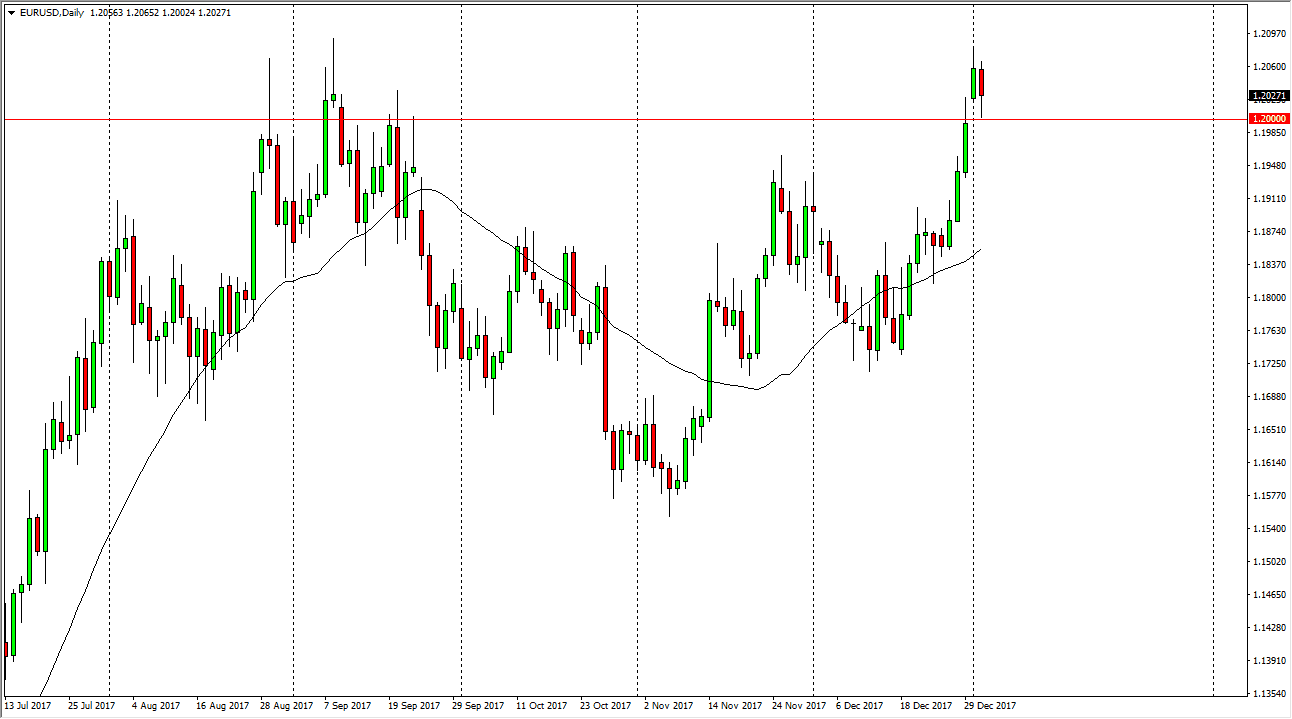

EUR/USD

The EUR/USD pair fell during most of the trading session on Wednesday, falling down to the 1.20 level, which was the scene of the gap from Tuesday. Now that we have filled the gap and bounce, I suggest that this market is trying to build up enough momentum to finally break out to the upside, perhaps reaching towards the 1.21 handle above. That is an area that is massive resistance, but I think that once we break above there, the market should continue to go much higher. We have broken above the bullish flag on the weekly chart, so I think that we are going to continue to go much higher. The US dollar has been struggling for some time, and that of course translates to a higher currency pair here. I think that the 1.20 level underneath is massive support, and I think it extends down to the 1.19 handle.

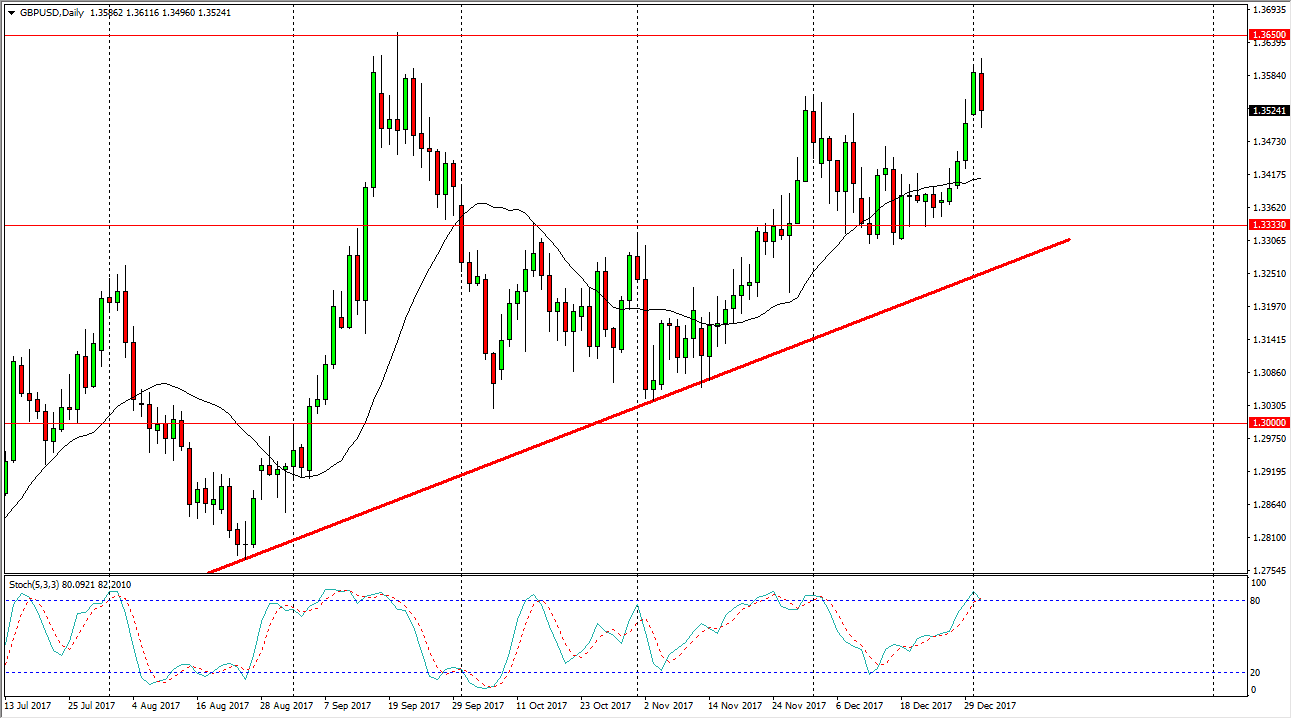

GBP/USD

The British pound ended up taking back most of the gains from the Tuesday session, testing the gap below. The 1.35 level looks very likely to offer support, and I think that in the meantime we are likely to go sideways in general. If we can break above the 1.3650 level, the market should continue to go much higher. If we were to break down below the 1.35 handle, the market could drop down to the 1.3333 handle. There is an uptrend line just below there, so even if we do pull back from here, I’m not willing to sell this market as I believe that the British pound is trying to build up enough momentum to finally break out to the upside. Once we break above the 1.3650 handle, I think the next target will be the 1.40 level above as we should enter a “longer-term buy-and-hold” signal.