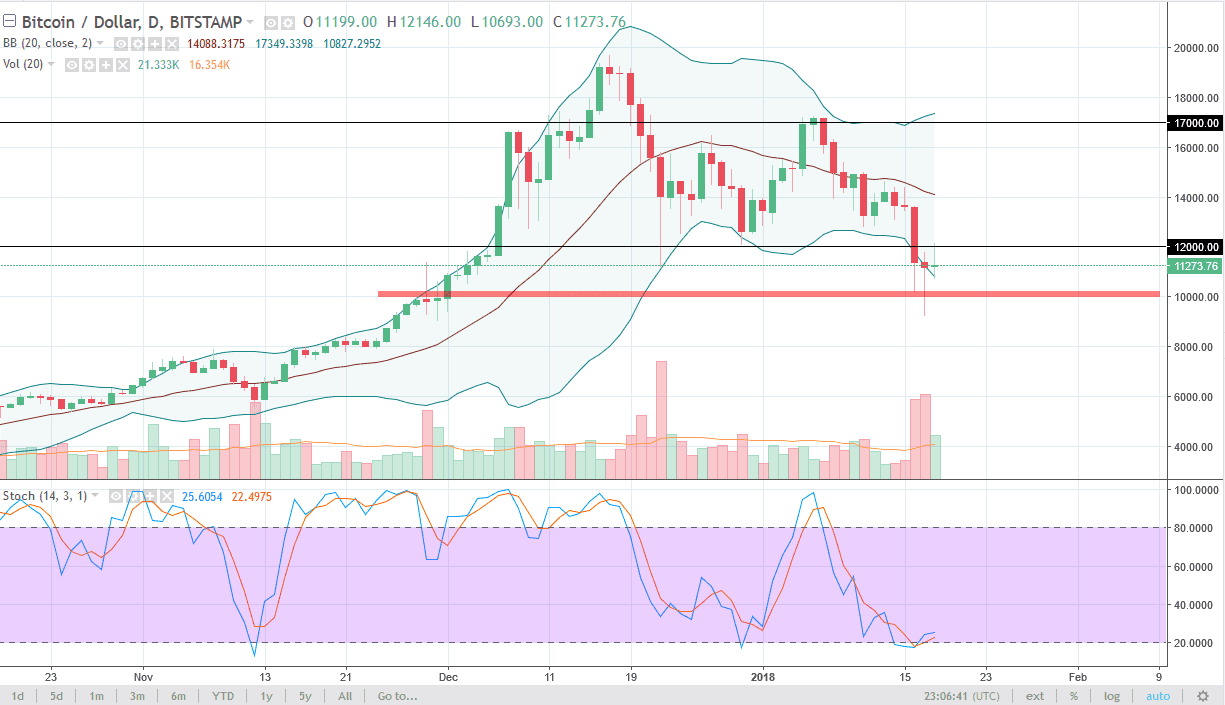

BTC/USD

Bitcoin went back and forth during the trading session on Thursday, and at one point looked somewhat positive. We broke above the top of the hammer from the session on Wednesday, which is theoretically a bullish sign. However, once we broke above the $12,000 level, we rolled over to show signs of exhaustion, and it looks very likely that we will end up forming a less than impressive candlestick, as we have formed a shooting star. There is a serious lack of volume on this bounce, and even though that the $10,000 level is essentially the 50% Fibonacci retracement level, I think that we are not going to be able to sustain gains at any time. In fact, I don’t trust this market until we break above the $14,000 level, and at this point I think we are going to consolidate between the $10000 level on the bottom, and the $12,000 level above. If we break down below the $10,000 level, look out below.

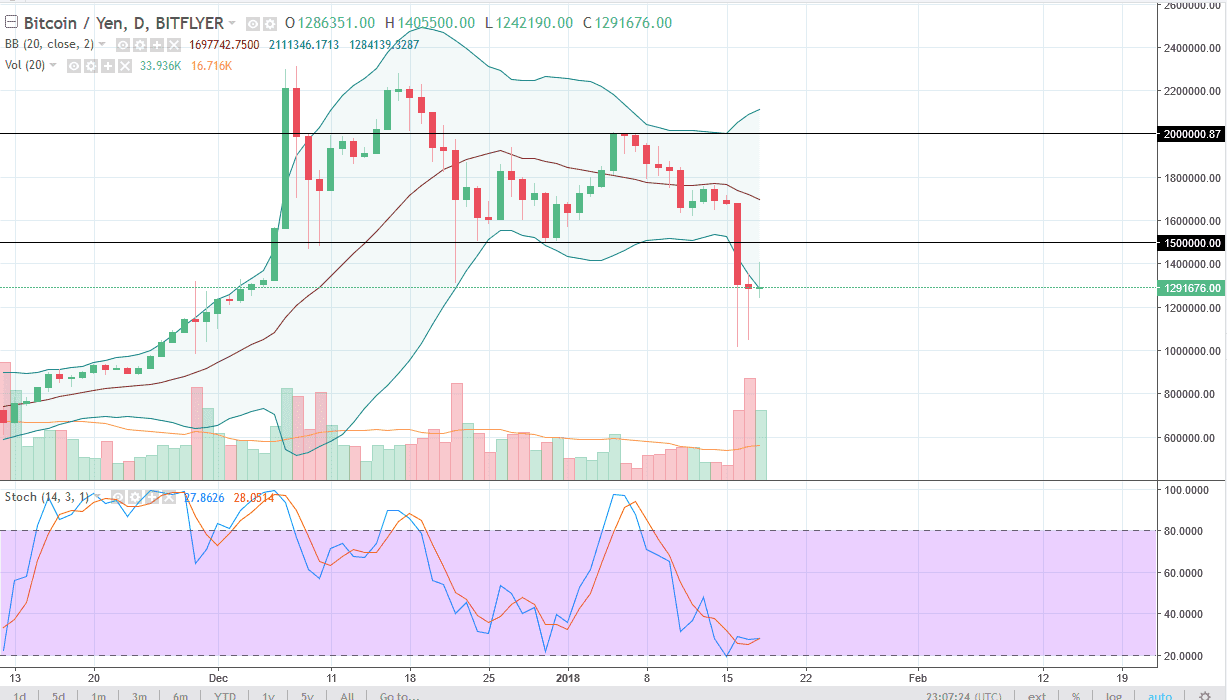

BTC/JPY

Bitcoin tried to rally during the day but turned around to form a bit of a shooting star as well. The ¥1.4 million level has offered enough resistance to turn things back around, with the shooting star being formed, looks like the sellers are coming back. At the very least, there aren’t any buyers in that it course is a major problem. The ¥1.5 million level above is very resistive, and if we can break above there it’s likely that we could continue to go higher. Overall, Asia has been one of the main drivers for Bitcoin, so the next 24 hours will be crucial, underneath current trading, there is the ¥1 million level, and that of course being broken to the downside would be extraordinarily negative.