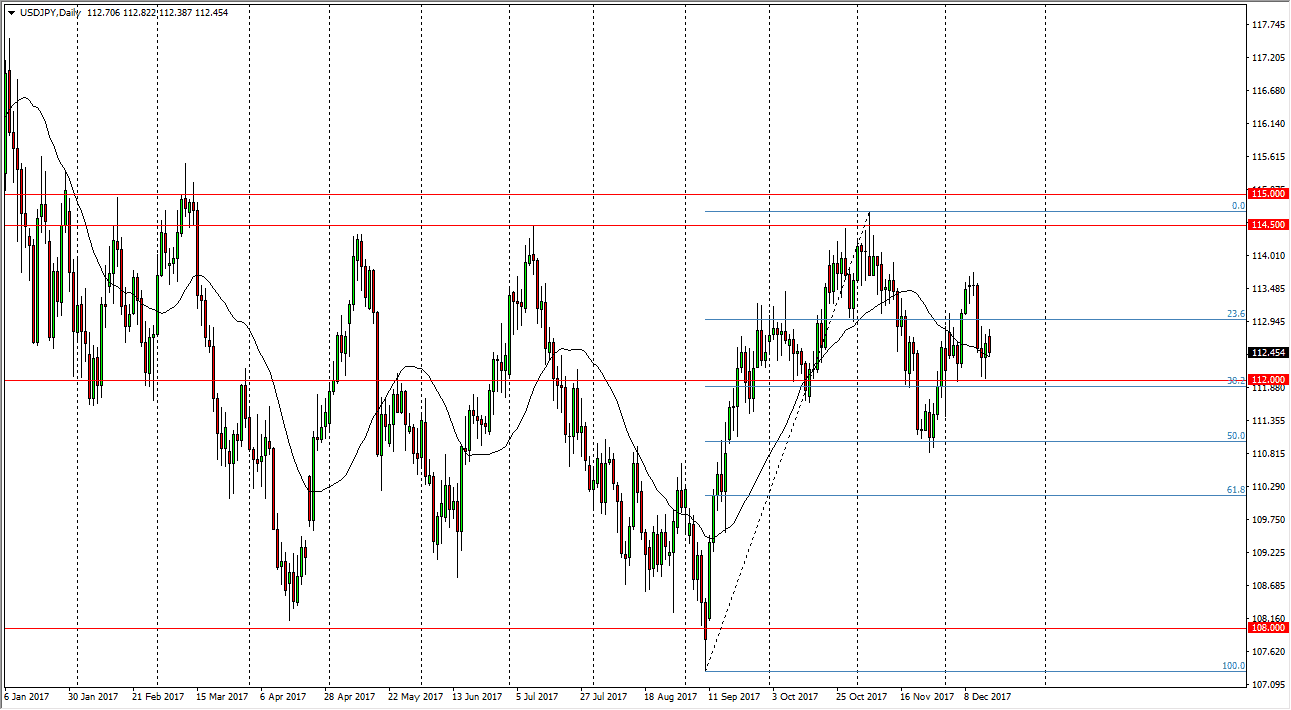

USD/JPY

The US dollar initially tried to rally during the trading session on Monday, but rolled over to essentially go slightly negative. I see a significant amount of support underneath that the 112 level though, and therefore I think that we will find buyers underneath. Given enough time, I look at pullbacks as value propositions, at least until we break down below the 112 handle. If we were to break down below 112, I think the market then goes looking towards the 50% Fibonacci retracement level underneath, near the 111 level. As this is the week before Christmas, liquidity might be an issue, but I think that the market still favors the upside considering we have recovered much of the losses that had been in the market over the last 24 hours. If we can break above the 113 handle, I think the market then goes to the 114.50 level.

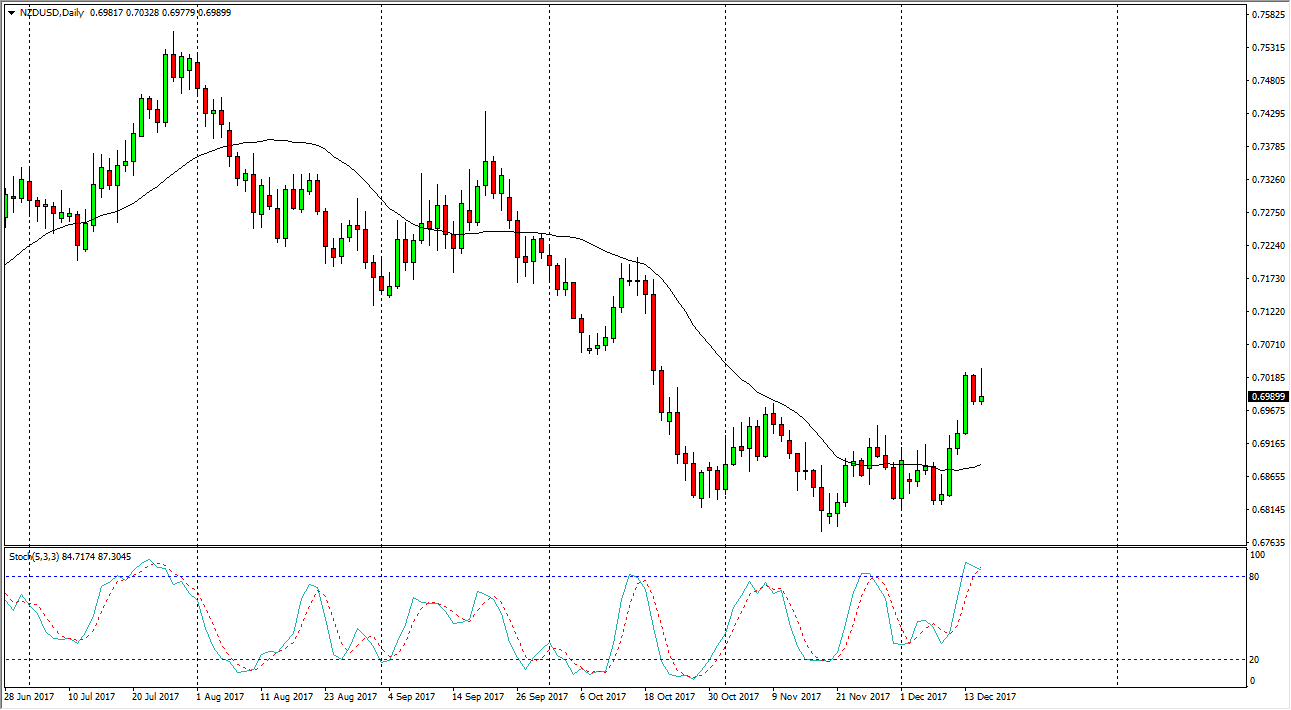

NZD/USD

The New Zealand dollar initially tried to rally on Monday also, but rolled over to form a shooting star. The shooting star was preceded by a shooting star on the daily chart, suggesting that there is a significant amount of resistance near the 0.70 level. If we can clear the recent high, then I think the market goes towards the 0.7150 level, perhaps even higher than that. Alternately, if we break down below the 0.698 level, the market roles over and reaches towards the 0.6850 level. I expect a lot of volatility in the New Zealand dollar, mainly because it is one of the least liquid currencies out of the Major pairs, and with us entering the holiday season, it will become even more illiquid. Overall, I think this market is ready to roll over though, so I much more comfortable shorting than buying.