BTC/USD

Bitcoin fell initially during the trading session on Tuesday but found the $10,000 level to be supportive. However, even though we formed a hammer on the daily candle, there is still a significant lack of volume. It is because of this that I feel any rally at this point will probably fail to stick. Unless we make a fresh, new high, essentially breaking above the $13,000 level, I anticipate that the market will continue to bang around off the $10,000 handle, and then eventually break down below it. If we do, the market probably goes down to the $8000 level next. If we can break out to the upside, then I think we began to see a move towards the $15,000 level, but right now I am a bit unconvinced, because while the US dollar has been getting pummeled, the crypto currency markets have not been able to take advantage of that.

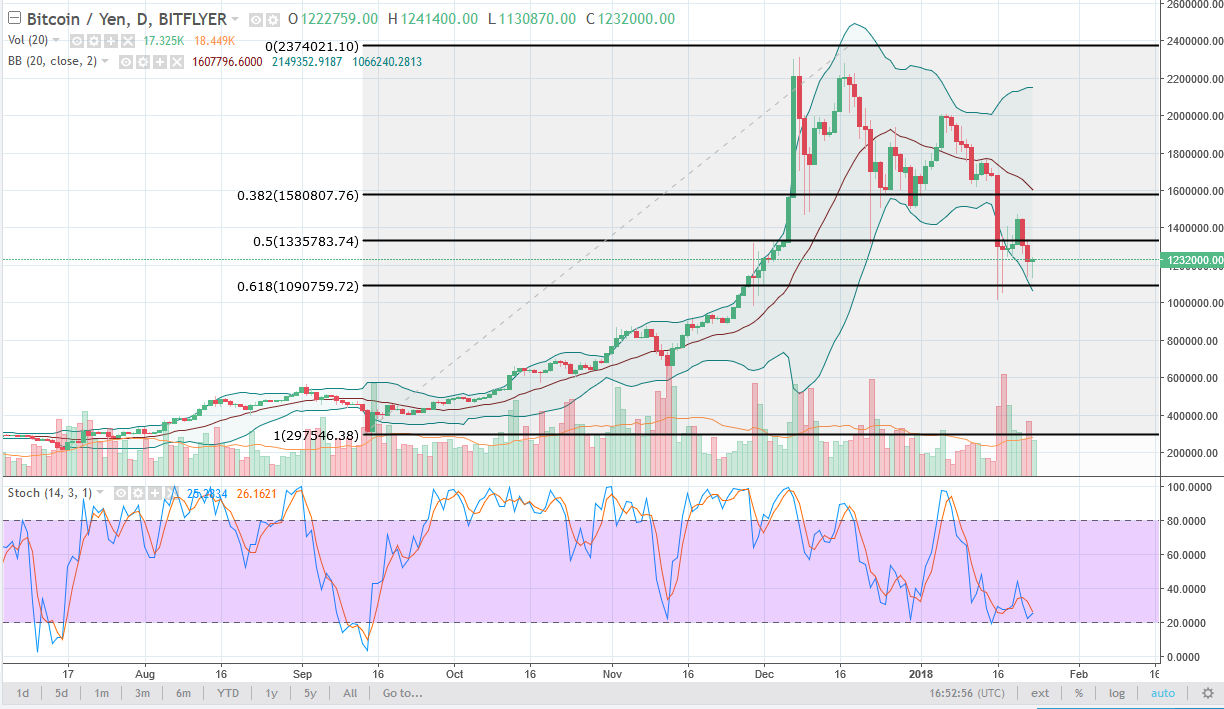

BTC/JPY

Bitcoin also fell against the Japanese yen but has found a bit of support near the 61.8% Fibonacci retracement level to form a hammer. Volume is still reasonably low though, and most certainly you can see that there is much more volume on the negative candles. Because of this, I anticipate that this rally will fail, and I am not convinced until we can break above the 1.5 billion in level at the very least. Even then, I need to see volume to get involved to the upside. Alternately, if we break down below the ¥1 million level, the market probably falls apart and goes looking towards ¥300,000, wiping out the gains from the last year or so, which of course has gotten ahead of itself. Either way, I suspect that a lot of the mania surrounding Bitcoin is dying before our very eyes. Most retail traders who have gotten in during the height of that mania have already lost roughly 45%.