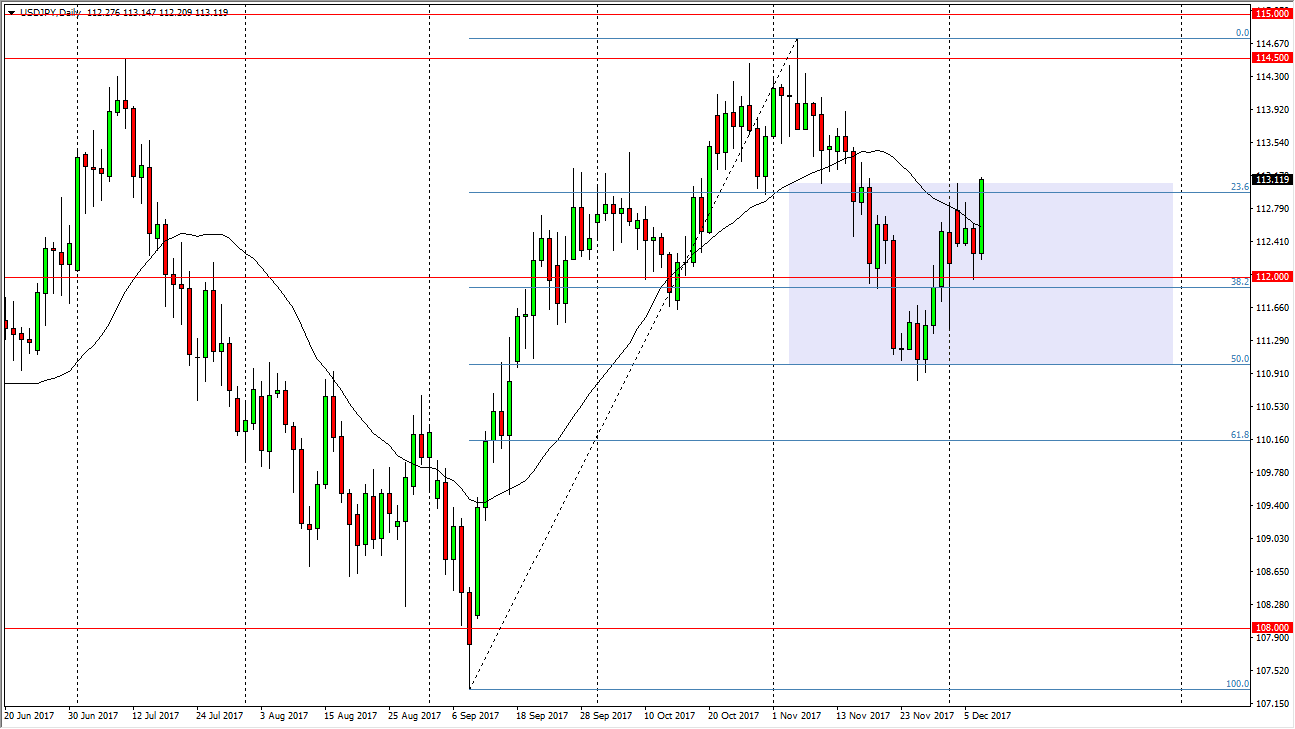

USD/JPY

The US dollar rallied significantly against the Japanese yen during the trading session on Thursday, smashing into the 113 handle. Simply put, I believe that the market has shown what it wants to do already, and a break above the top of the range for the day probably sends this market looking for the 114.50 level above. This will more than likely be a reaction to the larger than anticipated jobs number coming out during the day, but even if we do pull back from here, I believe that the 112-level underneath is essentially going to act as a “floor” in the market short term. If we can break above the 114.50 level, then we will have a significant fight on her hands at 115. Either way, I think that this is a market that is able to be bought on pullbacks.

AUD/USD

The Australian dollar fell during the trading session, reaching towards the 0.75 handle underneath. That is a large, round, psychologically significant number, but it also has a nice uptrend line dissecting it. Because of this, I think it’s only a matter of time before the buyers get involved, and on the first signs of a bounce, I think that we could have a little bit of a recovery. However, for the Australian dollar to gain for a significant amount of time, we will need to see gold markets take off as well. This would essentially be a “anti-dollar” play.

On the other hand, if we break down below the 0.7475 level, the market probably goes down to the 0.73 region. After that, I suspect we will go even lower, as the US dollar would be kicked into high gear against the Aussie. Today is going to be important for the next move.