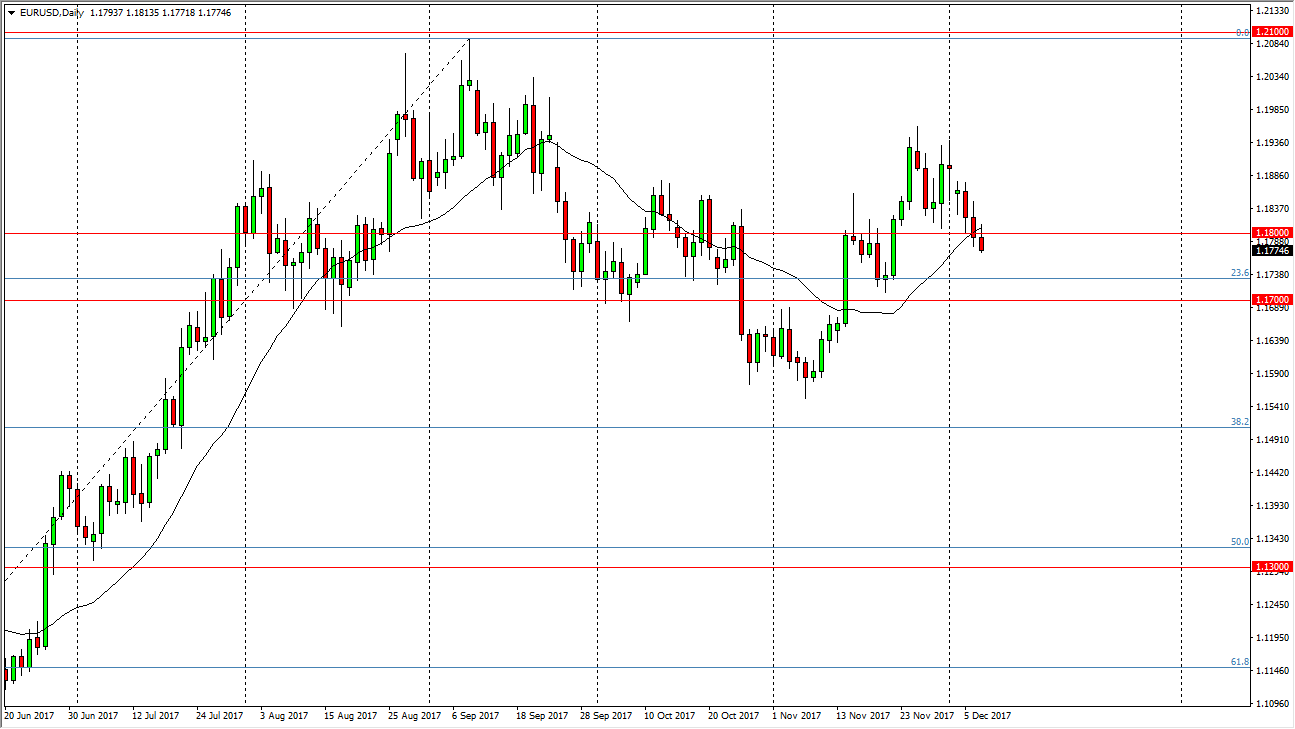

EUR/USD

The EUR/USD pair initially tried to rally during the trading session on Thursday, but found the area above the 1.18 level to be a bit too resistive. However, today is Nonfarm Payroll Friday, and that means that we will how volatility. This could give us an idea as to where the US dollar does next, which of course has a massive effect on this pair. Ultimately, I think that we will eventually find buyers as the 1.17 level should be rather important. I am looking for some type of bounce after the jobs number to get involved and start buying again. If we don’t get that, I would be a buyer above the top of the range for the session on Thursday. I don’t have any interest in shorting this market currently, but will reevaluate things if we break down below the 1.17 handle.

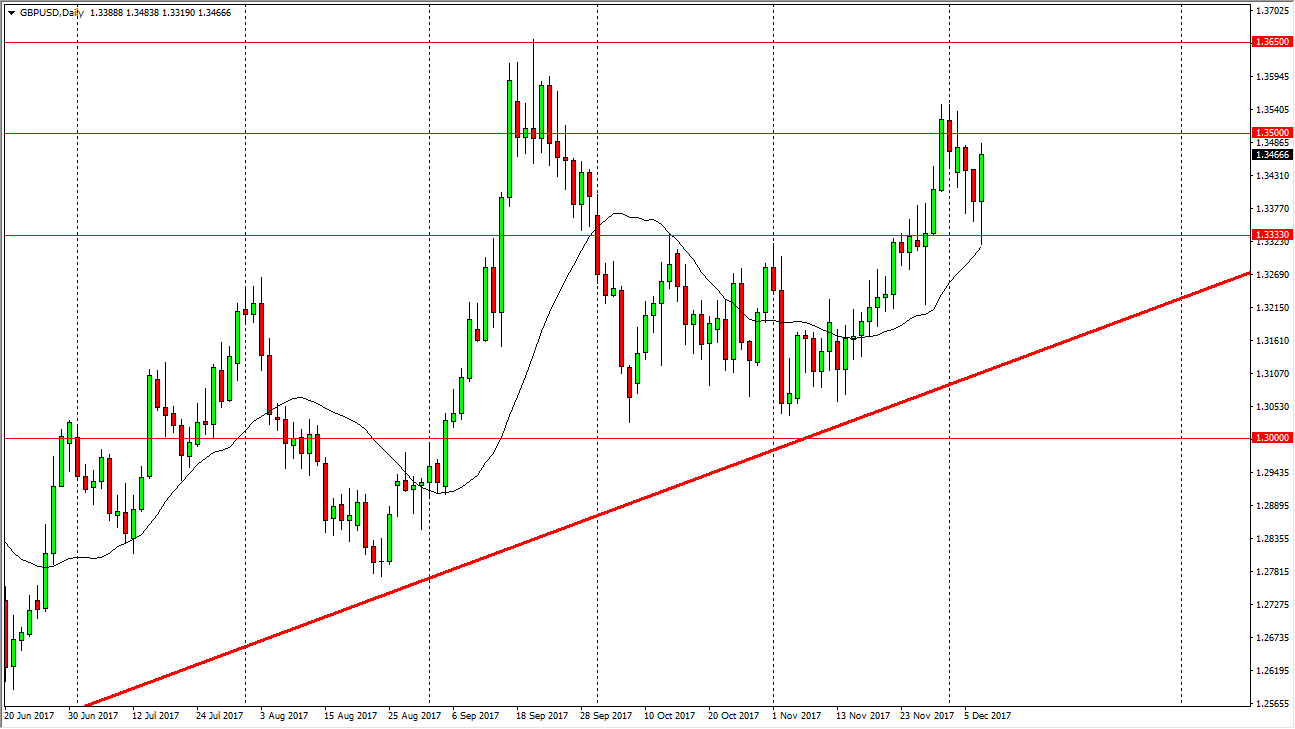

GBP/USD

The British pound initially fell during the trading session on Thursday, testing the vital 1.3333 handle, and then bounced enough to reach towards the 1.35 handle. If we can clear that area, the market should then go looking towards the 1.3650 level, which is a scene of massive resistance. I think that short-term pullbacks are buying opportunities, and I have no interest in shorting the British pound, although there is a certain amount of headline risk coming out of the negotiations between London and Brussels. Longer-term, I think we will break above the 1.3650 level, and go looking towards the 1.40 level above. That’s a longer-term call, and I do believe that eventually the British pound becomes more of a “buy-and-hold” scenario, so being patient is paramount to making profits in this market. I have no interest in shorting this market until we break down below the uptrend line on the chart.