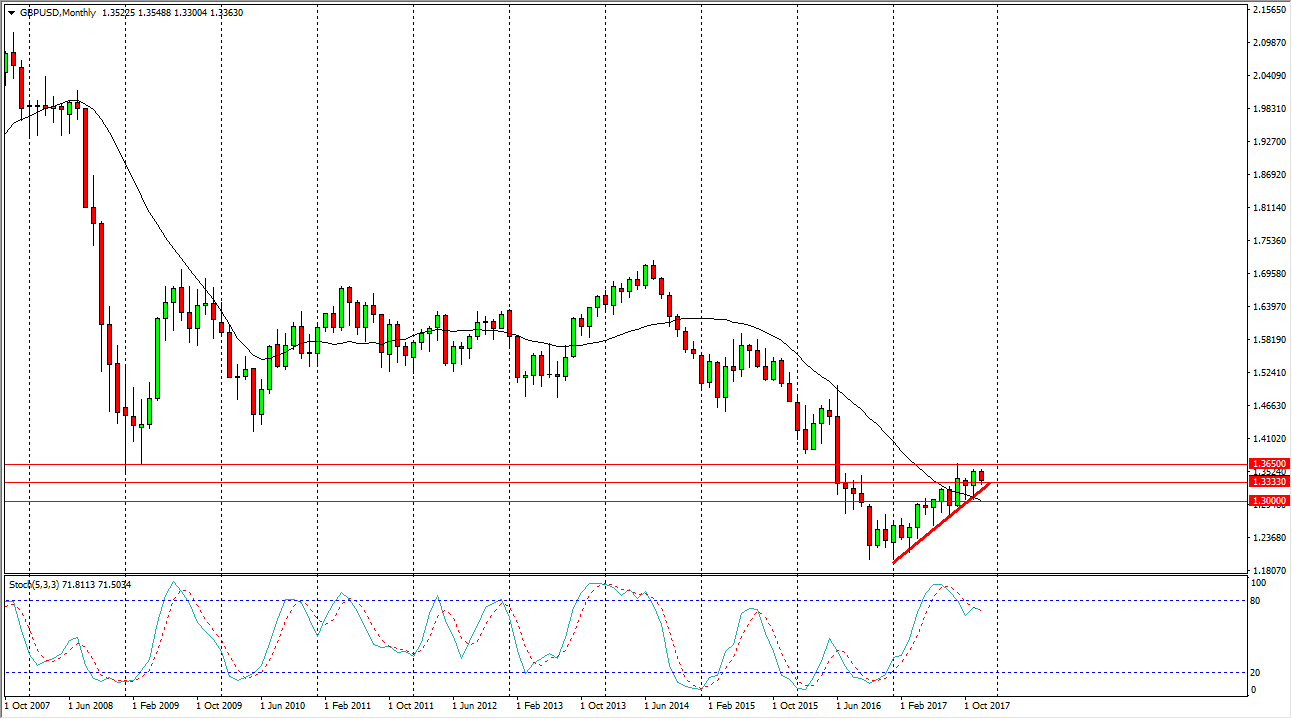

The British pound has been grinding higher for some time, and has been very bullish when you look back at 2017. That doesn’t mean it’s been an easy trade, rather that we have found a nice uptrend line that we have been following, and it looks as if we are ready to continue more of the same. I think that if we can break above the 1.3650 level, that will be the end of the overall downtrend. I recognize that there are a lot of headlines out there moving this pair round, mainly coming from the negotiations between London and Brussels. That means that there will be sudden moves on short-term charts, so having said that I think you need to be very careful about the leverage that you’re using, but I fully anticipate that we will break above the 1.3650 level, and at that point I would anticipate that we could go to the 1.50 level above.

The alternate scenario is that we break down below the 1.30 level, perhaps in reaction to something that’s going on with the negotiations between the UK and the EU, and that would send this market much lower, perhaps visiting the lows again. Looking at this chart, I think that the market continues to be bullish, but think of this as more of an investment than a trade, which is exactly how you should be looking at the British pound. You are betting on the British economy surviving and thriving down the road, and you need to keep in mind that there may be some bumps along the way. For what it’s worth, it looks as if the US dollar is going to struggle against many other currencies, so that could have a bit of a “knock on effect” here as well.