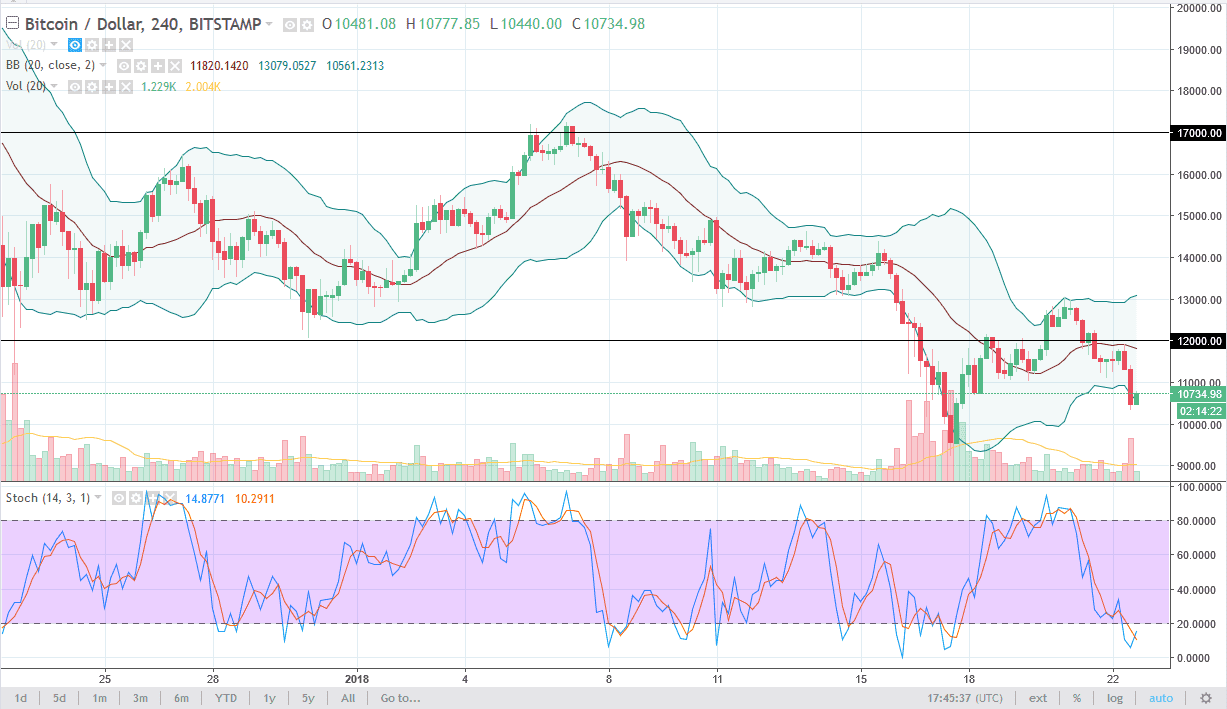

BTC/USD

Bitcoin fell during the trading session on Monday in general, as crypto currencies simply cannot get out of their own way. The US dollar has been following the downward trajectory, but at the same time it is not been benefiting crypto markets. I believe that the $12,000 level above should offer resistance, as it has in the past. I believe that the market could go down to the $10,000 level below, which is an area that has attracted a lot of attention. The marketplace continues to favor the downside, so I think it’s only a matter of time before we continue the selling, so at this point I would not have any interest in buying this market until we break above the $13,000 level, and with volume.

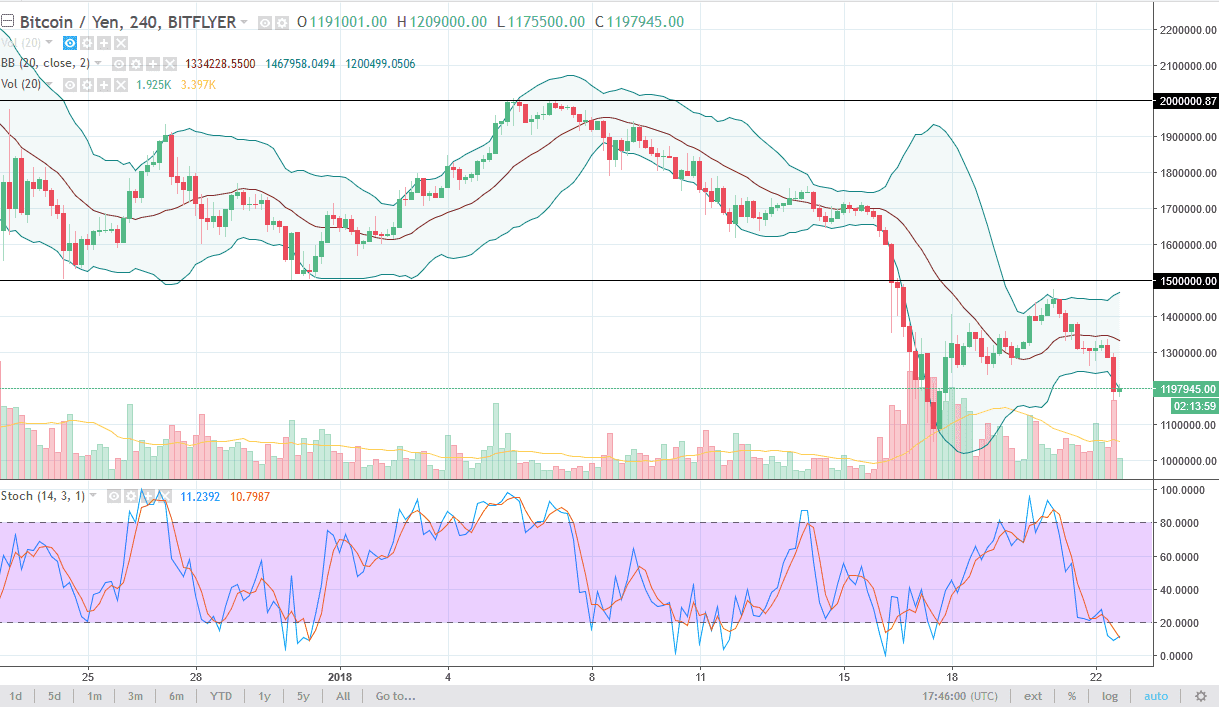

BTC/JPY

Bitcoin has fallen against the Japanese yen, and even more so stringently that against the US dollar. The volume is most certainly favoring the downside, and I think at this point were going to go looking towards the ¥1.1 million level underneath, which has been supportive. I suspect there is a significant fight on hand at the ¥1 million level and breaking down below there would send this market much lower. I think it will take several attempts to break down below there, but at this point I don’t see anything stopping this from happening. As far as buying is concerned, it’s very difficult to recommend doing so, we need to see a large amount of volume to the upside, and quite frankly that seems to be rare. With Japan being 40% of the volume, this market selling off is indeed very negative for Bitcoin in general. Most of the new retail traders in the North American region are already losing over 40%.