S&P 500

The S&P 500 was very noisy during the trading session on Tuesday, as traders came back from the Martin Luther King Jr. holiday. Initially, we rallied and broke above the vital 2800 level, but then fell rather rapidly later in the day. By the time the end of the day move came though, the market has rallied a bit, showing that longer-term “buy-and-hold” funds are more than likely buying these dips. Because of this, I think that the market is more than likely going to continue to find buyers regardless, and I think that should continue to be the thing going forward. I think that the 2700 level is the “floor”, but quite frankly I would be surprised if we reached that level. More immediately, the 2750 level will be support also, and I think that we will more than likely see the buyers come back into this market and push things above the 2800 level again. I have no interest in shorting the S&P 500.

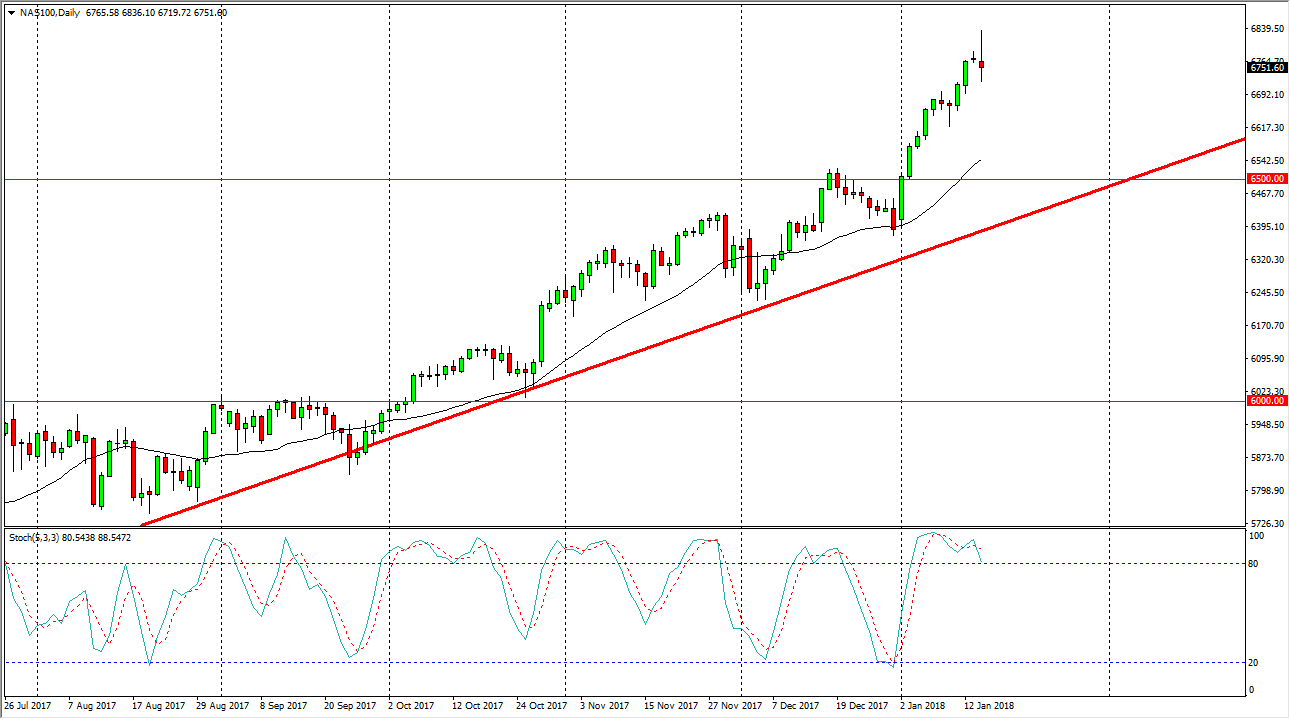

NASDAQ 100

The NASDAQ 100 initially spiked to the upside as well, but then fell enough to form a shooting star. The shooting star that formed during the trading session is a very negative sign, but I think there is more than enough support below to keep the market afloat. I would look at 6650 as a likely candidate for buying, just as a break above the top of the candlestick for the day would be bullish as well. I have no interest in shorting the NASDAQ 100, but I am fully aware that it is more than likely going to be a bit of a laggard when it comes to the stock markets in general, although I think in the end, they all rise.