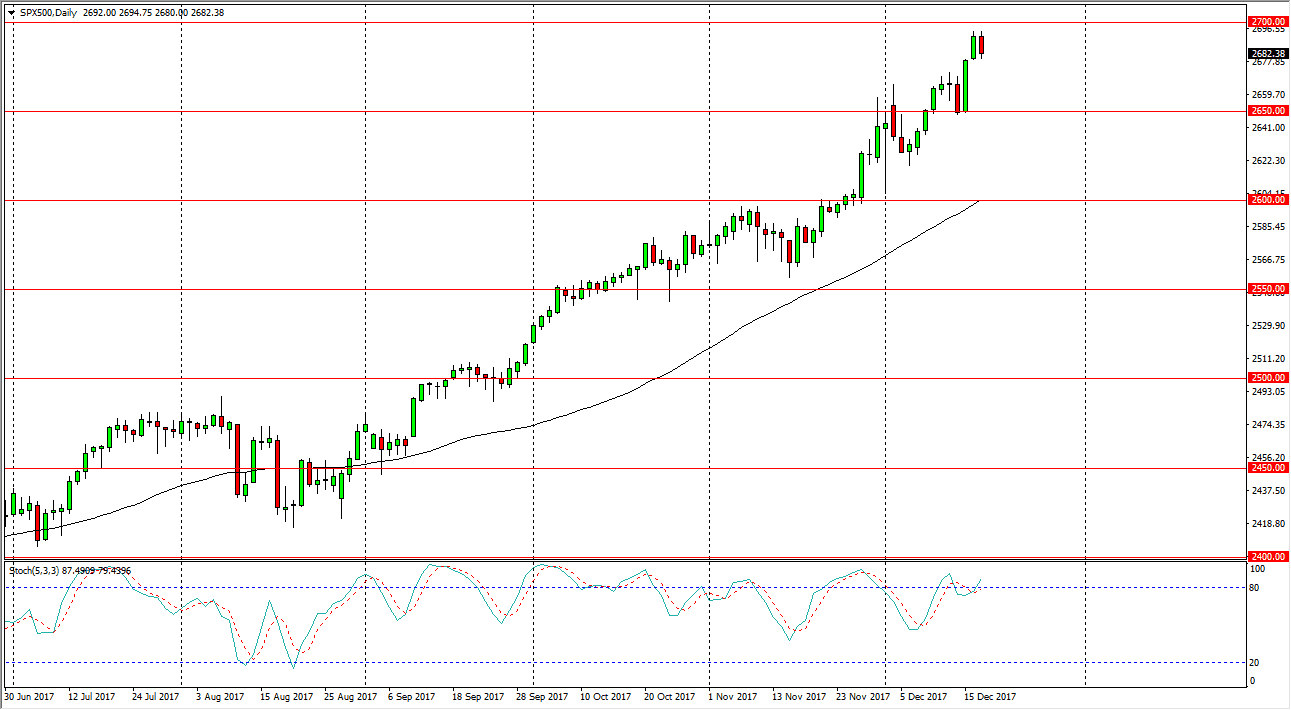

S&P 500

The S&P 500 spent most of the day falling on Tuesday, as we continue to struggle with the idea of breaking above the 2700 level. I think we will eventually, but it will take some time to build up the necessary momentum. The pullback during the day is a sign that we may be trying to build up that momentum, and I think at this point the 2650 level looks to be very supportive. Because of this, I’m looking for short-term pullbacks that show signs of support that I can take advantage of. This gives us an opportunity to follow the trend overall, and to pick up value. I think that the next couple of sessions will be very thin, as Christmas is getting close, but we should continue to see a general proclivity to go higher more than anything else in a market that has been so strong.

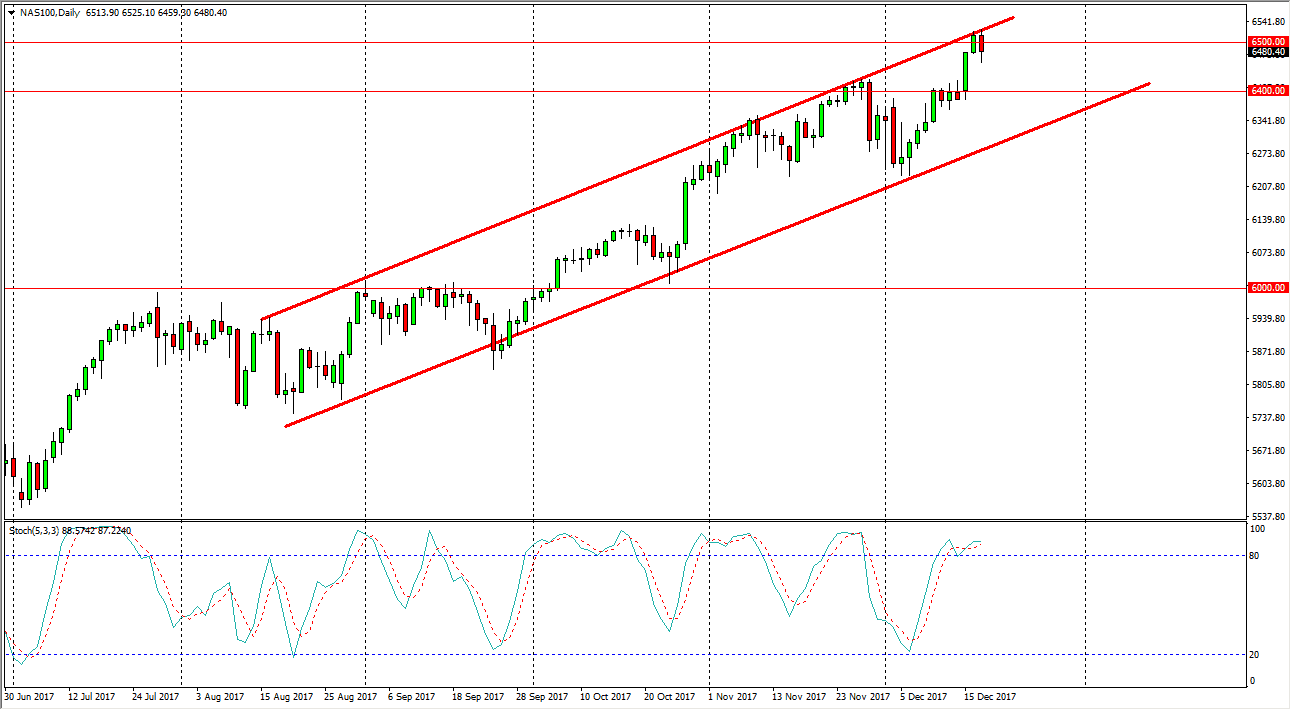

NASDAQ 100

The NASDAQ 100 fell during the day as well, but found enough support underneath to turn around and show signs of life again. I still think that we need to pull back a bit though, as we have reached the top of the channel on the daily chart, and of course are crossed over in the overbought section of the stochastic oscillator. I think that the 6400-level underneath is going to be massively supportive though, so I don’t have any interest in shorting this market. I think pullbacks offer value, just as they do in the S&P 500, and I think that given enough time we will clear the 6500 level handily, and continue to go much higher. It is not until we break down below the bottom of the channel that I would consider selling, and that something that we are nowhere near doing anytime soon.