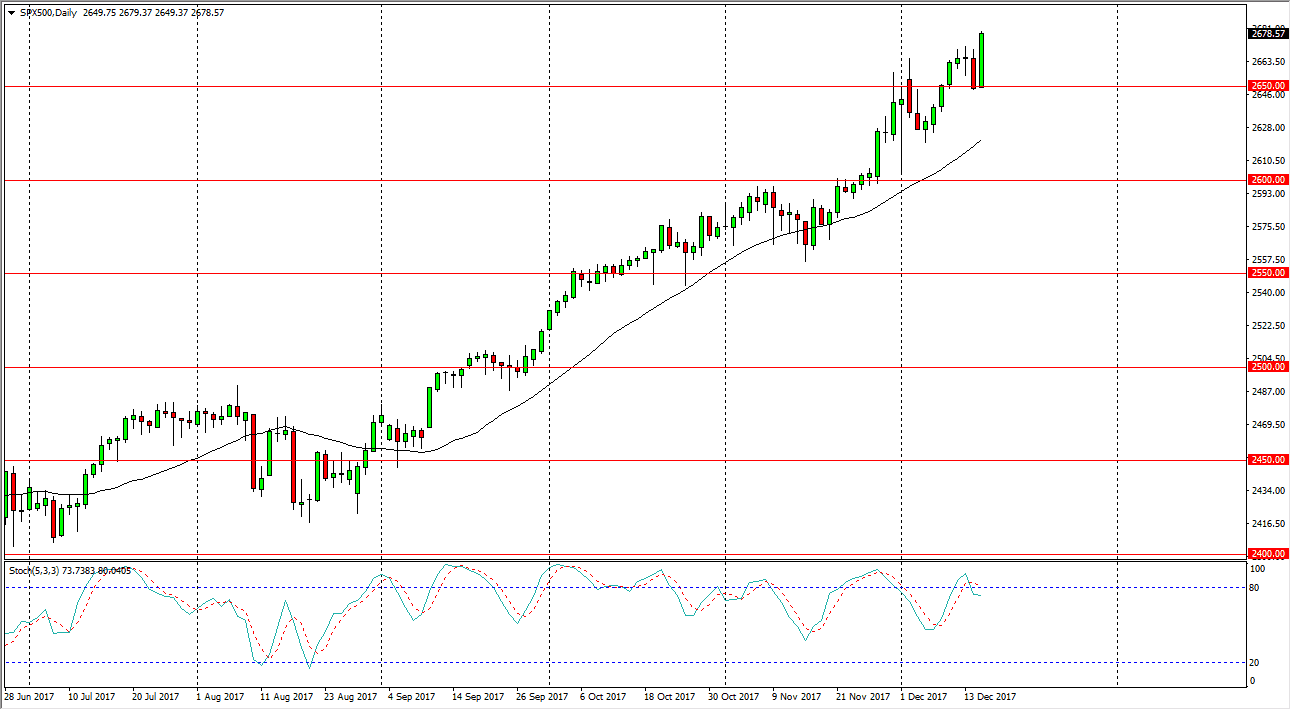

S&P 500

The S&P 500 rallied during the trading session on Friday, as word got out that it looks likely for tax reform to pass. The 2650 level offering support is no surprise, but the strength of the bounce couldn’t have been anticipated. By closing at the top of the range it’s likely that we will continue to go much higher, perhaps reaching towards the 2700 level above. The 2650 level should be massively supportive, and even if we break down below there I think there’s plenty support down to the 2600 level as well. In other words, this is a market that can only be bought and not sold. In general, I believe that we continue to see bullish pressure based upon not only tax reform, but the expanding corporate profits that we will almost certainly see due to that tax reform.

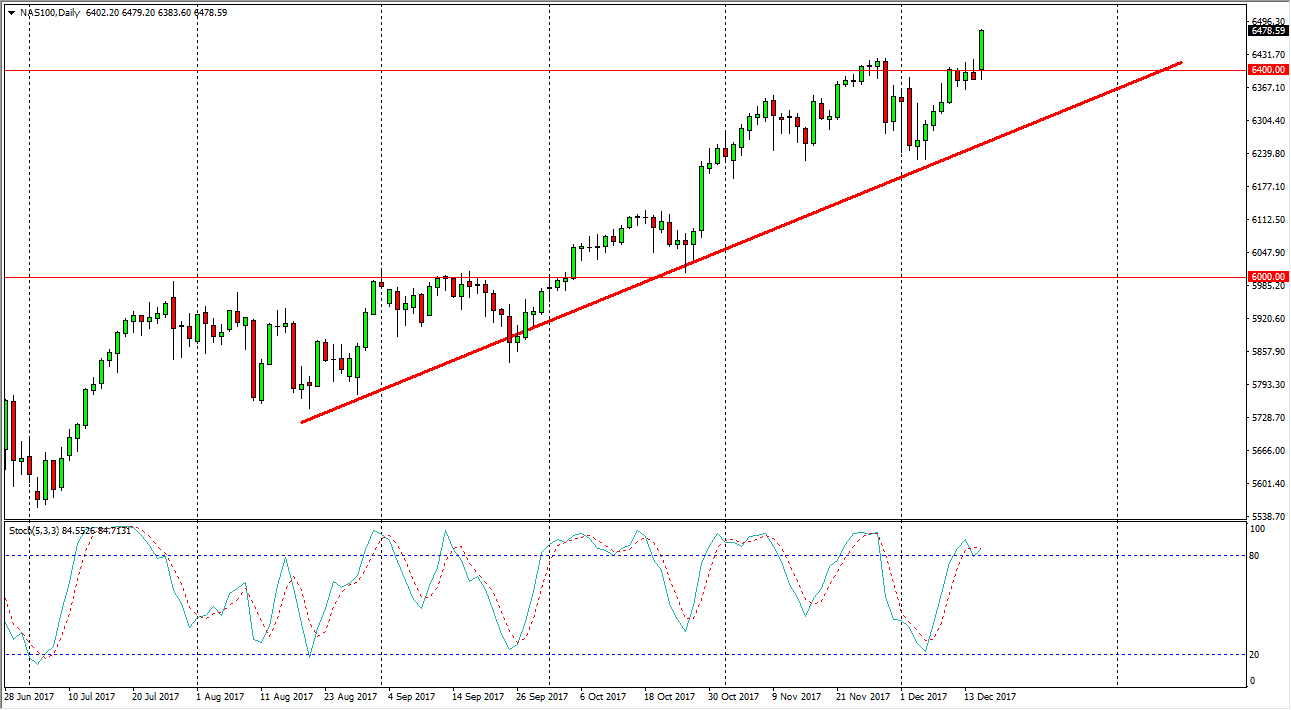

NASDAQ 100

The NASDAQ 100 initially dipped lower during the trading session on Friday, but turned around to explode to the upside. By doing so, we reached as high as 6478 at the close, and it looks likely that we will continue to go to the next large, round, psychologically significant number: 6500. That’s been my target for some time, and it now looks as if the 6400-level underneath will be support as it was previous resistance. I believe that the market should continue to find a lot of interest, as the NASDAQ 100 has been a bit of a laggard in the United States, and has a bit of catching up to do. I also believe that we break above the 6500-level given enough time. This is a market I have no interest in shorting, as you can clearly see you there is an uptrend line just below.