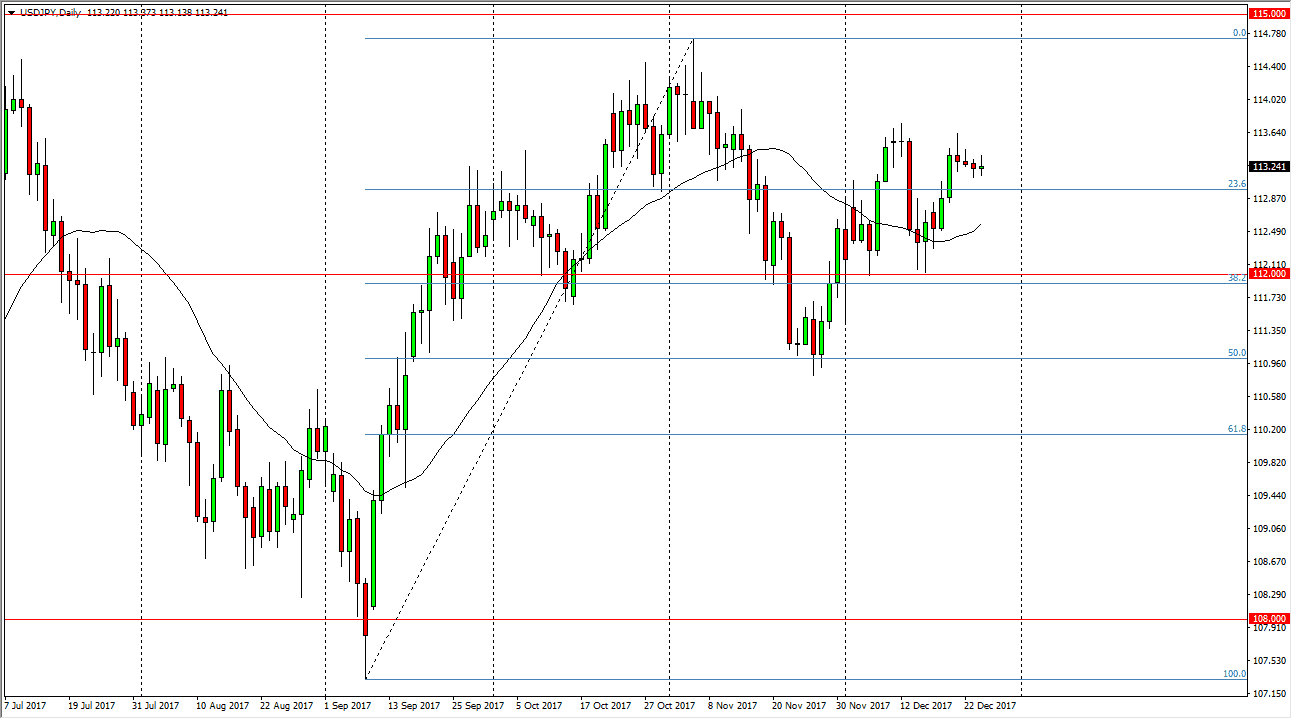

USD/JPY

The US dollar did almost nothing against the Japanese yen during the trading session on Wednesday, as most people are away from the currency markets. The tween holidays, this is probably the quietest time of year, and there’s nothing right now that suggest today is going to be any different. When I see this market, I recognize that there is a significant amount of support at the 112-level underneath. In the short term, I think we’re going to simply go back and forth, so there is potential for a bit of a pullback, but I would not be concerned about it and would look at it as a potential buying opportunity. I suspect it is probably after New Year’s Day before we find enough volume to break out to the upside.

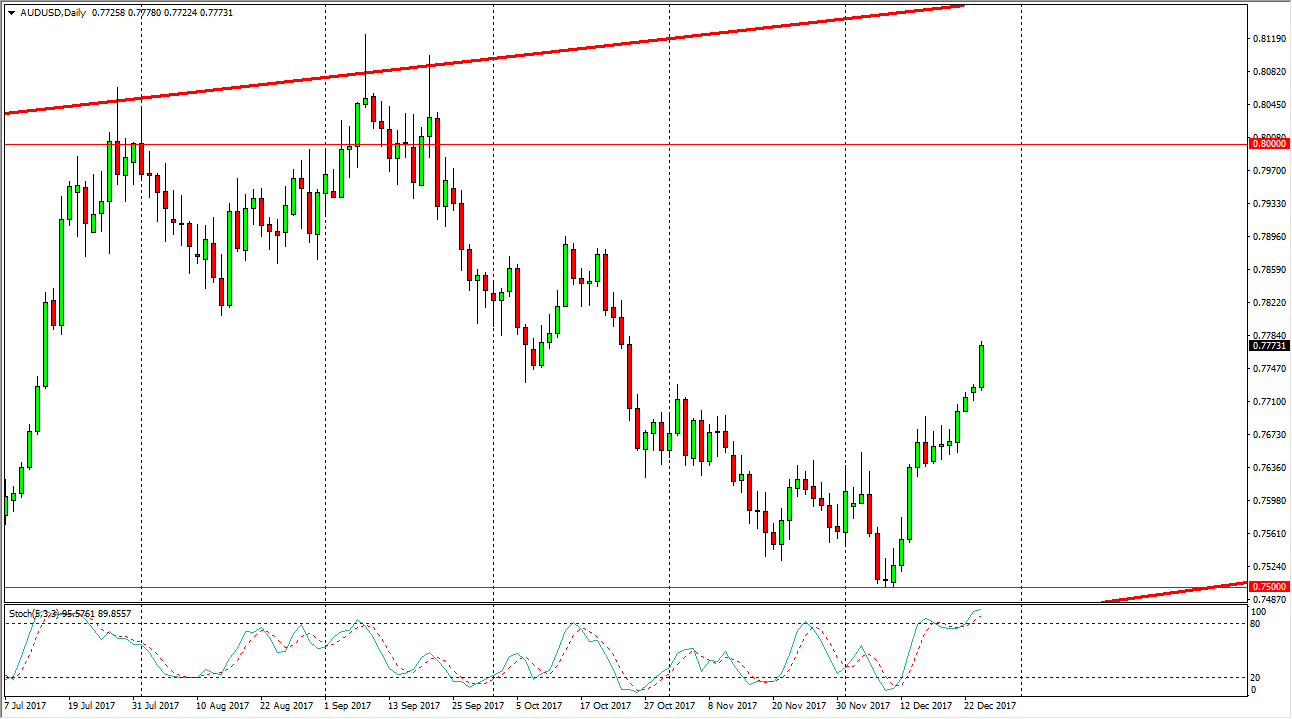

AUD/USD

The Australian dollar broke above the 0.77 handle, and continue to go much higher during the trading session on Wednesday. Now that we have this move, it’s likely that we will continue to grind towards the upside, and potentially the 0.79 handle, followed very closely by the 0.80 level. That is an area that has been important on longer-term charts, and as a result will probably attract a lot of attention. The 0.75 level offering support underneath is a strong sign, as it was the bottom of an uptrend in channel, and of course a large, round, psychologically significant number. If we can stay above the 0.80 level for any real length of time, it’s likely that this could end up being a bit of a “buy-and-hold market”, and that will be exacerbated if gold starts to rally as well. A break above the $1300 level in the gold market would be extraordinarily bullish for the Australian dollar going into 2018.