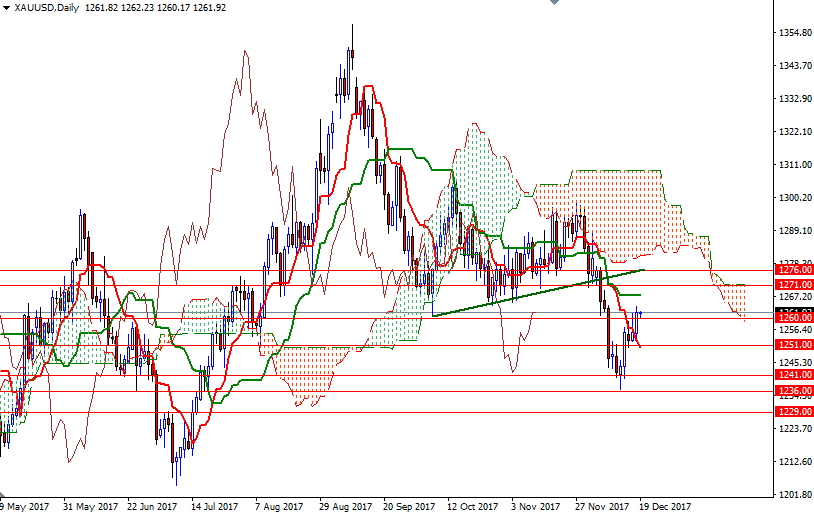

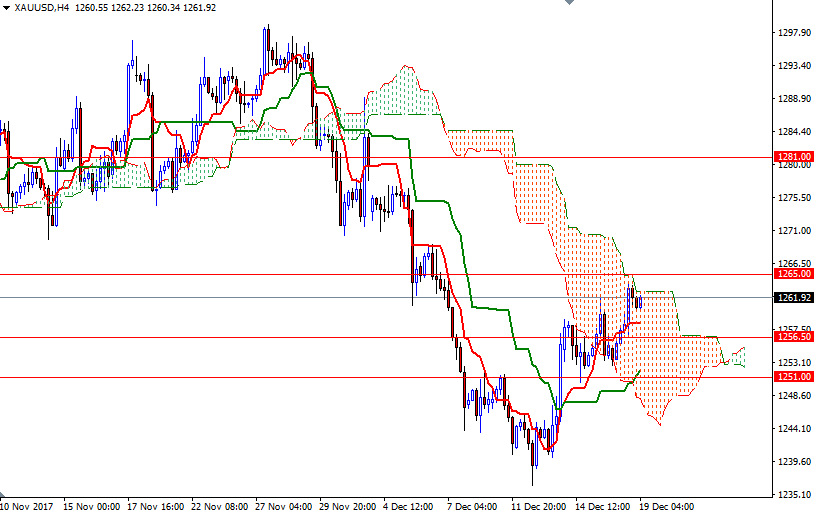

Gold prices rose $6.91 on Monday as a retreat in the dollar took some pressure off the precious metal. XAU/USD headed towards the $1265 level after the market broke through the resistance at $1260. Prices returned to $1260 in early Asian session, and this level looks to have flipped from resistance to support.

From a chart perspective, the bulls have the near-term technical advantage. XAU/USD is trading above the Ichimoku clouds on the H1 and the M30 charts. The Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) lines are positively aligned on the 4-hourly and the hourly charts.

If the market can confidently get back above 1265, then the 1271/69 area will be the next stop. The bulls have to produce a daily close beyond 1271 to gather momentum for 1276. However, if prices are unable to penetrate the 4-hourly cloud, keep an eye on the support in the 1256.50-1255 zone. A break below 1255 implies that the market will be testing 1253 next. Not too far from there, we have a strategic support at 1251-1248.50. The bears will need to pull prices below 1248.50 to challenge the bulls waiting in the 1245/4 area.

Gold prices rose $6.91 on Monday as a retreat in the dollar took some pressure off the precious metal. XAU/USD headed towards the $1265 level after the market broke through the resistance at $1260. Prices returned to $1260 in early Asian session, and this level looks to have flipped from resistance to support.

From a chart perspective, the bulls have the near-term technical advantage. XAU/USD is trading above the Ichimoku clouds on the H1 and the M30 charts. The Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) lines are positively aligned on the 4-hourly and the hourly charts.

If the market can confidently get back above 1265, then the 1271/69 area will be the next stop. The bulls have to produce a daily close beyond 1271 to gather momentum for 1276. However, if prices are unable to penetrate the 4-hourly cloud, keep an eye on the support in the 1256.50-1255 zone. A break below 1255 implies that the market will be testing 1253 next. Not too far from there, we have a strategic support at 1251-1248.50. The bears will need to pull prices below 1248.50 to challenge the bulls waiting in the 1245/4 area.