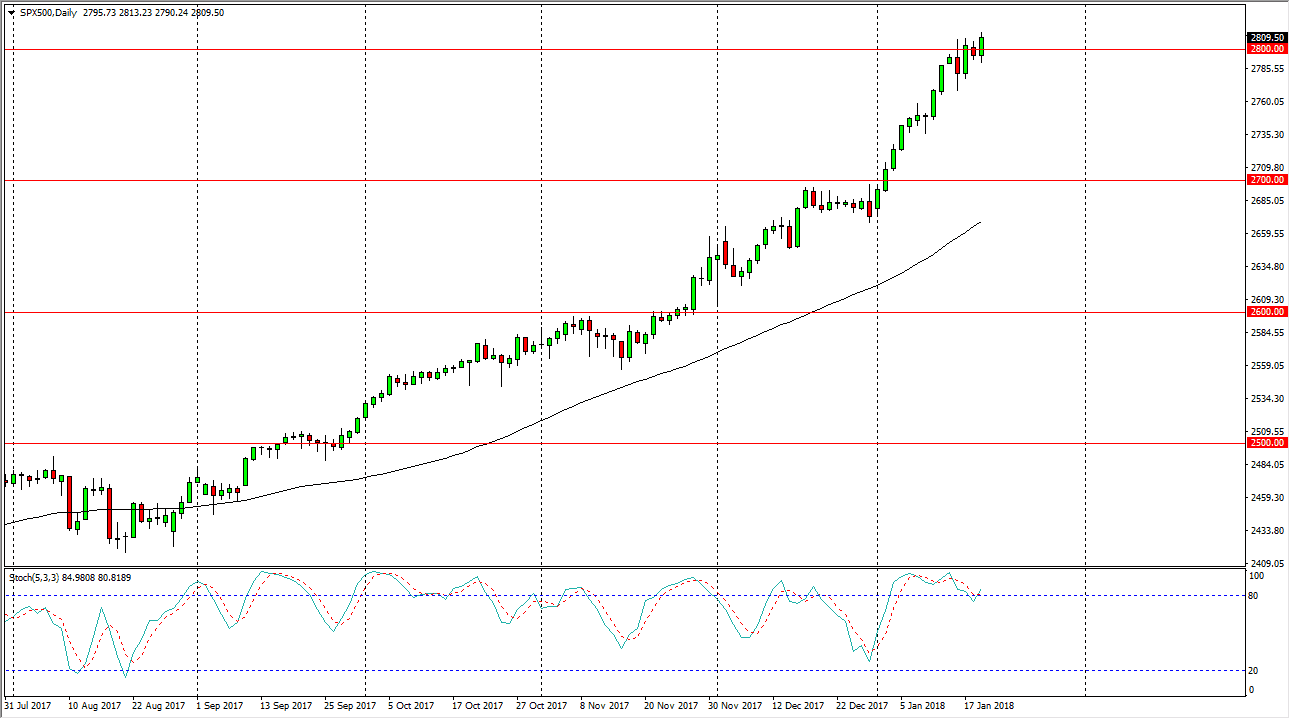

S&P 500

The S&P 500 rallied during the day after initially falling on Friday, as we have closed well above the 2800 level. In fact, we are testing the all-time highs yet again, and I think it’s only a matter of time before we rally and continue to gain. Pullbacks at this point should be a buying opportunity, as I recognize that we are bit overextended, but most certainly we are very bullish. Because of this, I have no interest in shorting this market and I look at the 2750 level as a very significant support level, just as I look at the 2700 level underneath. Longer-term, I believe that the market should continue to go to the 3000 handle above, which is where I expect this market to be by summer. Currently, I look at the 2700 level is massive support.

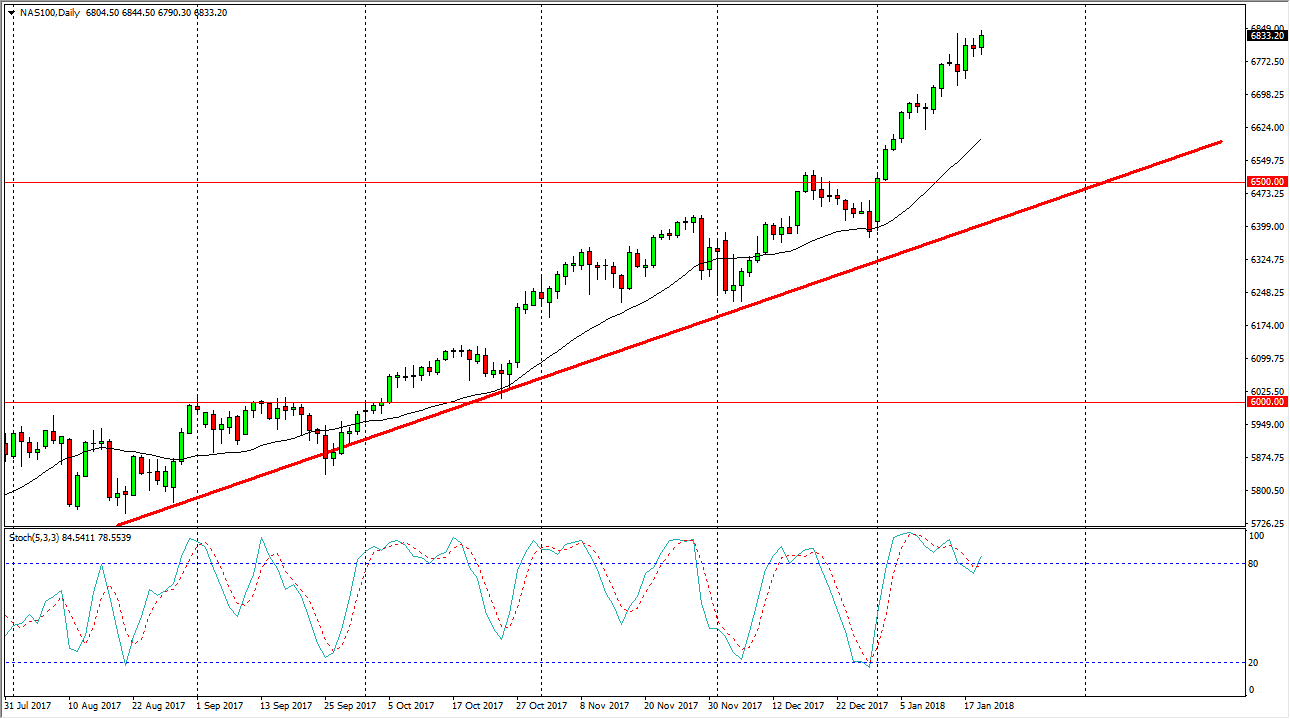

NASDAQ 100

The NASDAQ 100 continues to be very noisy as well, but most certainly bullish. I believe that we will break out to the upside and continue to go higher, perhaps the 6850 handle, and then the 6900 level. Pullbacks offer opportunities to pick up value, and it now looks as if the NASDAQ 100 is going to lead the way in America again, something it has not done for some time. I believe that the 6500-level underneath continues to be a “floor” in the market, just as the uptrend line that is just below there will be. Ultimately, I think that a falling US dollar will continue to help the market, but don’t be surprised if we get a soft market for the next couple of days, and quite frankly I think that would be a good thing as we have gotten a bit overextended as of late.