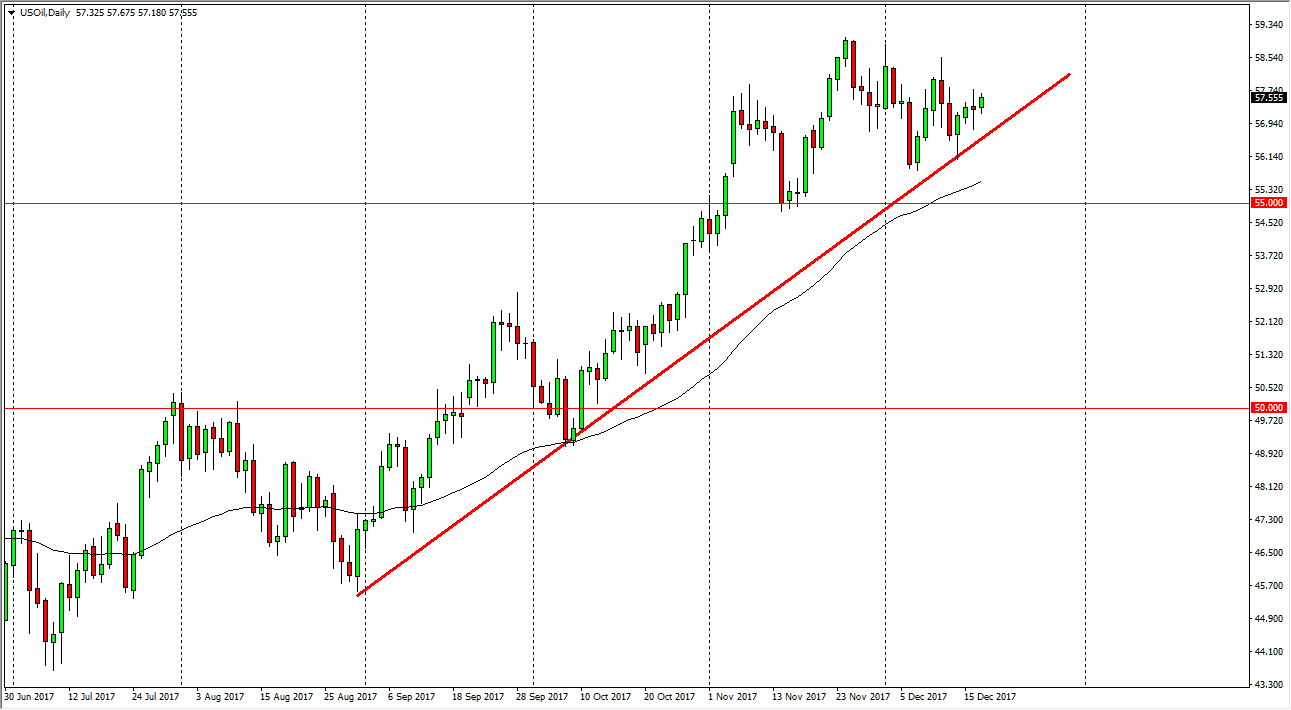

WTI Crude Oil

The WTI Crude Oil market rallied slightly during the trading session on Tuesday, but we have a significant uptrend line underneath. The market has been bullish in general, but I think that the volatility will probably continue as holidays are approaching, and liquidity will disappear. There are concerns about oversupply, and at the same time OPEC and Russia have agreed to cut production. This causes a lot of volatility in the market, but with today being the Crude Oil Inventories announcement, we could get added volatility. Until we break down below the $55 level, I believe that traders will come back in and pick up this market on pullbacks. I believe that the $59 level above is resistance as well. There should be plenty of noise, and I think that the market will be difficult to trade, especially considering with all of the nonsense in the headlines.

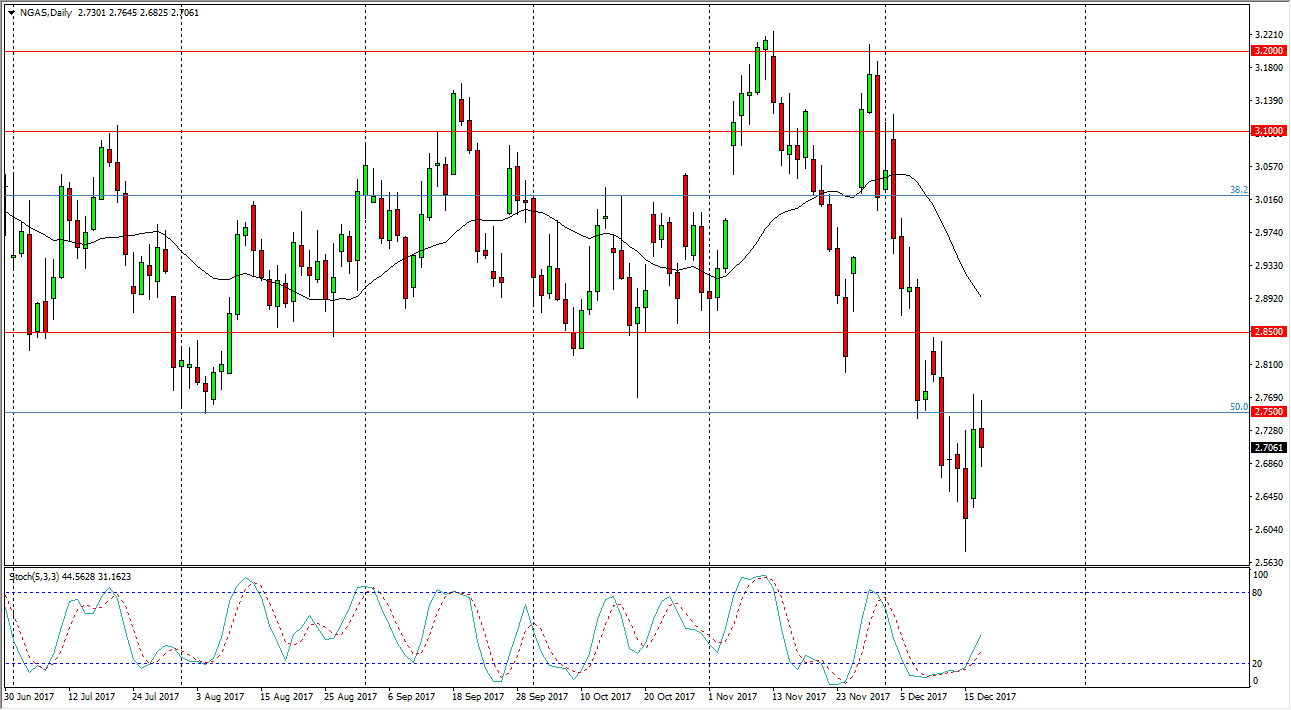

Natural Gas

Natural gas markets continue to be very noisy, as the oversupply continues to be a massive problem. Beyond that, there are plenty of issues in the natural gas market as the Americans can flood the market at will. As you can see, we’ve gone back and forth during the trading session on Tuesday, but struggled at the $2.75 level to form a reasonably negative candle. If we can break down below the bottom of the range, I think the market is ready to go down to the $2.50 level under that. Alternately, if we did rally I suspect that the $2.75 level will be resistive enough to keep the market down as well. I am waiting for either breakdown or some sign of exhaustion after rally to start selling, and have no interest whatsoever in trying to buy natural gas.