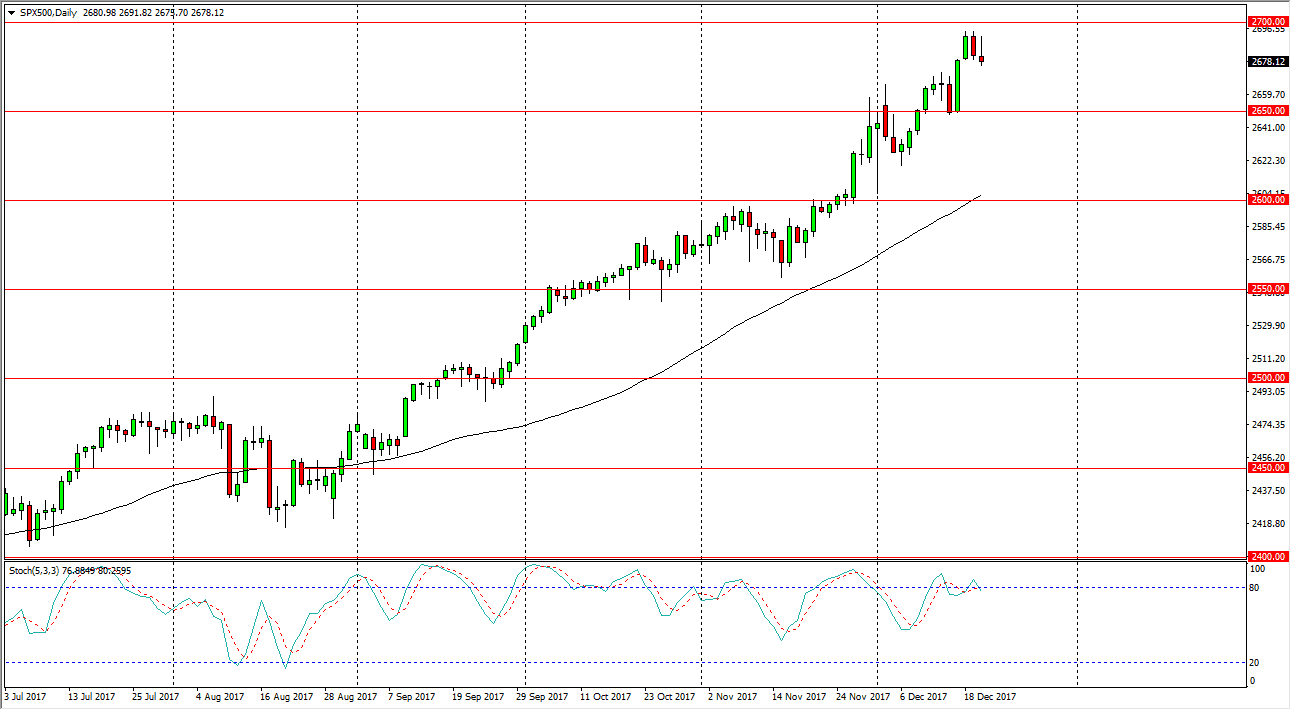

S&P 500

The S&P 500 initially tried to rally during the day on Wednesday, but seems to lack the ability to break above the 2700 level. Because of this, we ended up rolling over and forming a massive shooting star. The shooting star is a negative sign, and I think we may be looking at a market that’s ready to pull back a little bit. There is a serious lack of liquidity going forward, as Christmases Monday, so please keep that in mind. I don’t necessarily think that this is a selling opportunity, rather I think it is an opportunity to start going long, with the 2650 level underneath being supportive. I don’t think that the pullback is anything more than trader stepping away and going home for the holidays. I do believe that eventually we will see this market rally significantly, and break above the 2700 level.

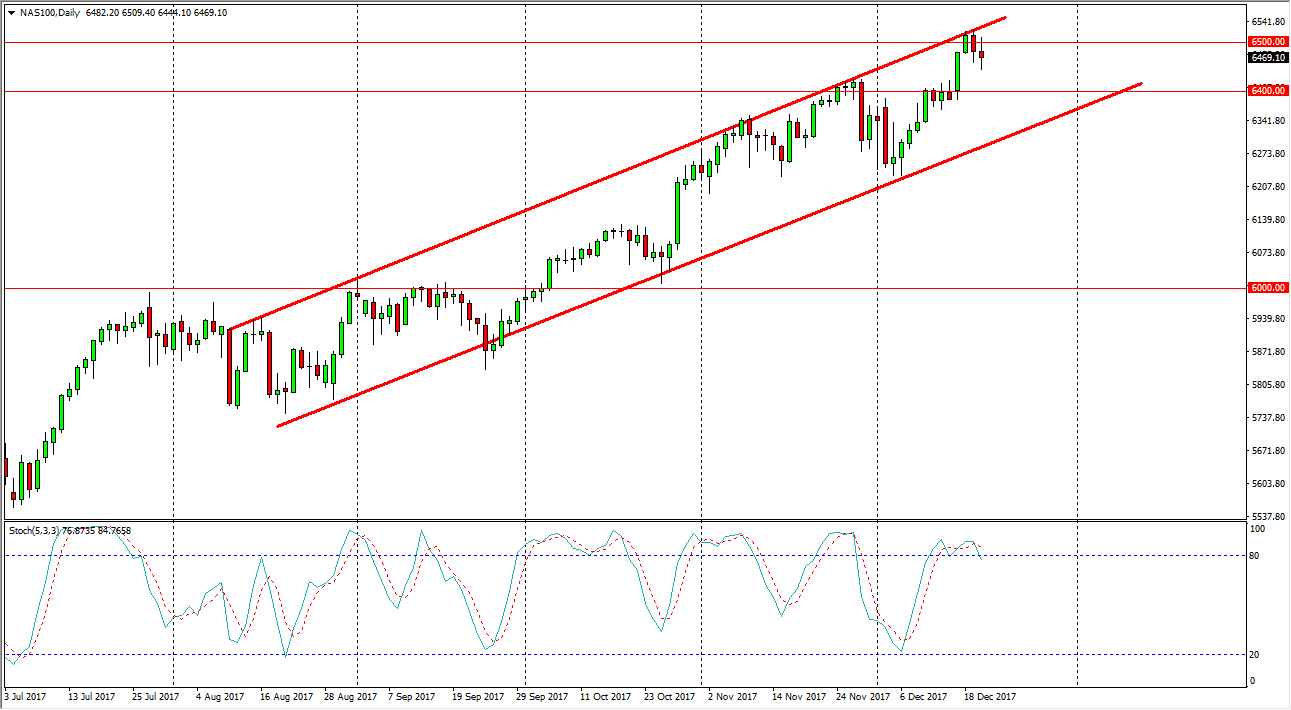

NASDAQ 100

The NASDAQ 100 went back and forth during the trading session, showing a slightly negative tone as the 6500 level has offered a massive amount of resistance. If we can break above the top of the range for the day, I think the market can continue to go higher. Otherwise, if we pull back from here I think that there is a significant amount of support near the 6400 level after that. Either way, I’m a buyer and I do not want to sell this market but I’m the first person to admit that the NASDAQ 100 has lagged behind the US markets overall. Longer-term, I believe that the market is going to go higher, but the NASDAQ 100 is struggling event, so keep in mind that you will have to be much more patient with any trades that you take to the upside.