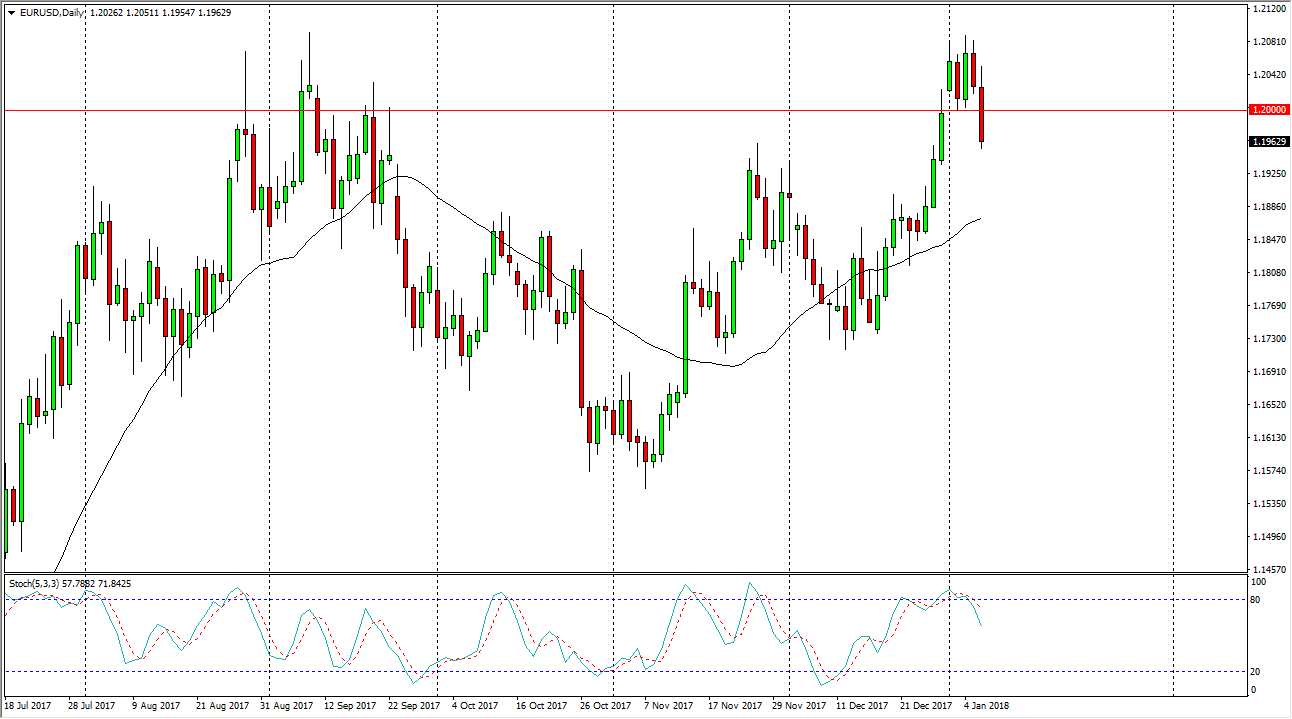

EUR/USD

The EUR/USD pair initially rallied on Monday, but then turned around to sliced through the 1.20 level. That’s a very negative sign, but I do recognize that there is a lot of support underneath, and that it’s likely we will see buyers enter the market sooner, rather than later. I believe that we will see a bit of a bounce from closer to the 1.19 level, which has been structurally important as well. If we can break above the 1.20 level again, I think that the market then eventually goes looking towards the 1.21 level above, which is massively resistive. A break above that level should be a very strong signal that the market is going to go much higher, perhaps reaching towards the 1.24 level, and then eventually 1.25 after that. I have no interest in trying to short this market right now, and look at this pullback is simply that, a pullback.

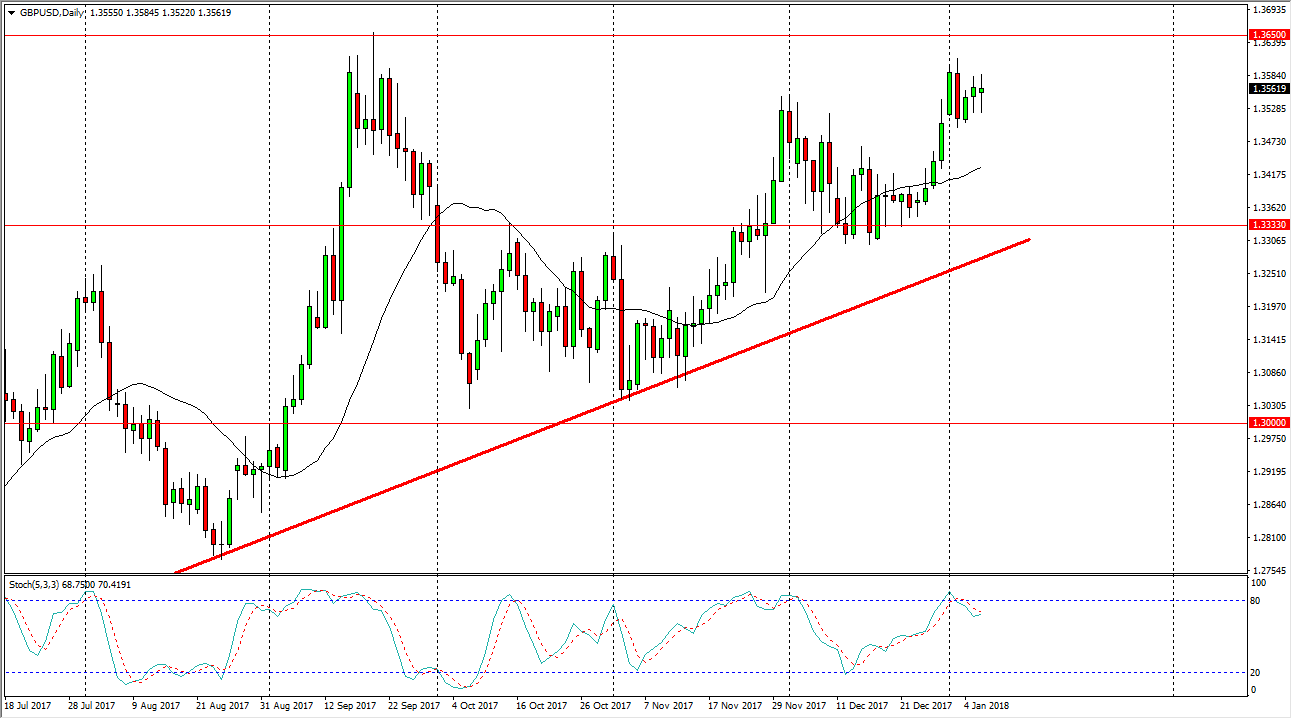

GBP/USD

The British pound went back and forth during the day on Monday, showing signs of choppiness and indecision. I think that it is simply an area that is difficult to break through, so this candle doesn’t mean much to me other than it shows that we continue to see trouble. If we can break above the 1.3650 level above, we could break out for more of a buy-and-hold scenario. In the meantime, I think that pullbacks offer buying opportunities and I will treat them as such. I look at the 1.3333 handle as a bit of a “floor” underneath, and suspect that the buyers will return if we drift down towards that area. We also have the uptrend line underneath, so I am bullish in general and believe that it’s only a matter of time before we get the break out.