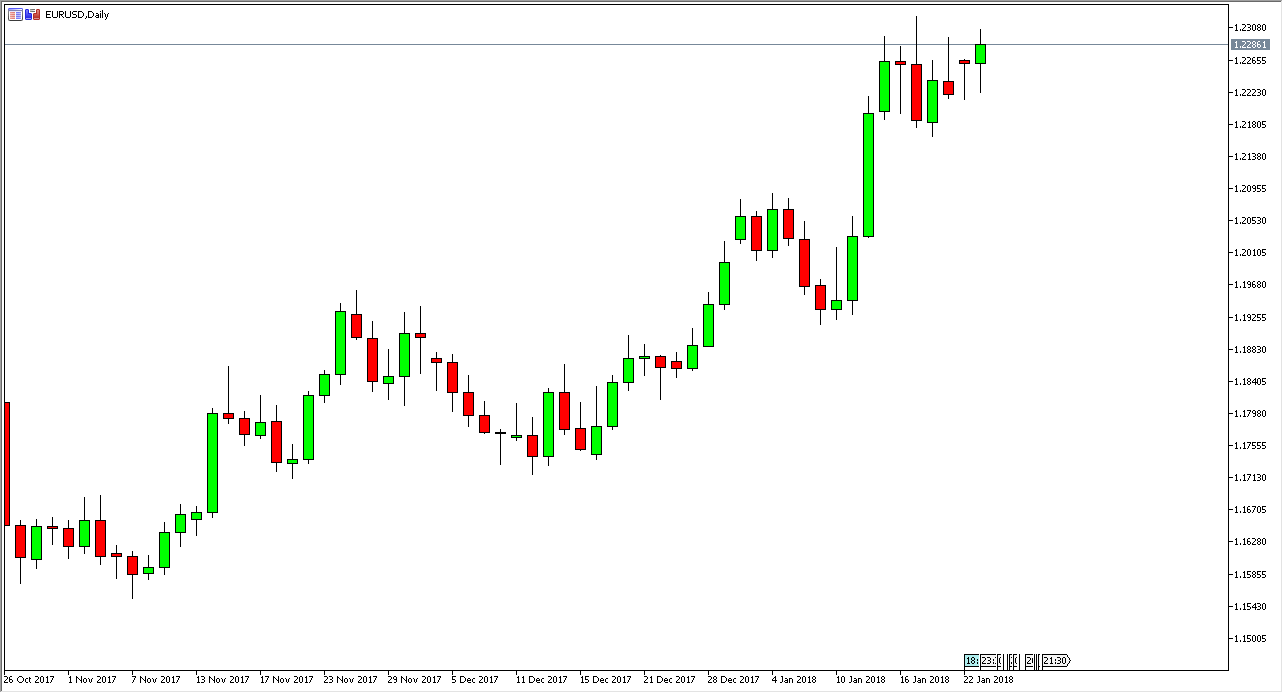

EUR/USD

The EUR/USD pair initially fell during the trading session on Tuesday but pulled back only to find a certain amount of support. It looks as if were trying to form some type a hammer, and I think we are going to continue to go much higher. The 1.23 level is offering resistance, but I think we will eventually not only break above there but extend to the next logical resistance barrier - the 1.25 handle. Pullbacks offer value for longer-term traders and those who can be patient enough, and I think that these pullbacks will offer nice opportunities for longer-term traders who have been holding onto this trade to the upside. I don’t have any interest in shorting this market, least not anytime soon as I think there is a massive amount of support to be found at the 1.20 level underneath. If we can break above the 1.25 handle, then we continue the move higher based upon longer-term charts, within the eventual target of 1.32 over the next several months, if not years.

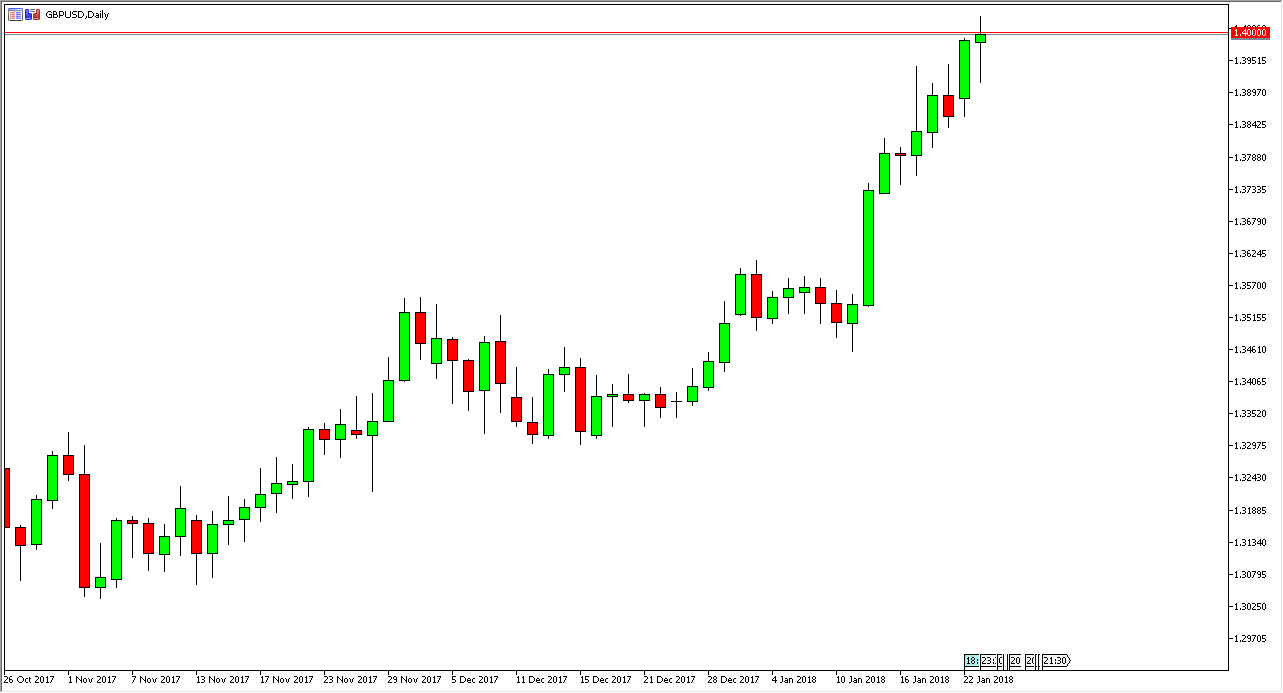

GBP/USD

The British pound went back and forth during the trading session on Tuesday, as we tried to break above the 1.40 level. I think eventually we will break above there, but it’s obvious that we have a certain amount of resistance based upon the large, round, psychologically significant number. These areas tend to be areas where traders will take profits, and of course a lot of stop loss orders will be filled. Because of this, volatility is what you expect, but I think that we will reach much higher, eventually the 1.50 level over the longer term. Pullbacks should find plenty of support underneath, especially near the 1.39 handle.