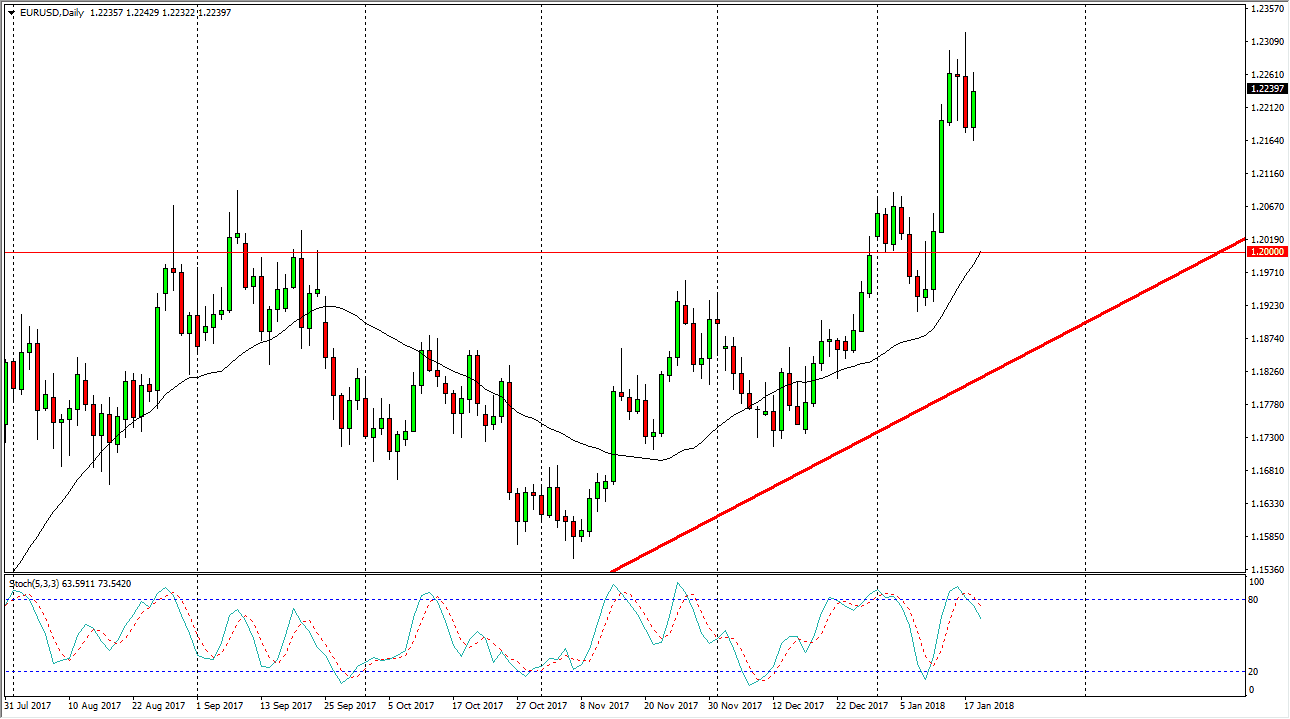

EUR/USD

The EUR/USD pair rallied a bit during the trading session on Thursday, as we continue to see a lot of volatility in this market. Longer-term, I believe it’s time to start finding buyers every time we pull back. The market will eventually go to the 1.25 level above, but ultimately there is a lot of noise in the Forex markets, but I think that the one underlying statement is that the US dollar continues to fall overall. The 1.21 level underneath is massive support, and I think that it runs down to the 1.20 level after that. Pullbacks would be buying opportunities, and I think that the pretty trader will look at these pullbacks as opportunity. I think that we are starting to form a little bit of a bullish flag, but a break above the 1.21 handle is a very significant sign longer-term, and I believe that the markets will continue to go bullish.

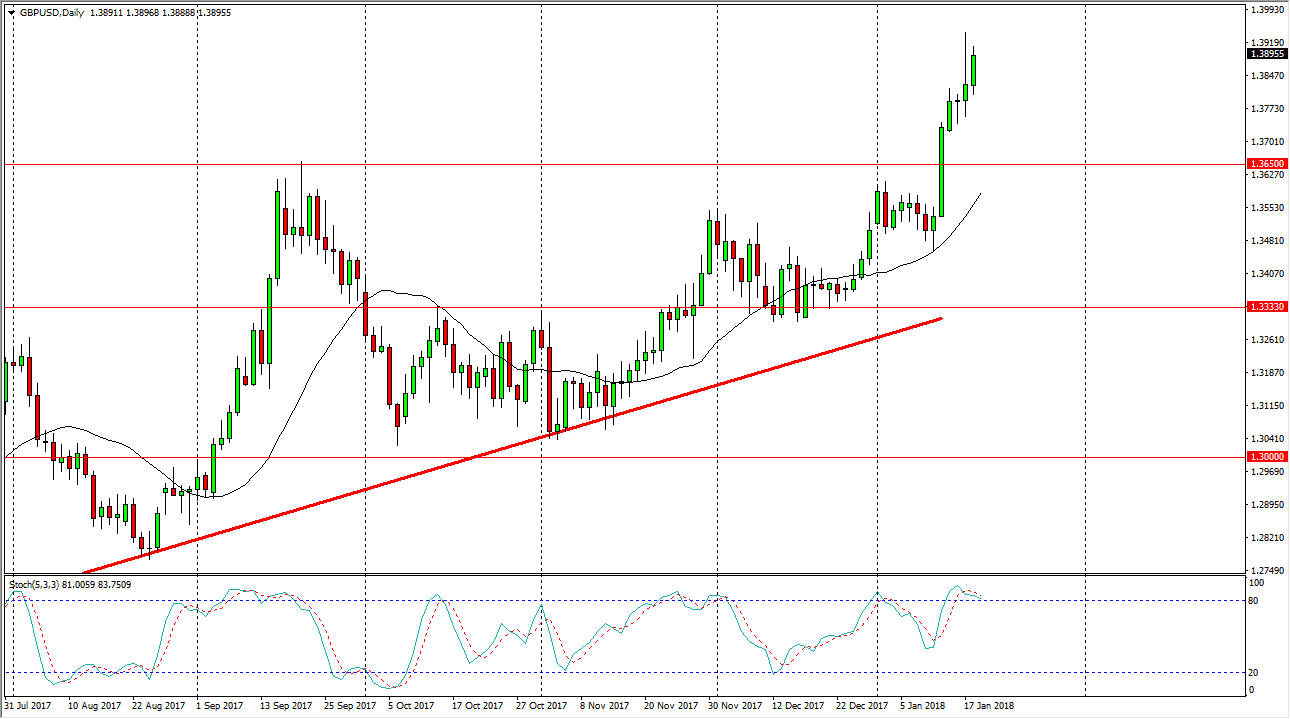

GBP/USD

The British pound rallied a bit during the trading session on Thursday, reaching towards the top of the shooting star from Wednesday. I believe that a break above the top of the shooting star sends this market much higher, perhaps on a break of the 1.40 level as well. It will take several attempts a break above there in my estimation though, so look at short-term pullbacks as value that you can take advantage of. The US dollar continues to be pummeled, and I don’t think that’s changing anytime soon. The 1.3650 level underneath should be massively supportive, so if we were to break down below there would turn everything around. I’m looking for support underneath, and I think that ultimately, we will find that as the “floor” of the longer-term move to the upside.