Gold prices ended Monday slightly higher after a quiet session. XAU/USD initially headed lower, weighed down by a stronger dollar, but it was able to hold above the support at $1316. World stock markets were mostly firmer and the euro fell against the greenback.

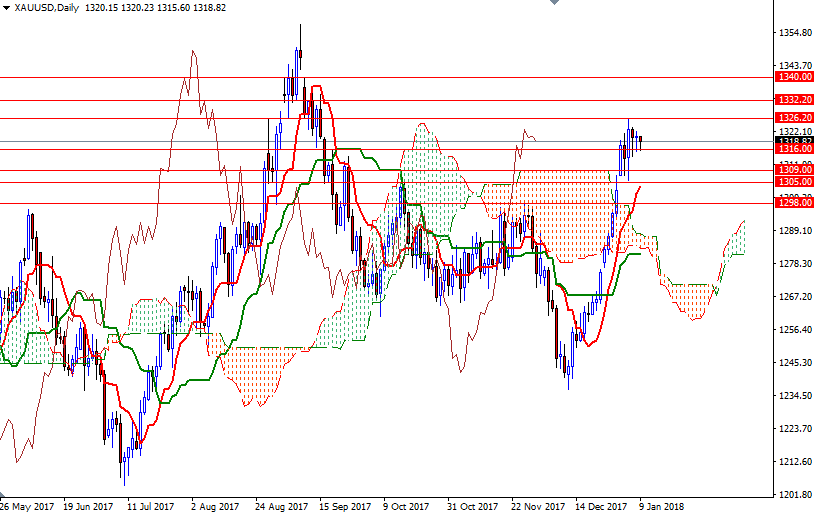

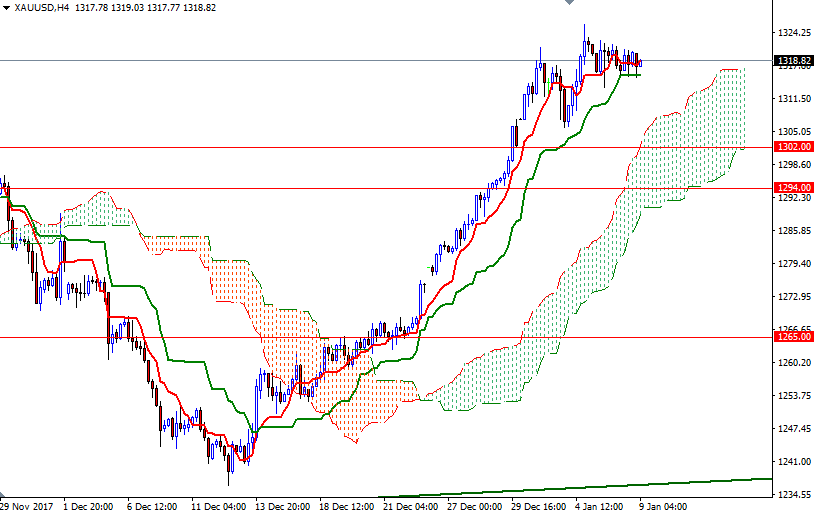

From a chart perspective, the bulls still have the near-term technical advantage. XAU/USD is trading above the daily and the 4-hourly Ichimoku clouds. In addition to that, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned on both time frames. However, I advise a bit of caution at this point as the market consolidates in a relatively tight range.

To the upside, there are hurdles such as 1323 and 1326.20. If the bulls confidently push prices above 1326.20, then the 1333 level may be the next target. Penetrating this barrier on a daily basis is essential for a continuation towards 1340. To the downside, keep an eye on the 1316-1315.80 area, the confluence of a horizontal support and the 4-hourly Kijun-sen. If this support is broken, XAU/USD will probably visit 1313/2. The bears have to capture this strategic camp to drag prices back to the 4-hourly cloud. In that case, the market could test 1309 and 1306/5.