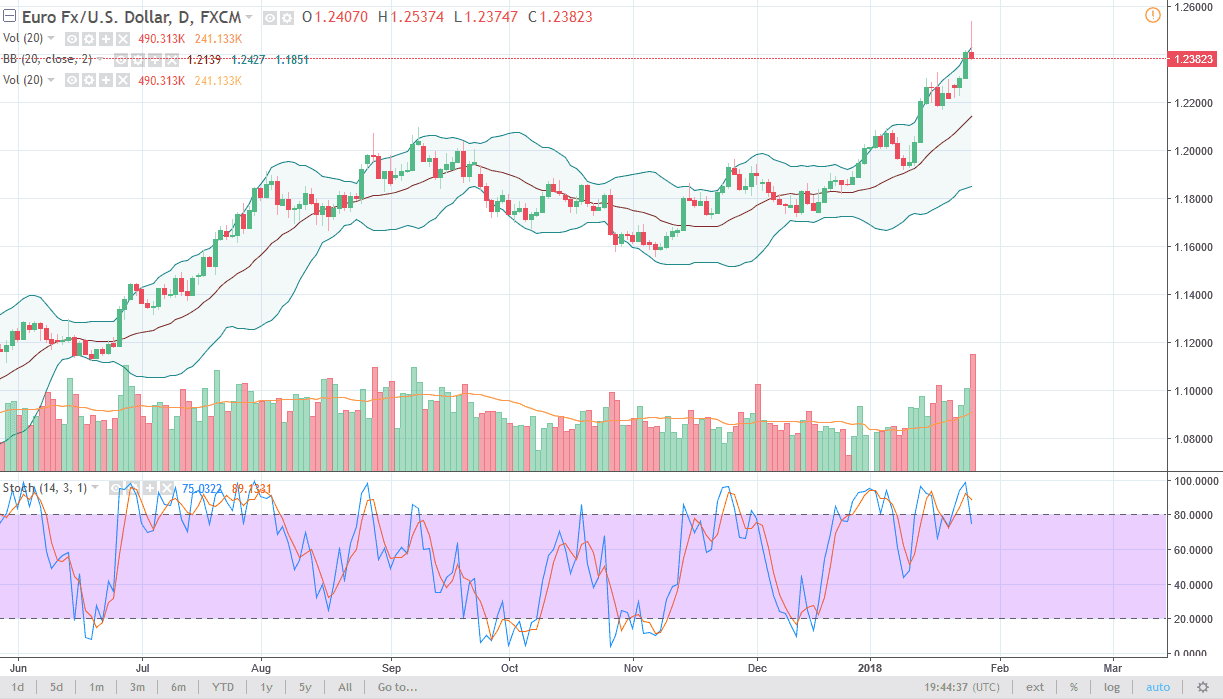

EUR/USD

The Euro rallied significantly during the trading session on Thursday, touching the 1.25 level. We did find selling pressure there though and have formed a reversal bar. This is not a selling opportunity though, is simply a pullback that is necessary. I suspect that a lot of the movement is based upon profit-taking, and not much more than that. I think if we can break above the top of the candle, that’s obviously a bullish sign but I prefer to wait for a pullback to the 1.22 region to take advantage of value, assuming we fall that far. I suspect there is a significant “floor” in the markets or near the 1.20 level underneath there, so it’s not until we break down below that level that I would be comfortable shorting this pair. There’s noise in the market, but quite frankly we needed to see this.

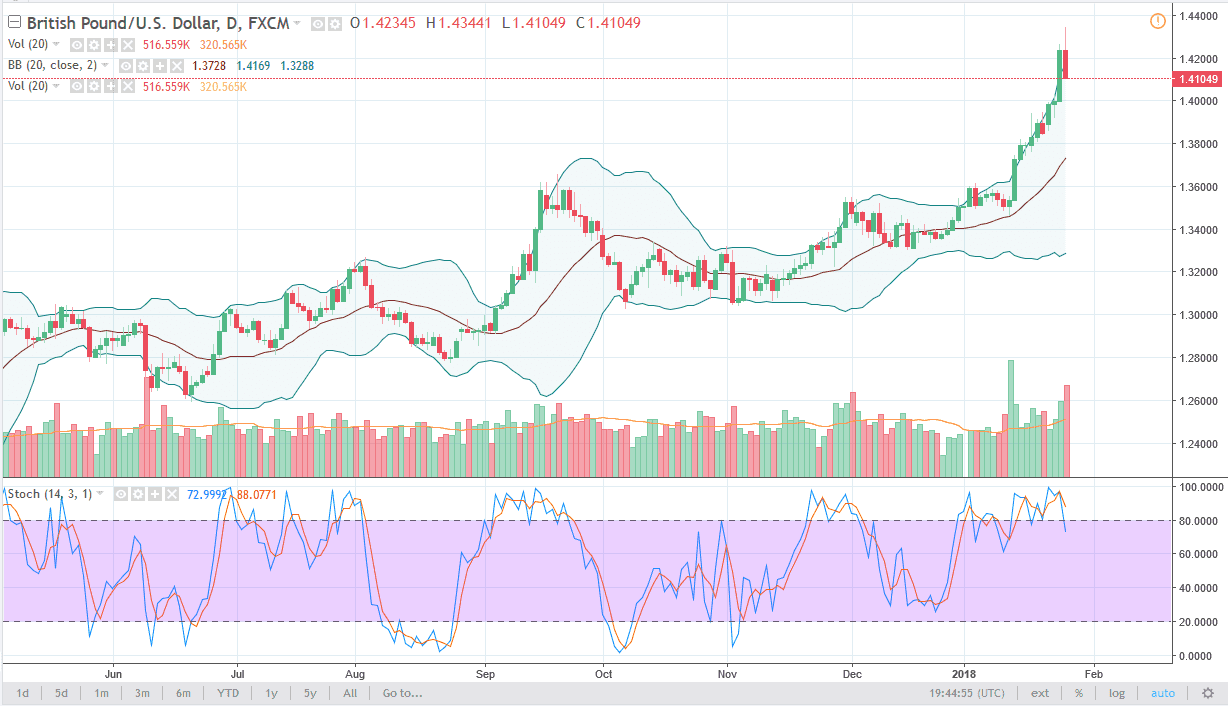

GBP/USD

The British pound initially rallied against the US dollar as well but found trouble near the 1.4325 handle. We are overextended and the GBP/USD pair anyway, so again, I think this is a necessary pullback in a market that has been overdone. I like the idea of picking up value at lower levels, and I think that we will eventually get some type of supportive candle or a bounce that we can take advantage of. I think the 1.40 level could be the first candidate to show an opportunity for value hunters, but I think it’s even more impressive closer to the 1.3 level if we get support. Ultimately, I do think that this market goes much higher, but these pullbacks are necessary to clear out orders so that we can continue to climb. I have no interest in shorting the British pound, it has been an absolute beast as of late.