EUR/USD

The EUR has rally during the trading session on Friday, reaching towards the 1.25 level. That’s an area that continues to offer resistance, and we had formed a shooting star for both Thursday and Friday, suggesting that the market is going to continue to struggle. A pullback should be a nice buying opportunity though, and I expect that the 1.2250 level is going to be massively supportive. If we can break above the top of the shooting star from the Thursday session, the market is then free to go much higher, perhaps looking towards the 1.30 level over. Ultimately, I think that the market should continue to be bullish, so I’m not interested in shorting, although I expect the market to drop. This is a market that is going to need to build up the necessary momentum to make the massive breakout.

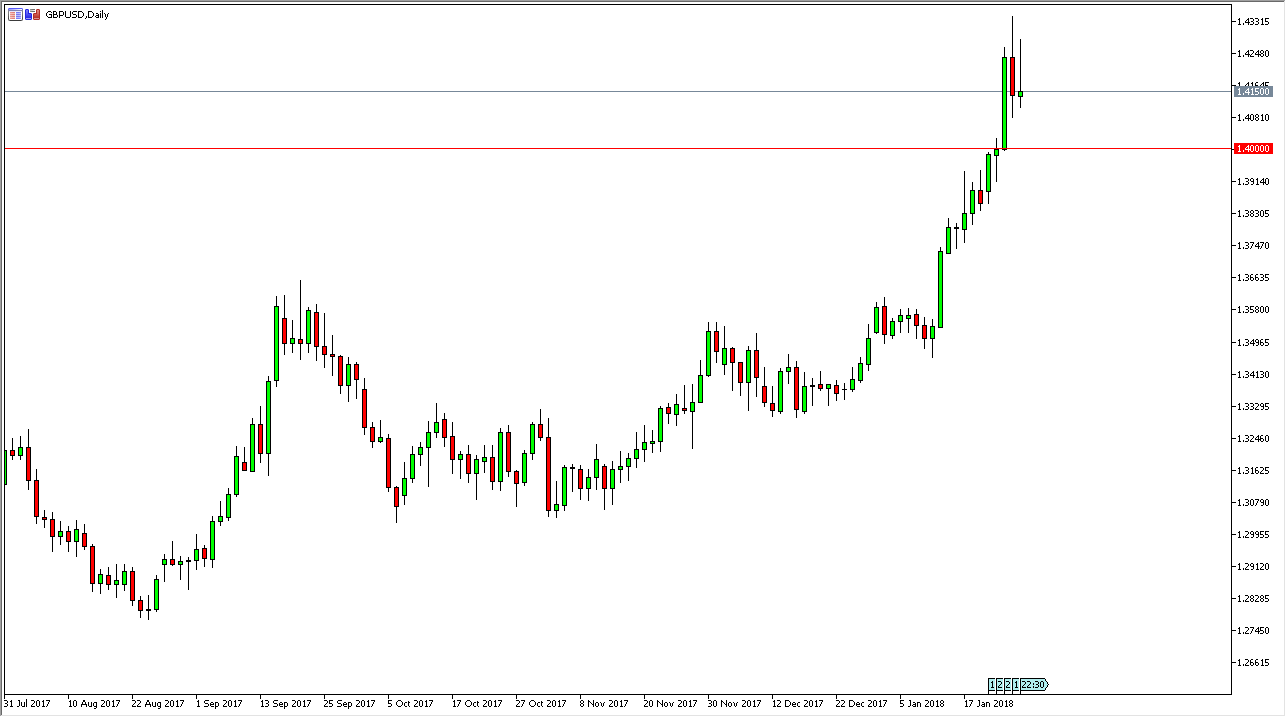

GBP/USD

The British pound has tried to rally during the trading session on Friday but continues to struggle as we turned around to form a shooting star. The shooting star Gore shows a significant amount of resistance, and I think we may have to drop down towards the 1.40 level. I believe that the market should continue to be a bit overextended, but I think there’s more than enough support between the 1.40 level on the top, and the 1.39 level on the bottom. The markets should continue to be very noisy, but I believe ultimately well supported. I believe that the US dollar continues to struggle, and I think that it will be shown in this market. However, there’s a lot of noise just above, so I welcome this pullback as an opportunity to pick up a longer-term investment. Short-term scalping is going to be a bit difficult at this point.