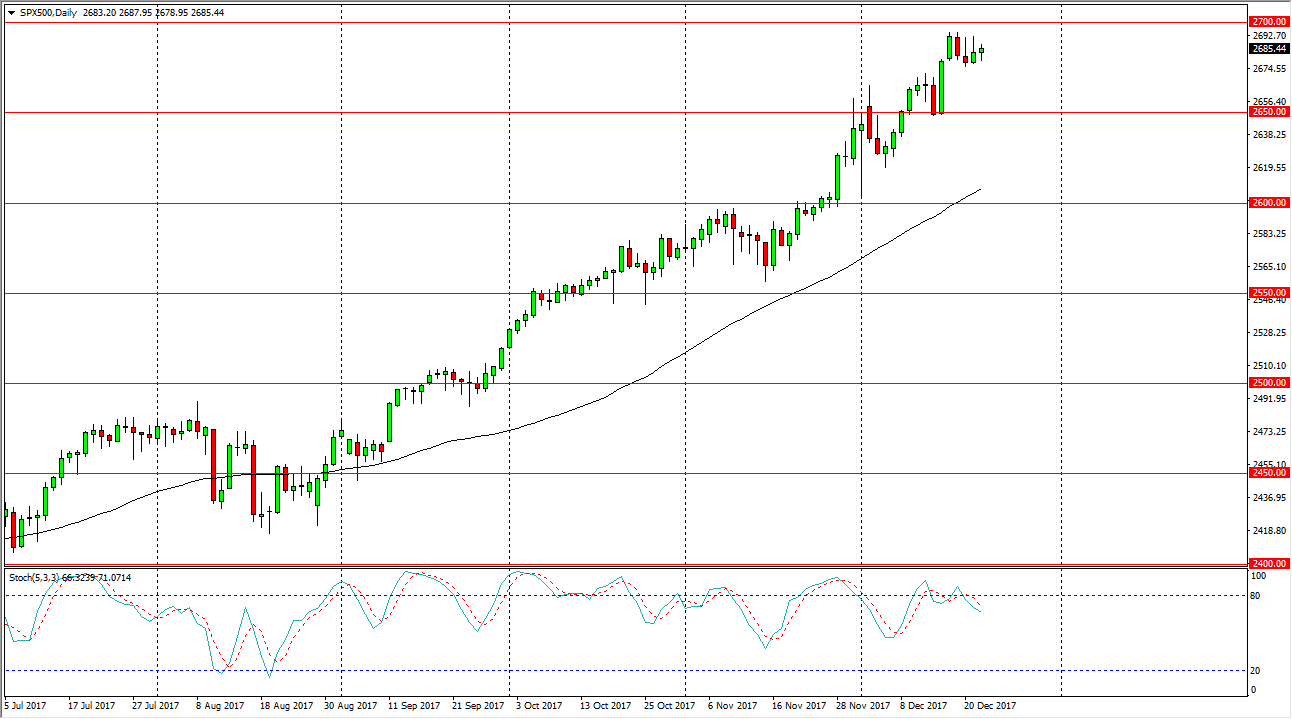

S&P 500

The S&P 500 did very little during the trading session on Friday, as we have gotten a bit overextended. With the lack of volume, it’s not a huge surprise that the market simply sat still. The 2700 level above is massive resistance, and I think at this point we are more likely to see a bit of a pullback to build up momentum and more importantly, volume in the market to break out. I believe that the 2650 level underneath should be massively supportive, and I think that it’s only a matter of time before we can go long. If we were to break down below the 2650 level, I think there is even more support at the 2600 level. Volume won’t be very strong over the next several sessions, so keep that in mind.

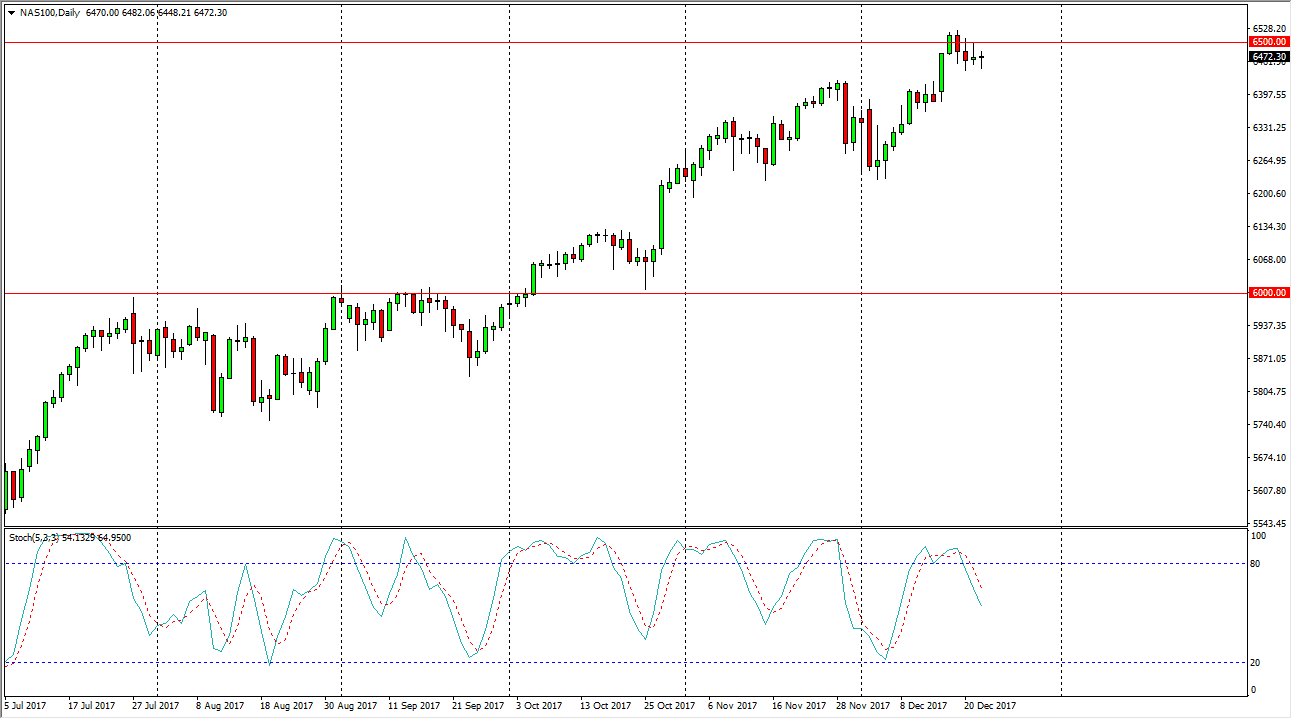

NASDAQ 100

The NASDAQ 100 also went back and forth to form a neutral candle during the day, but much like the S&P 500, we have a bit of an exhaustive shooting star candle on the weekly chart. This doesn’t tell me to start selling, it tells me that it’s only a matter of time before the buyers can pick up the markets at lower levels, and at a discount. The 6000-level underneath is the absolute floor in this market, but I think there is significant support at the 6250 level as well. I’m waiting for some type of bounce or supportive daily candle to start buying again, unless of course we break out to the upside significantly, and close well above the 6500 level, and a fresh new high. That would also be a buying opportunity in a market that has been strong, but a bit of a laggard when it comes to the US indices.