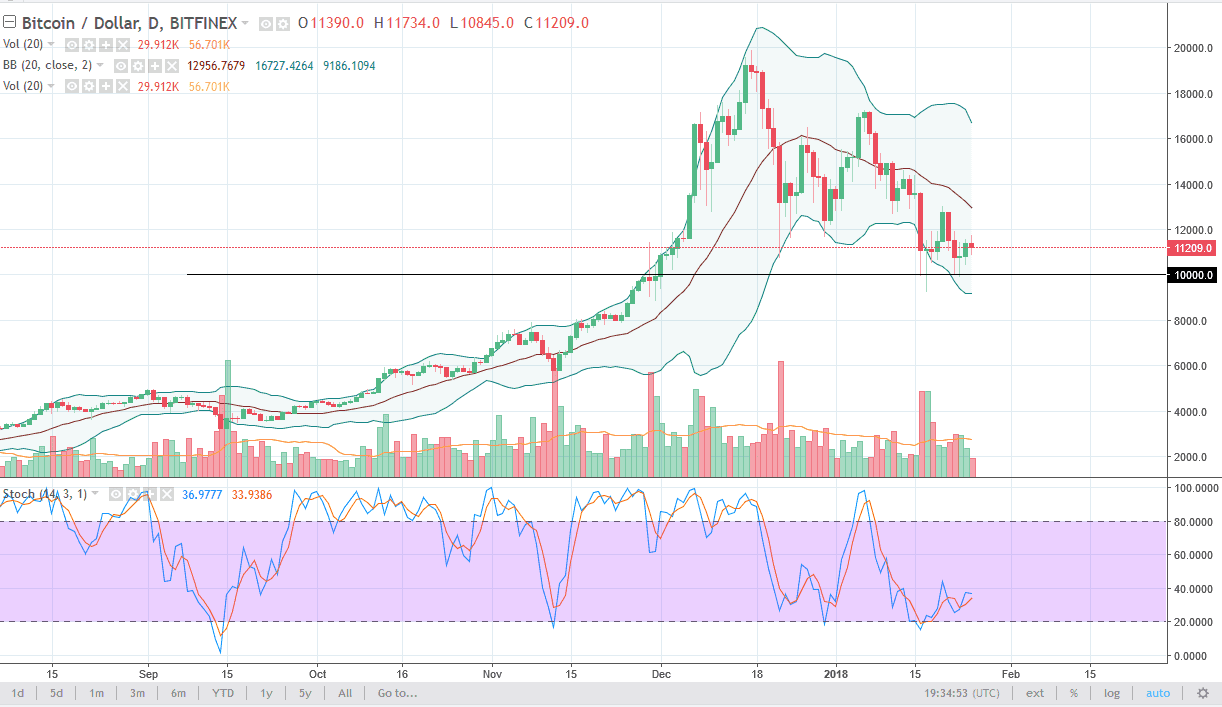

BTC/USD

Bitcoin traders did very little during the session on Thursday, as we continue to bounce around above the $10,000 support level. We are above $11,000, which in and of itself is slightly positive, but I am still concerned by the lack of volume that we see in the market. I believe that for tells a lot of weakness, and if we break down below the $10,000 level, especially on volume, I suspect that we are going to fall to the $8000 level, if not the $6000 level after that. There has been an incredible amount of damage done to the psyche of crypto currency traders, especially on the retail side. Because of this, I anticipate that the general malaise should continue, and at this point I would anticipate very little in the way of movement. If we broke above the $13,000 level though, then we could start to get bullish again.

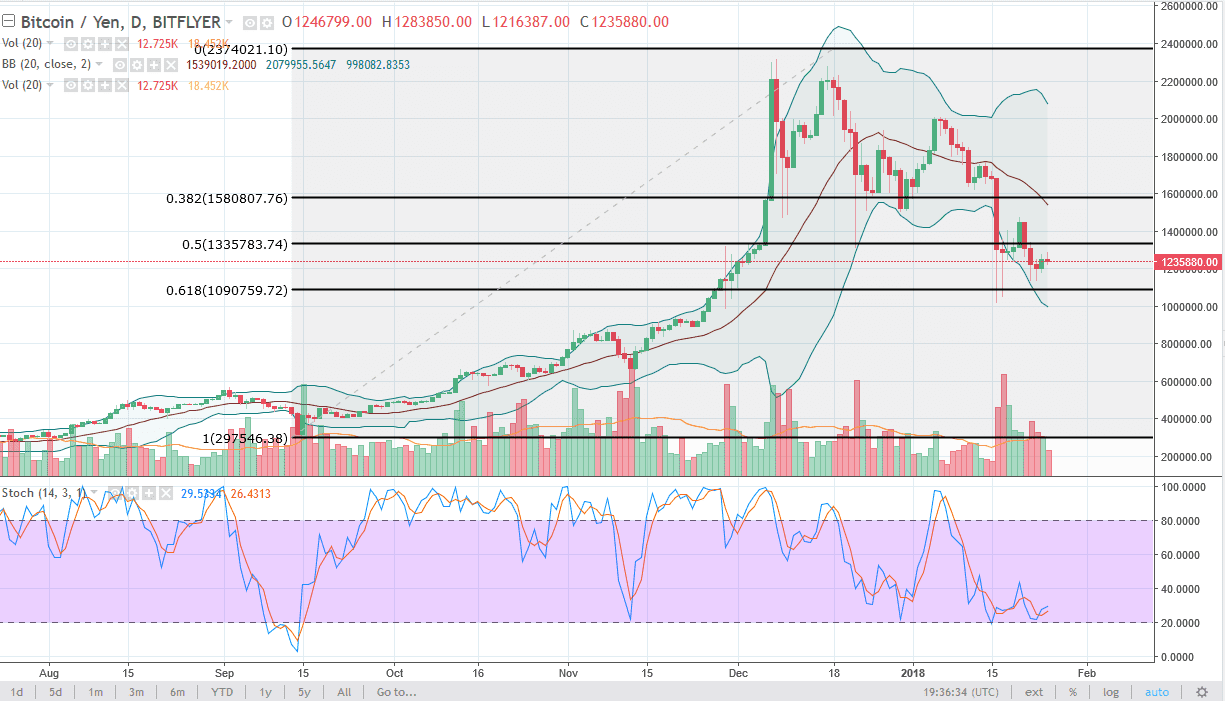

BTC/JPY

Bitcoin has done almost nothing against the Japanese yen as well, as one would expect. Volume is light in Asia, which is too bad considering that Japan is roughly 40% of the Bitcoin market worldwide. It’s not until we see volume pick up in this pair that we will see a continued push to the upside by Bitcoin traders. With this in mind, I believe that this market continues to go sideways, using the ¥1 million level underneath as the “floor” in the market, and the ¥1.35 million level above as resistance. A break above the ¥1.4 million has me buying again, but right now I don’t see it happening. Beyond that, there would have to be some type of volume for me to be truly interested in this market. It does not look like we’re going to get it in the short term, so therefore I remain fairly ambivalent.