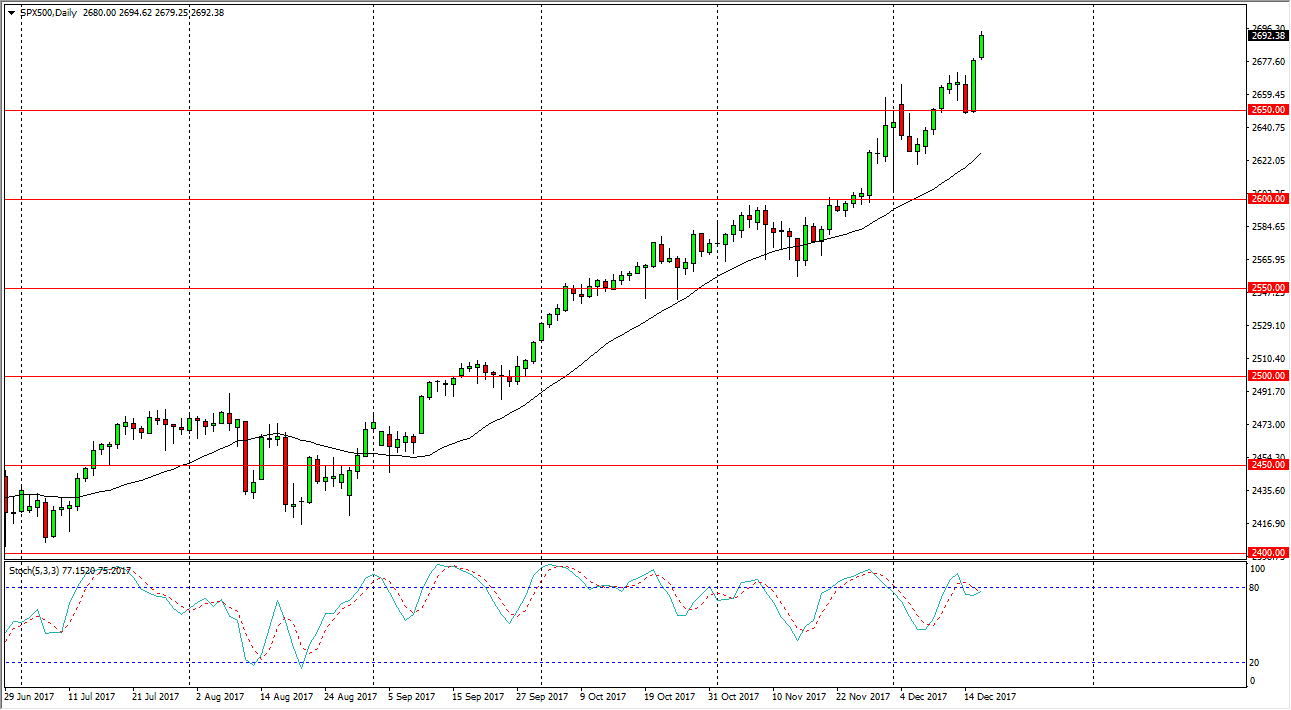

S&P 500

The S&P 500 rallied slightly during the trading session on Monday, breaking towards the 2700 level. I think that the market is likely to find a bit of short-term resistance at this large, round, psychologically significant number, but given enough time I think that there are buying opportunities underneath. I think that the market is probably supported stringently at the 2650 handle, and the Santa Claus rally should continue. I believe that it is only a matter of time before people start buying the dips. The algorithmic traders continue to jump in as well, so at this point I don’t have any interest in shorting this market, and I recognize that even though there is a certain amount of psychological importance to the 2600 level, at the end of the day, it’s only a round number and I think we will continue to go higher than that.

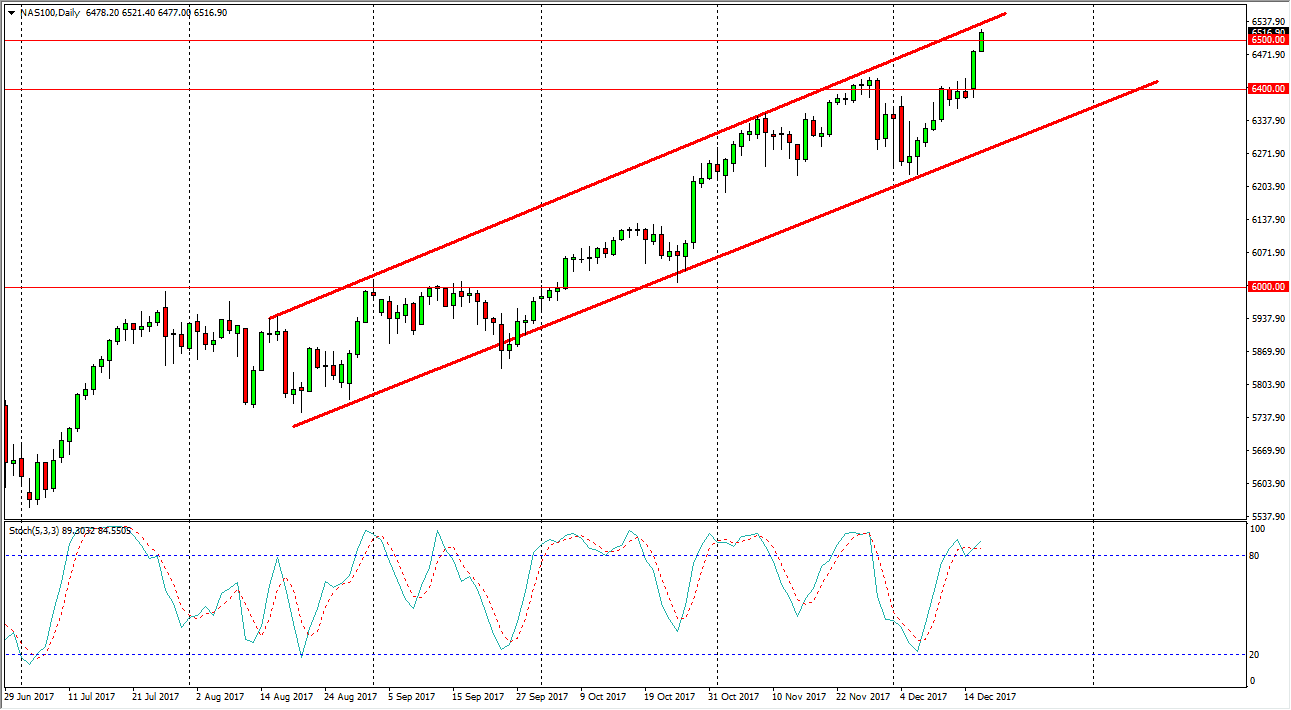

NASDAQ 100

The NASDAQ 100 has broken above the 6500 level during the trading session on Monday, as we reach towards the top of the ascending channel. If we can break above the top of the channel line, then I think that we are going to see a significant shot higher. Otherwise, a pullback makes sense, but I would expect buyers below at the 6500 level, and most certainly at the 6400 level after that. I think that buying the dips continues to be the best way to take advantage of a longer-term uptrend. I think that the markets continue to be volatile, yet bullish. The market looks likely to be a bit thin this week, so that might exaggerate some of the moves. Nonetheless, I have no interest in shorting this market as it is obviously very bullish.