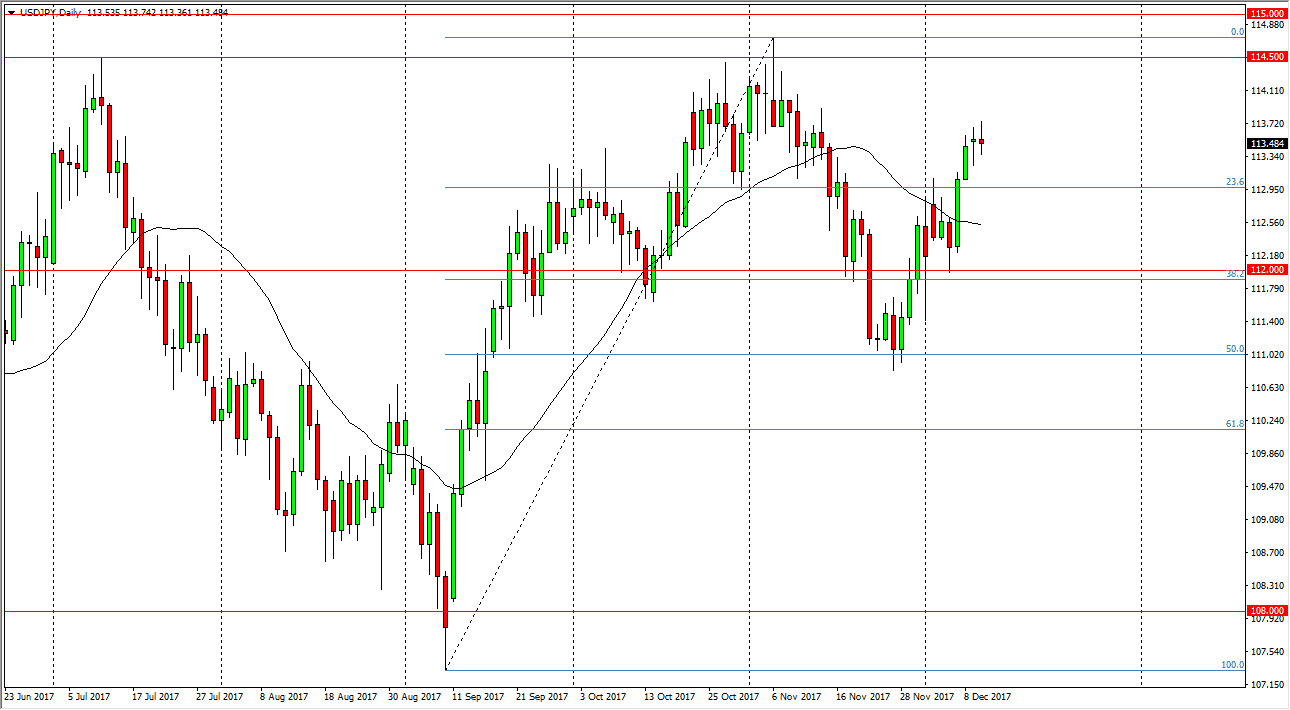

USD/JPY

The US dollar had a volatile session against the Japanese yen during the trading session on Tuesday, and ended up forming a neutral candle. I think that the market is waiting for the Federal Reserve and its attitude during the trading session today, as we get an interest rate announcement, and more importantly: a statement afterwards. The statement gives us an idea as to whether the central bank is going to be hawkish or dovish, and that will greatly influence where the US dollar goes next. If the statement is more hawkish, that should send the US dollar towards the 114.50 level above. That begins a massive amount of resistance to the 115 handle, which breaking through would be very bullish. Otherwise, we could pull back to the 112 level on a dovish statement.

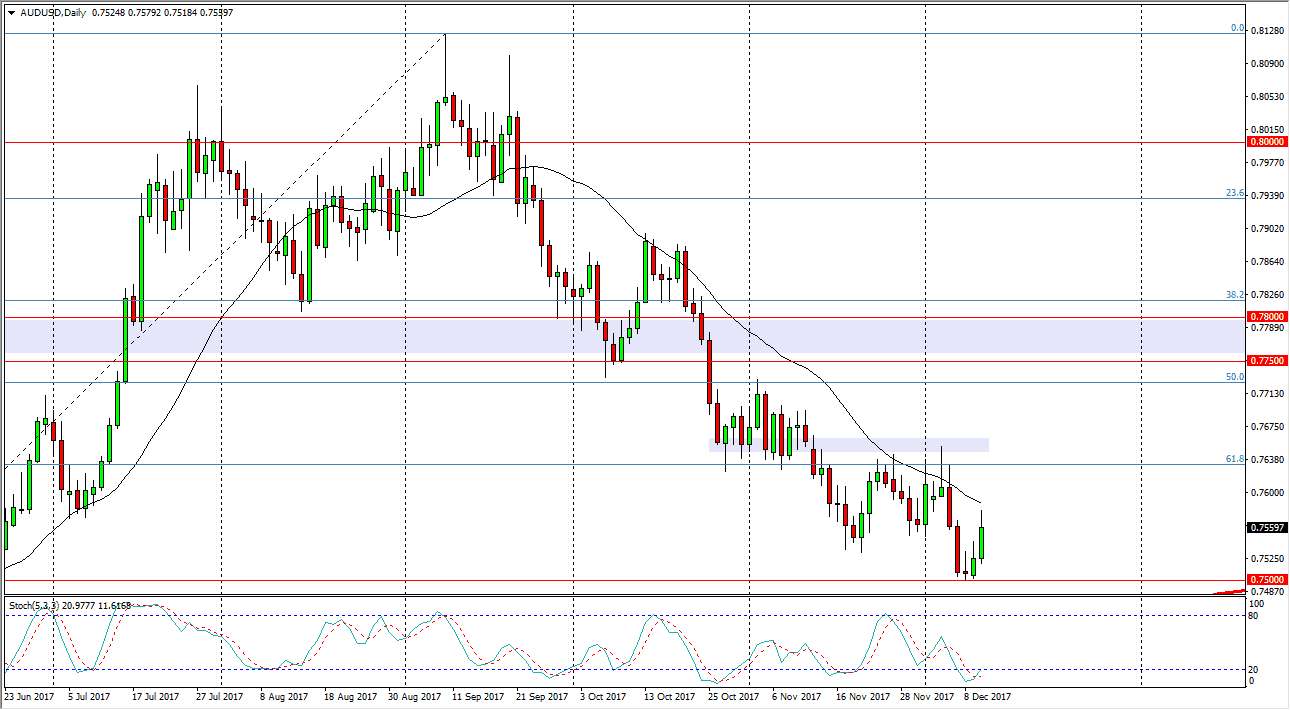

AUD/USD

The Australian dollar rallied during the day on Tuesday, as we continue to find a significant amount of support at the 0.75 handle underneath. If we can break down below that level, I think that the market breaking below the 0.75 level would be very negative, perhaps send in the Aussie down to the 0.7350 level. Alternately, if we rally from here, there should be a significant amount of resistance at the 0.7650 level. I think we are going to see a lot of noise today, and that makes sense considering that the US dollar is going to be greatly influenced by what comes out of the Fed. I believe that waiting for the daily close will probably be the best way to trade this market, as the noise will be significant. Beyond that, the gold markets will have their say as well. Because of this, I am on the sidelines until we get a daily close telling me which direction to go.