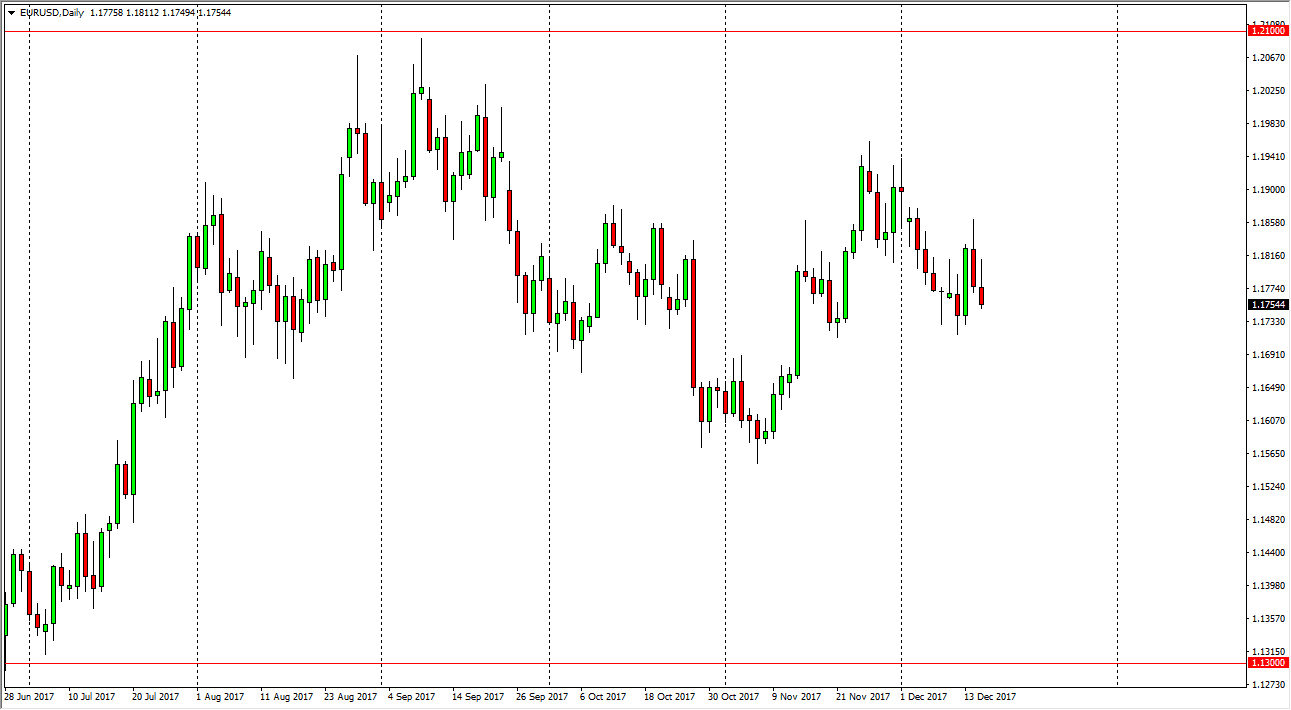

EUR/USD

The EUR/USD pair initially tried to rally during the trading session on Friday, but turned around to form a negative candle. By doing so, it looks like the market is forming a shooting star. The shooting star is a negative sign, but I think that the 1.17 level underneath should be supportive. I think a breakdown below there would be very negative, perhaps send in the market to the 1.15 handle. However, in the meantime I think that if we break above the top of the shooting star, the market should then go to the 1.1950 level. This is a market that I believe will continue to be very volatile and choppy, but longer-term I believe that we are going to the upside.

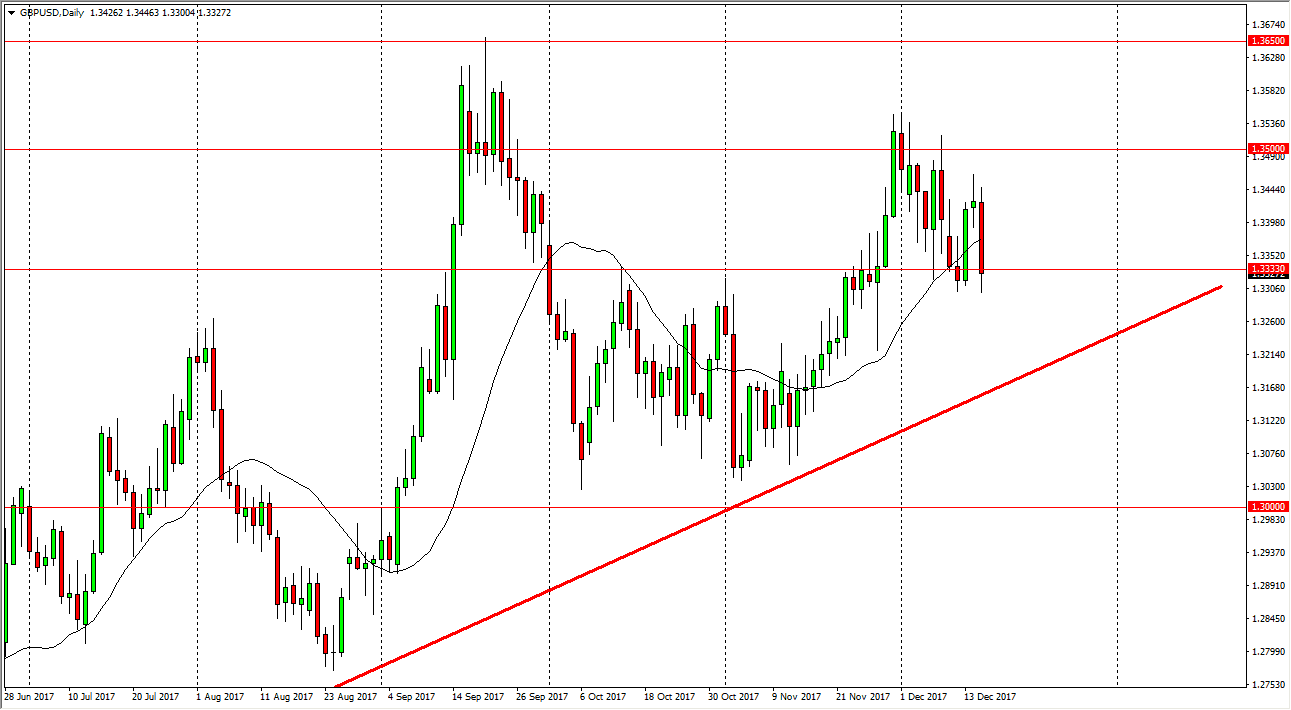

GBP/USD

The British pound initially tried to rally during the day on Friday, but then slashed lower and reached towards the 1.3333 handle. As an area that should continue to be of interest, and we bounced slightly at the end of the day, showing that the area does in fact remain important. I believe that the uptrend line underneath continues to be one of the main drivers technically speaking for the up move. When I look at this chart, and if I squint real hard, I can make out a slight bullish flag. It is because of this that I think that the pair is going to turn around given enough time, and therefore I think that buyers will probably jump in based upon value. If that’s the case, I expect the market to make a move towards the 1.35 level next. However, if we were to break down below the 1.31 handle, that would be negative enough to have the market break down significantly, with of course a reaction at the psychologically important 1.30 level