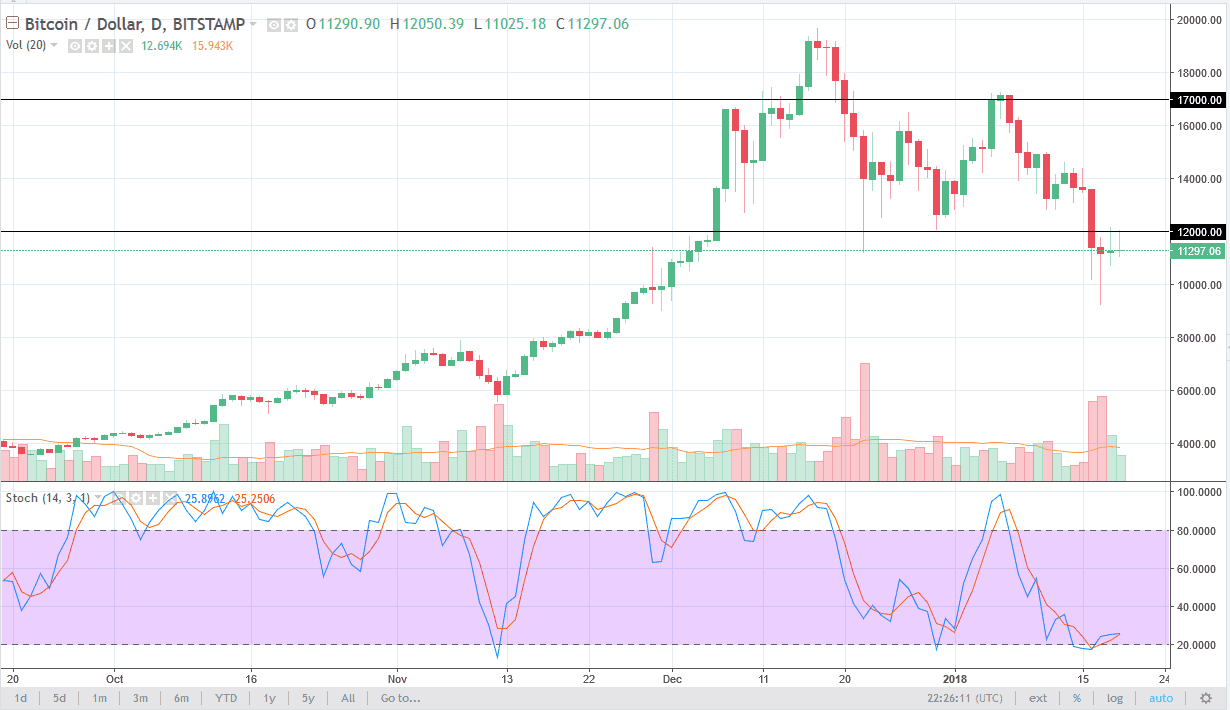

BTC/USD

Bitcoin went back and forth during the trading session on Friday, testing the $12,000 level again, and finding it resistant yet again. Volume is anemic, and this tells me that there is no conviction in this market yet, as the massive selloff has done a significant amount of damage to most retail accounts. As you will typically see in a bubble, we started to see a massive mania at the top. I don’t know whether we can reach the $20,000 level again, but keep in mind that there were over 300,000 accounts being added every weekend at Coinbase near the highs. Everybody who put money in that exchange during that timeframe is now down about 50%. That does not bode well for the future, and I think that the lack of volume speaks volumes, if you will. Because of this, I think that we will more than likely see this market break down below the hammer from the Wednesday session and unwind even further. Alternately, if we were to break above the $12,000 level, that would be significant, but only if the volume is strong.

BTC/JPY

Bitcoin went back and forth during the trading session on Friday, forming a neutral candle. Again, the volume is relatively anemic, but stronger in Japan. That makes a bit of sense, 40% of all volume is done in Asia, and most of that in Japan itself. However, it’s obvious that we do not have enough confidence in the market to continue to grind higher, and the ¥1.5 million level will more than likely continue to be a barrier. The ¥1 million level underneath is massively supportive, so I think in the meantime we are looking at consolidation between those 2 levels.