EUR/USD

The EUR/USD pair has broken to the upside during the day on Wednesday, sending the market towards the 1.24 level above. That’s an area that should be resistive, but only for the short term. I believe that the final target is the 1.25 level, but we are getting a bit ahead of ourselves. I think a short-term pullback should offer an opportunity to pick up this pair based upon value, and then eventually send this market looking towards higher levels. Based upon longer-term charts, I still believe that the market will probably try to reach the 1.32 level later this year, but it will probably also take several attempts to break out above. The uptrend line on the chart should continue to keep this market going higher longer term, so shorting isn’t much of a thought right now.

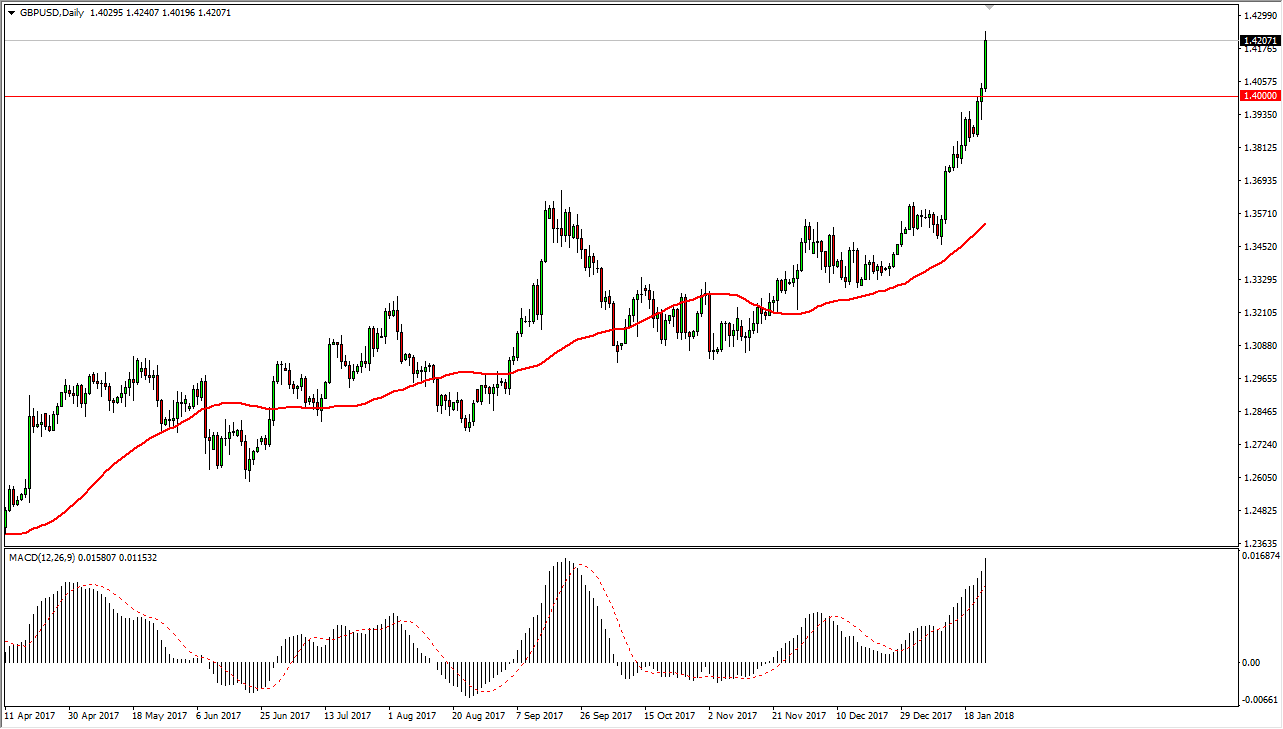

GBP/USD

The British pound has broken out to the upside during the trading session on Wednesday, clearing the 1.40 level. Now that we have broken above this resistance, we will more than likely must pull back. We are bit overbought, so I think it makes sense that we would do so, in order to offer a bit of value. Furthermore, on the longer-term charts we are starting to approach a serious area of clustering, and that should offer resistance. However, I think that the longer-term outlook for this market is much higher, so it is only a matter of time before the buyers return. I would anticipate a bit of support at the 1.40 level, but we could even go down to the 1.37 level and find plenty of buyers as well. The US dollar continues to be soft in general, and I think that will be the story going forward, as we continue to follow the uptrend.