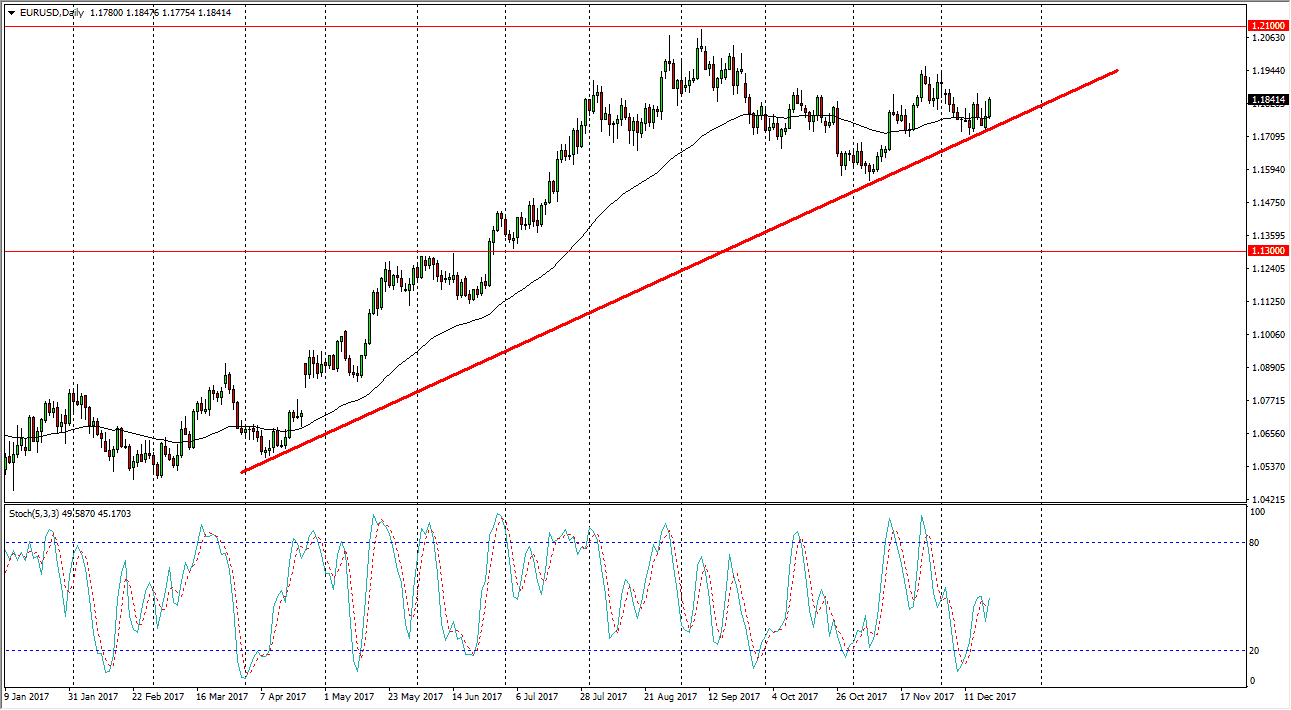

EUR/USD

The EUR/USD pair pulled back over the last several sessions, but during the day on Wednesday, we have seen bullish attitudes slip back into the market. The uptrend line of course has held, and therefore I think it’s only a matter of time before we go higher. Because of this, the market will probably go looking towards the 1.20 level above, perhaps to the 1.21 level above. A break above that sends this market much higher, so I think that we may have to pull back several times to build the necessary momentum to break out, but I do expect that to happen longer term. After today’s actions, I think that the buyers are starting to become a little bit more aggressive, but we should also keep in mind that this is a very illiquid time a year, so it’s possible that moves could be exaggerated.

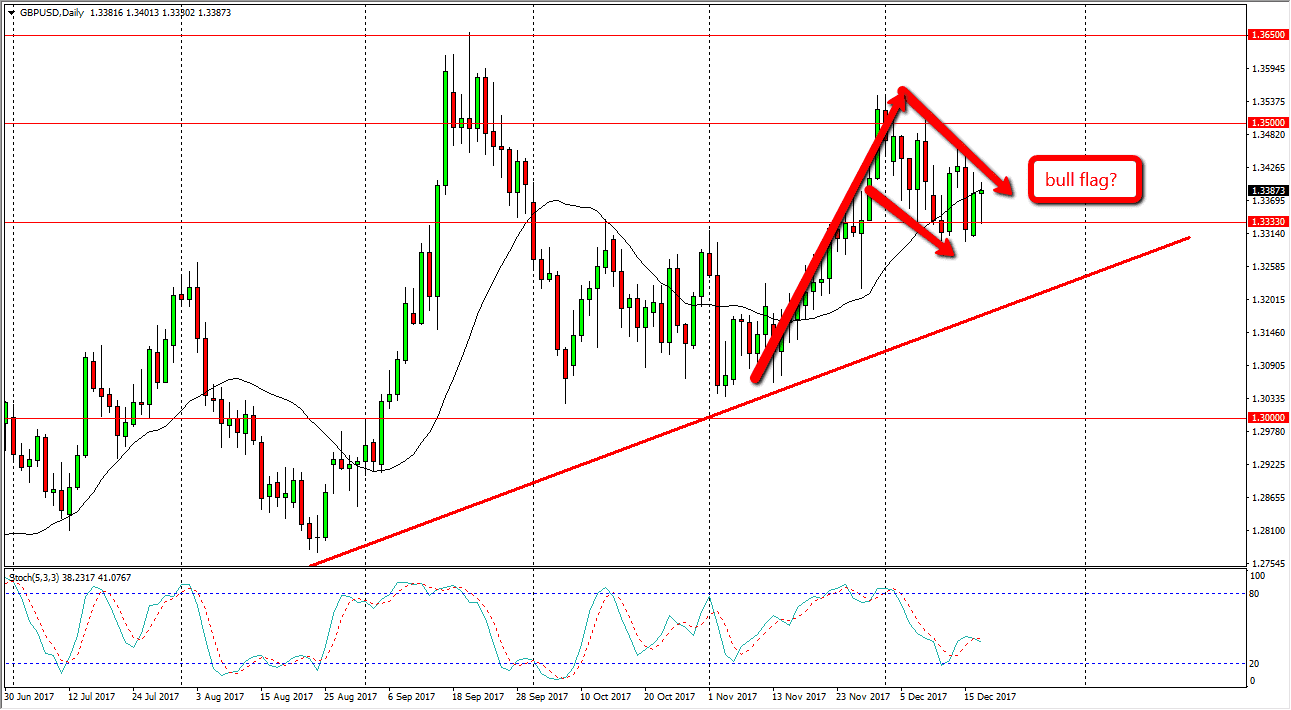

GBP/USD

The British pound fell initially during the trading session on Tuesday, but found enough support near the 1.3333 handle to turn around and form a hammer. The hammer is a very bullish sign, and I think if we break above the top of the range for the day, the market will probably go to the 1.35 level above. A break above that level is a sign that we should go to the 1.3650 level. A break above the top of the candle also signifies that we are back above the 20-day exponential moving average, which is also a very bullish sign. I have no interest in shorting this market, I believe there is more than enough support at the uptrend line to keep the market going forward. Longer-term, I believe that the market will break out during 2018, and offer is plenty of “buy-and-hold” opportunities.