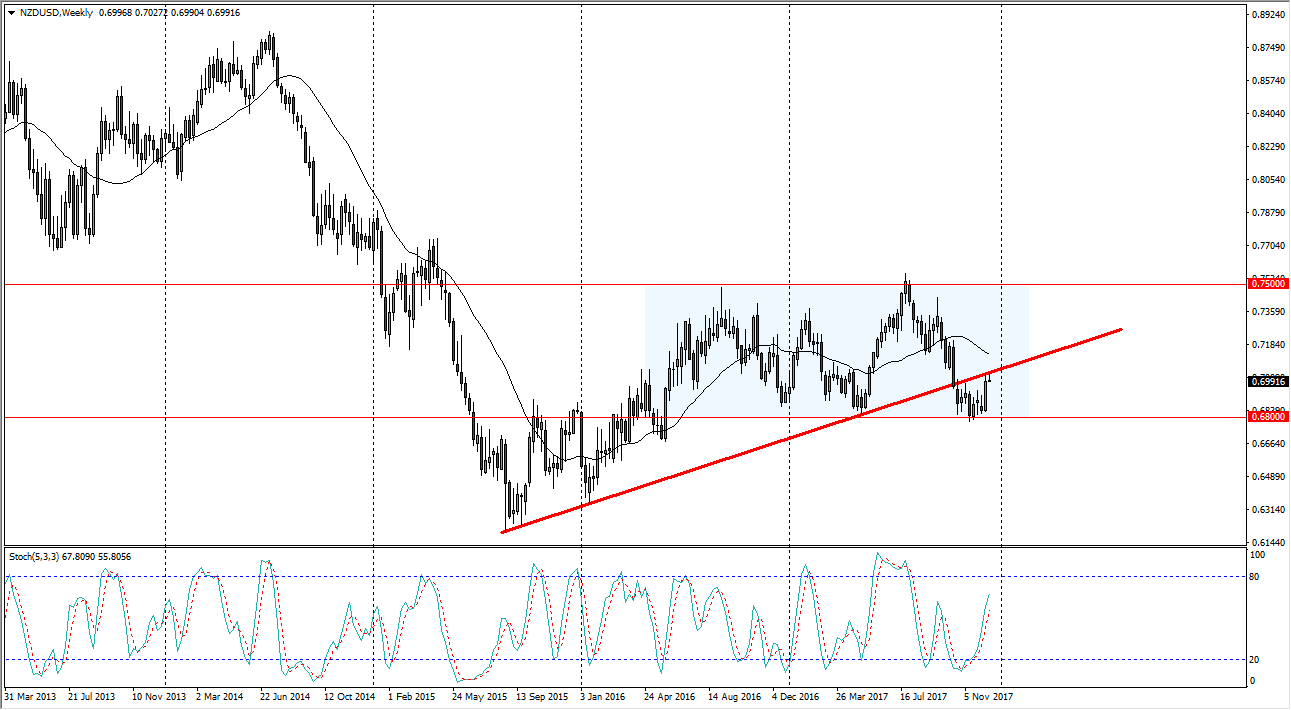

The New Zealand dollar has bounced recently from the vital 0.68 handle, and as I write this, testing the vital 0.70 level above, which coincides with the previous uptrend line that we had broken down below. This is a very vital area for the New Zealand dollar, and as I write this article it’s likely that we are trying to decide where the market goes for Q1.

Simply put, if we break above the 0.70 level on a weekly close, I think we go to the top of the blue rectangle, continuing the consolidation that we have seen for 18 months. That could send this market to the 0.75 level again, which has been significant resistance. Alternately, if we roll over from here we probably go to the 0.68 level, an area of significant support. If we break down below there, the market could drop to the 0.63 handle, and when I look at this chart, I must think that it is likely a thought of traders around the world. The New Zealand dollar is highly sensitive to risk appetite and commodity markets, so we will have to see what happens next in those markets before we get some type of confirmation over here I believe. Wait for a weekly close, and then you can perhaps anticipate where this market goes next. In general, this is a market that I think will be very noisy during Q1, but once we finally make a significant move, I think that the next trade will be relatively obvious, and therefore I think that the overall market will flood volume in one direction or the other once we get that confirmation. There are concerns about the new PM in New Zealand as far as spending is concerned, but then again there are concerns about the US dollar as well.