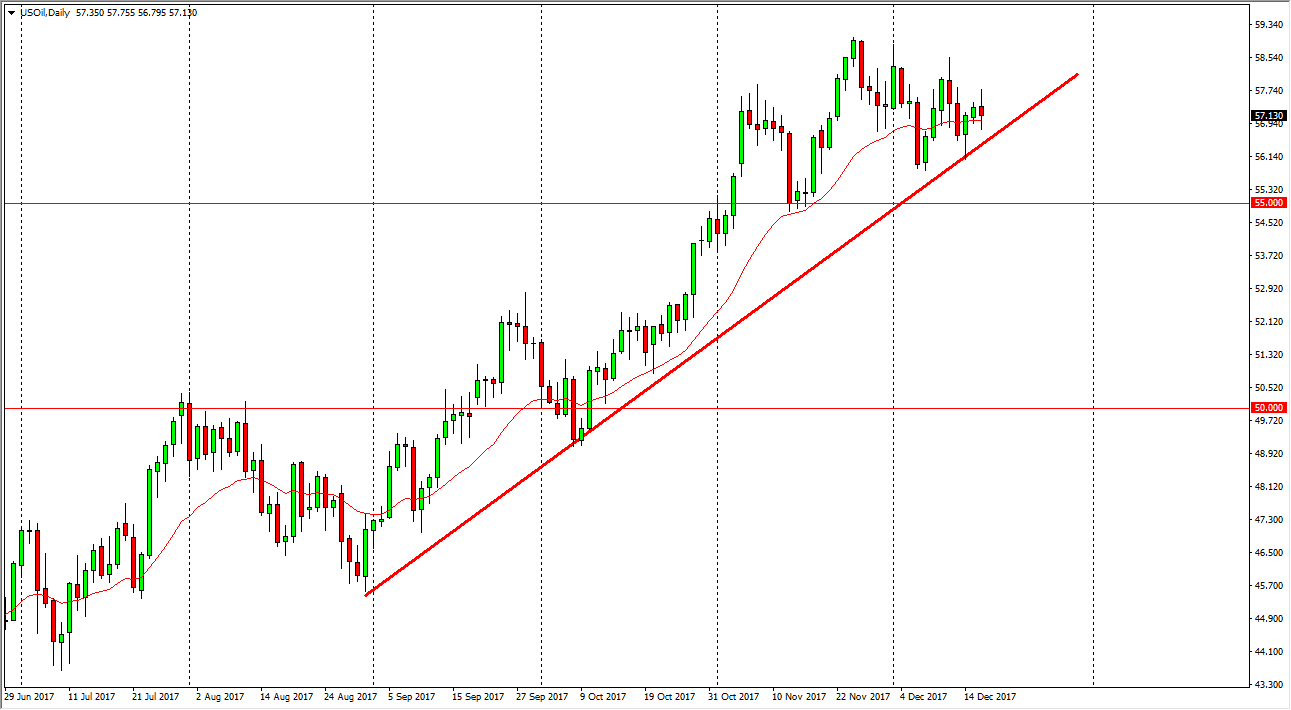

WTI Crude Oil

The WTI Crude Oil markets were volatile during the trading session on Monday, as we continue to bang around the $57 level. However, there is a nice uptrend line that I have marked on the daily chart, and I believe that if we can stay above there, the market will continue to find buyers. Alternately, we may break down below the $56 level, and that should send this market down to the $55 level. Overall, this is a market that I think is going to be very noisy, because the Americans have so much in the way of supply waiting to come into the marketplace, and as prices rising will attract more supply. Alternately, if the markets fall, it feels only a matter of time before we buy. This is because we are essentially range bound and it is towards the end of the year. The liquidity becomes a major issue.

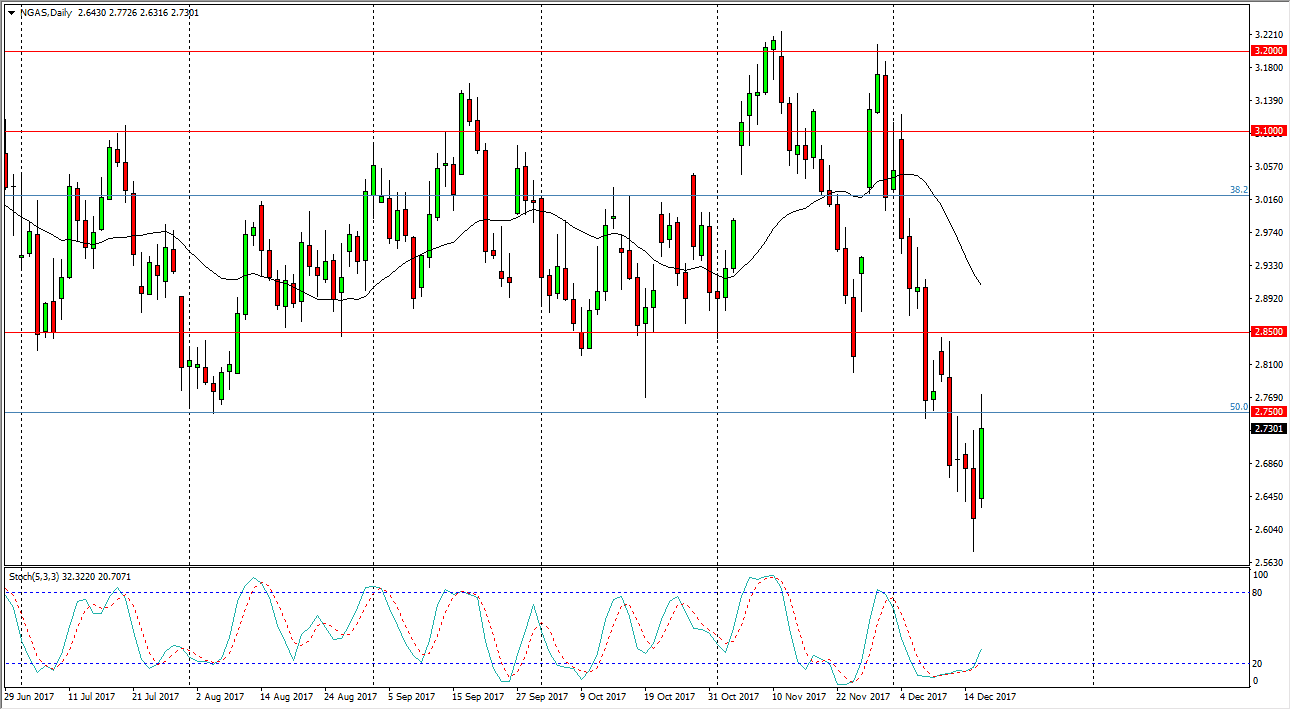

Natural Gas

Natural gas markets rallied significantly during the day on Monday, breaking above the $2.75 level at one point, but we did get back some of the gains. When I look at the daily chart, I think it makes more sense that we may go to the $2.85 level above before we run into a buzz saw of selling. Because of this, I’m waiting to see some type of exhaustion that I can get involved in, and perhaps send the market down to the $2.60 level. The $2.50 level underneath is the “floor” in the market, but I think at this point we need to back up in order to build up enough momentum to go looking towards that level. I do not think we will break down below there, because if we do that would be catastrophic for natural gas. There is far too much in the way of supply out there to have any rally last for a long time.