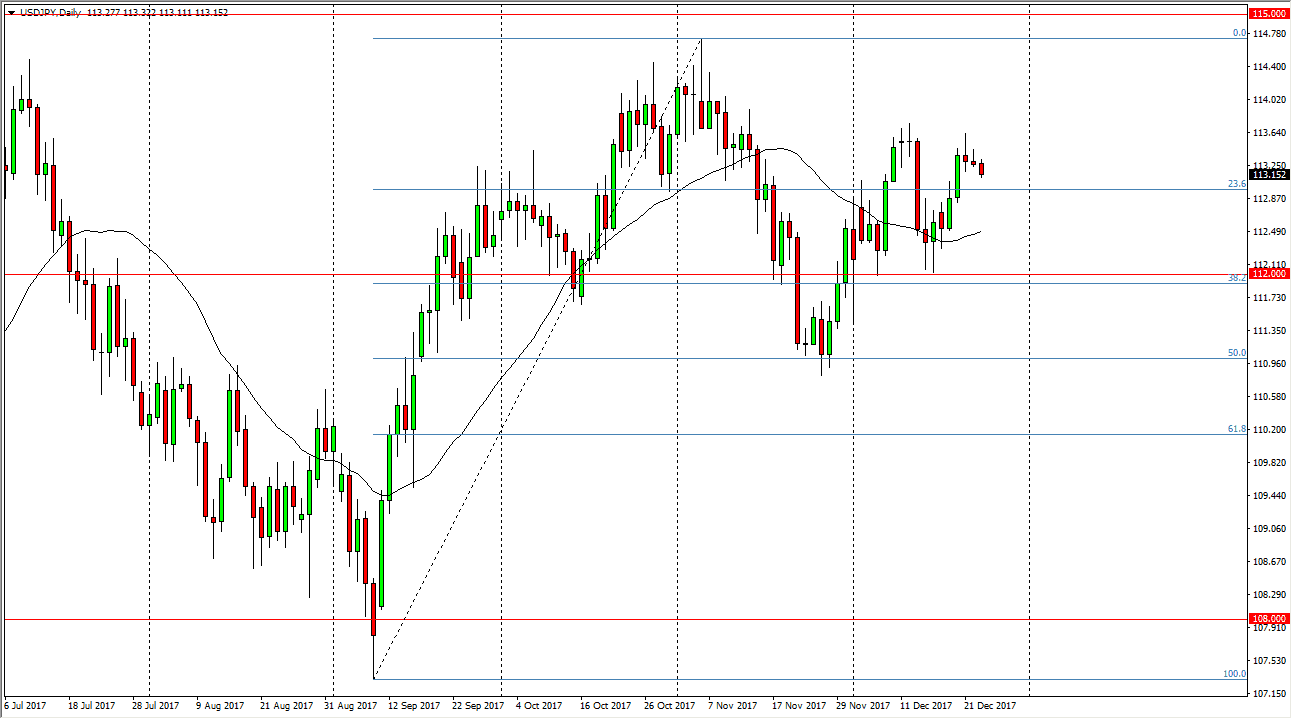

USD/JPY

The US dollar fell slightly during the trading session on Tuesday, as traders came back from the holidays. However, most of them are still away so there is a serious lack of volume. I believe that falling from here makes sense, as we are at the top of the recent consolidation area. The 112-level underneath is support, and I would fully anticipate that if the buyers come back at that area, we would return to the 113.25 level yet again. I don’t see anything changing the overall attitude of the market in the short term, and I do believe that longer-term the interest rate differential will continue to push the US dollar higher. Even if we do break down below the 112 level, I think there is a massive amount of support at the 111 level. Above, I see the 115 level being broken as a sign that we can “buy-and-hold.”

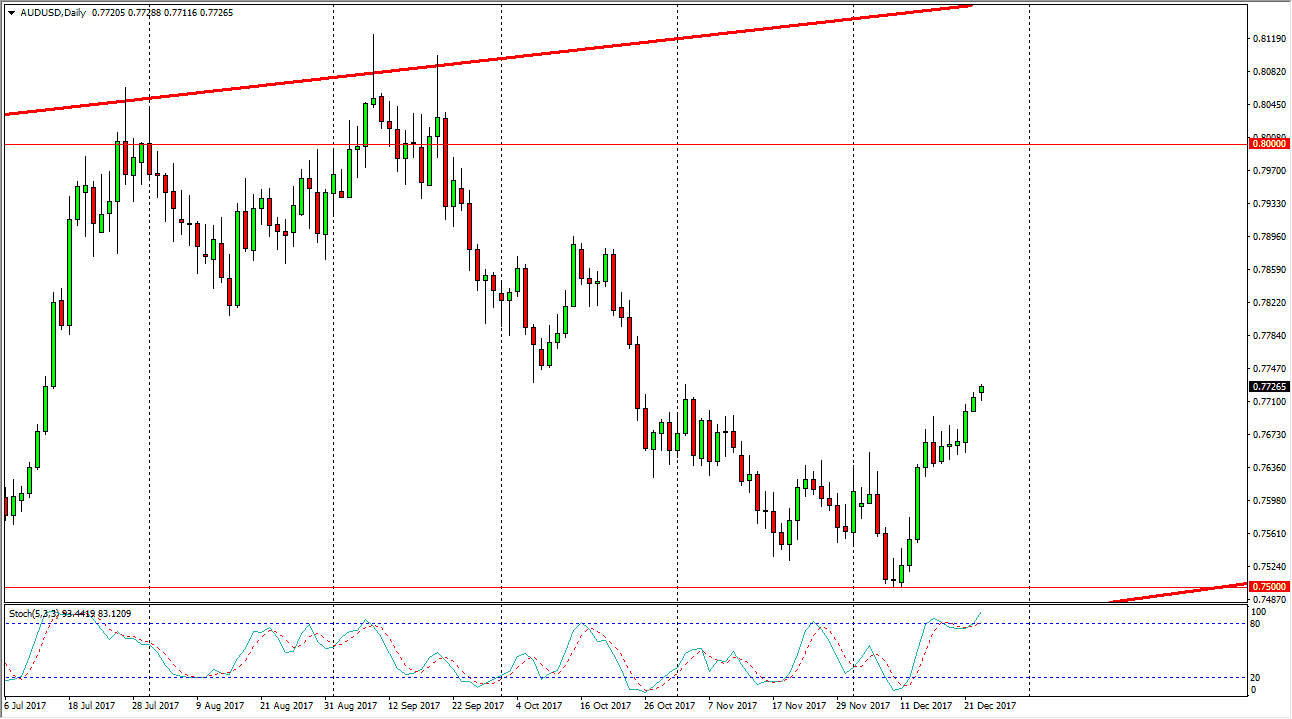

AUD/USD

The Australian dollar initially dipped during the day on Tuesday, but turned around to form a bit of a hammer. By breaking the top of the candle, we should continue to reach towards the 0.7850 level. There is a lot of noise between here and the 0.80 level, and if we can break above the 0.80 level, the market should continue to go much higher and more of a “buy-and-hold” pattern. Ultimately, I believe that the Australian dollar may try to break out during the year, but were going to need to see a lot of bullish pressure in the gold markets as well. The US dollar has been softening, so it’s likely that we could continue to see the Aussie rally, but in general I believe that there will be easier trades to take.