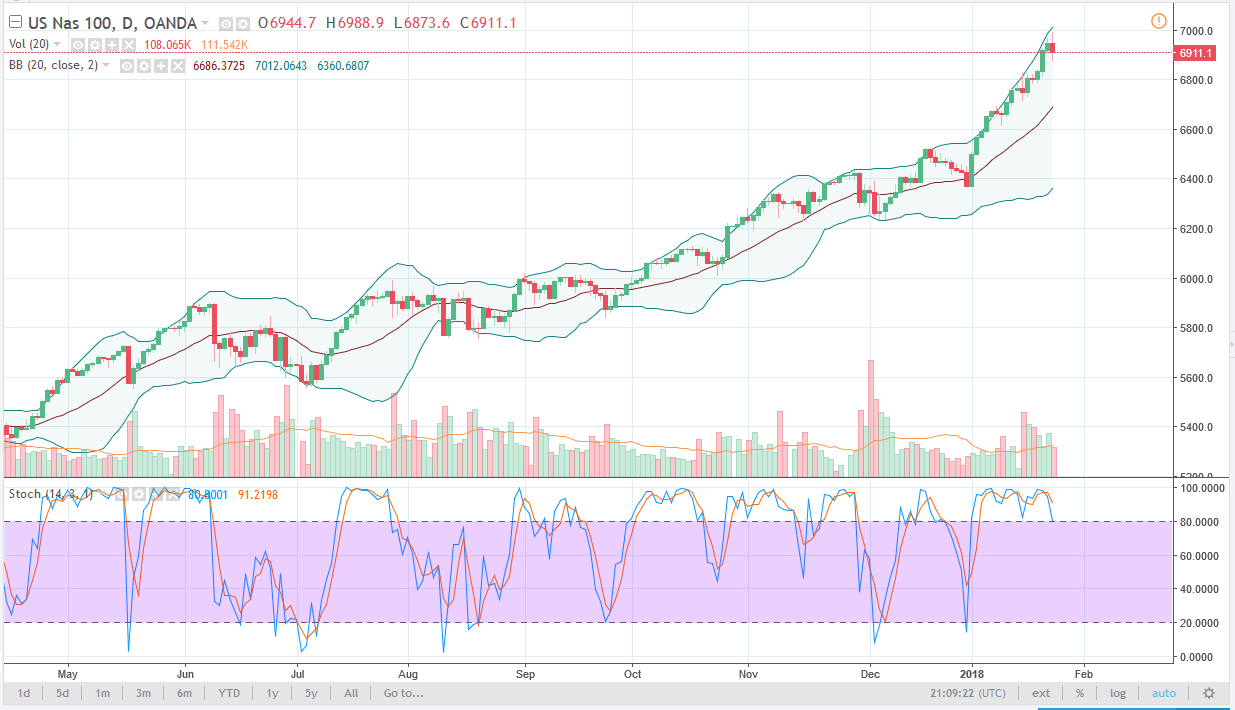

NASDAQ 100

The NASDAQ 100 went back and forth during the session on Wednesday, as we reached towards the 7000 handle. That’s an area that should offer resistance, and I think that it’s only a matter of time before we would see some type of value on the pullback. I think we can break above the 7000 handle, that should send the market much higher, but quite frankly it’s not likely to happen at this point. I think that there are massive amounts of support below, extending down to the 6400 level, so it’s not until we break down below there before I would be interested in selling. Longer-term, I think that we not only break the 7000 handle, but we end up going much higher. The NASDAQ 100 looks likely to lead the way going forward, and I will treat it as such.