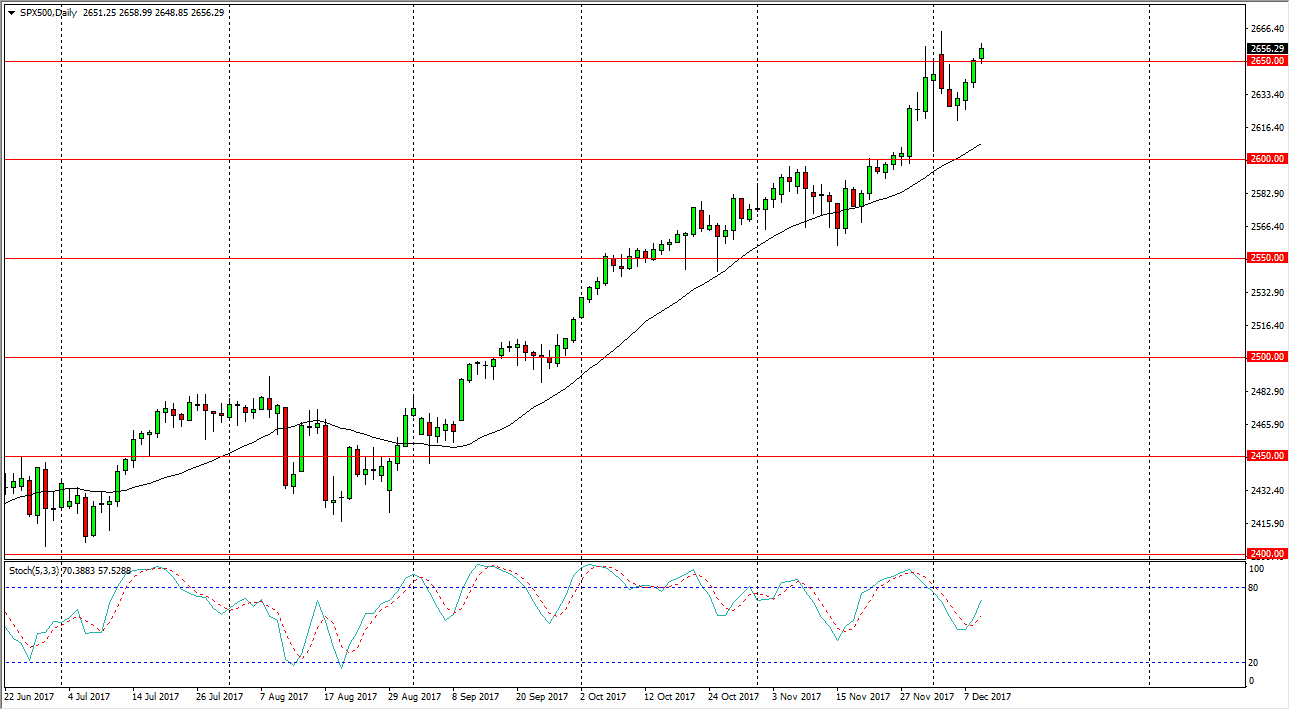

S&P 500

The S&P 500 broke out and above the 2650 handle during the trading session on Monday as the uptrend continues. I believe at this point that short-term pullbacks will continue to offer value the people are willing to take advantage of, because we have seen such a large move over the last several months. Also, this is the time of year where people to jump into the marketplace and try to pad their results for clients. This is known as the “Santa Claus rally”, something that happens almost like clockwork. Overall, I think that the markets are almost impossible to sell, and I think we will go looking towards the 2700 level given enough time. I also believe that the 2600 level underneath is the “floor” in the market, and therefore I think dips will continue to be opportunities for people to pick up value.

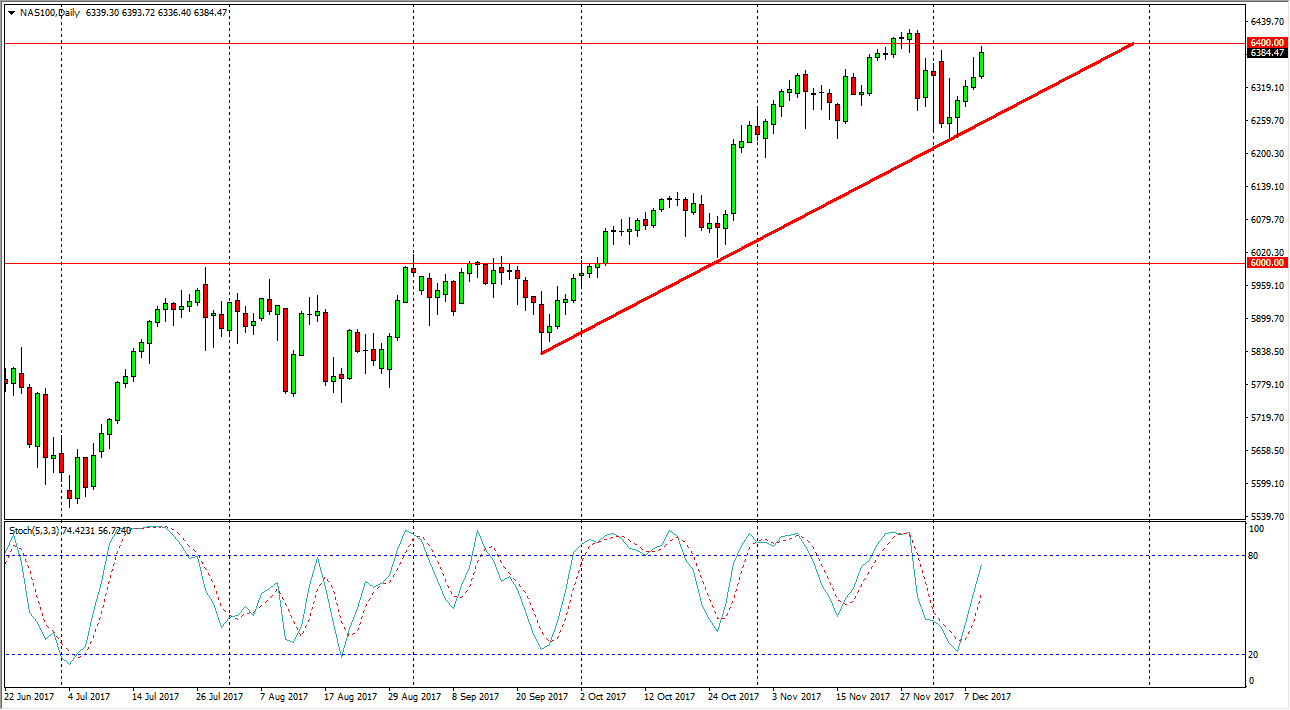

NASDAQ 100

The NASDAQ 100 rally during the trading session as well, breaking above the top of the shooting star from Friday, and that is a very bullish sign. Because of this, I think that it’s only a matter of time before we break out above the 6400 level, and pullbacks will offer buying opportunities. Because of the “Santa Claus rally” that I had mentioned with the S&P 500, it makes sense that the NASDAQ 100 would also get a lot of attention, because quite frankly it has underperformed, and therefore could have a farther way to run. If we can break out above the highs of last month, extensively the 6415 handle, then I think that the market could go to the 6500 level.

The uptrend line on the chart is going to continue to support this market, so if we break down below the 6225 handle, it’s likely that the market could go down to the 6000-handle underneath.