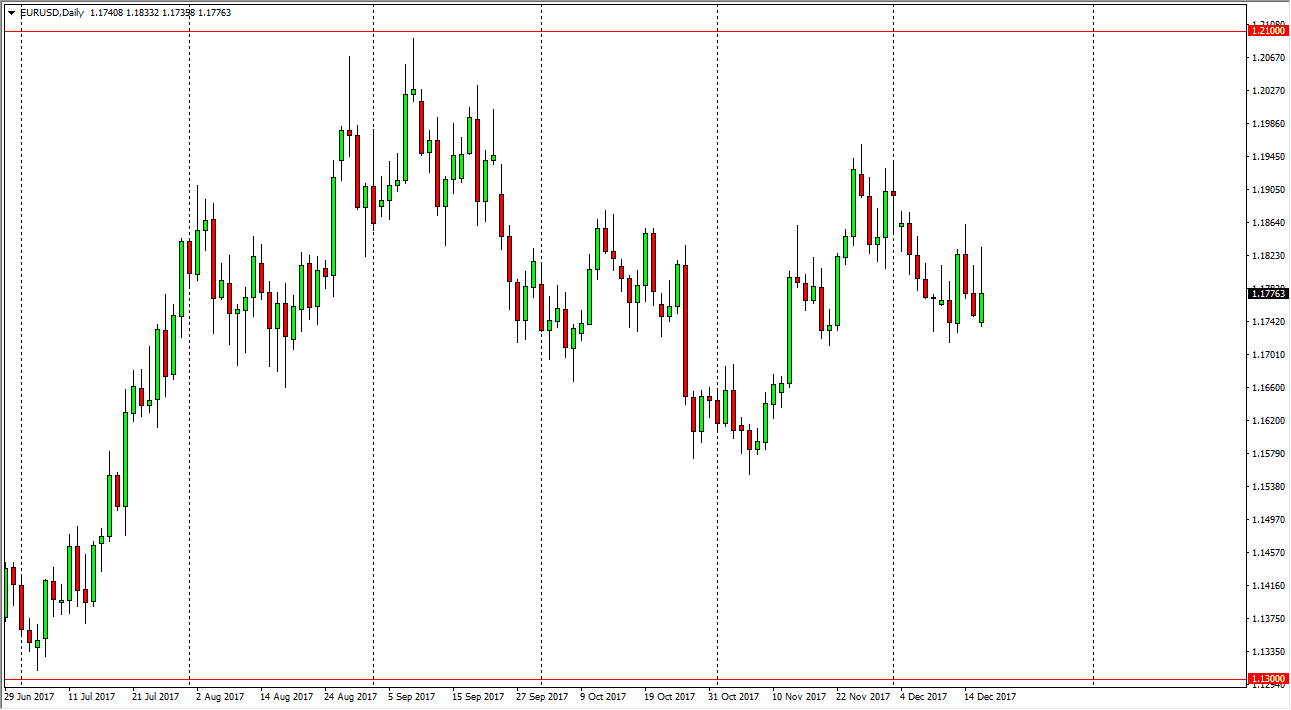

EUR/USD

The EUR/USD pair initially rally during the trading session on Monday, but gave back some of the gains. I believe that given enough time, the market should continue to go much higher, as we have been forming a large bullish flag on the weekly chart, and it is more than likely going to be triggered soon. I think that it might be after New Year’s, so in the meantime I believe that we are buyers, but we could get volatile moves occasionally. The liquidity is going to leave the marketplace, so large traders jumping in and out of the market could have more of an effect than usual. I believe that the 1.1575 level underneath is going to offer support, so if we can stay above there I am more inclined to be a buyer. Longer-term, I anticipate that we are going to go looking towards the highs of the 1.21 handle after that. Volatility is common this time year, so don’t be surprised by it.

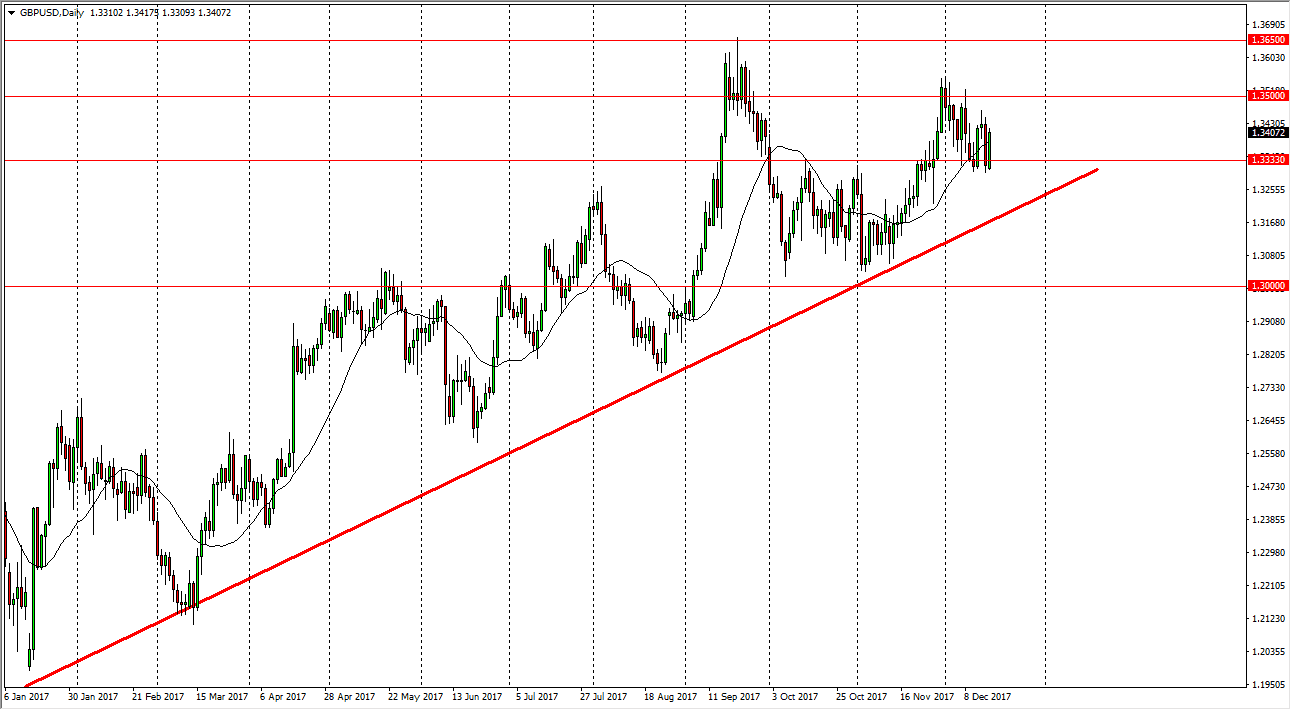

GBP/USD

The British pound rallied during the day, using the 1.3333 level for support yet again. I believe that the market is eventually going to rally towards the 1.35 handle, but you will more than likely need to keep a reasonably small trading position to take advantage of this move, as we have a lot of potential choppiness. I think that we will not only break above the 1.35 handle, the market should then go to the 1.3650 level. That is the scene of a major gap, so I think that it will continue to be resistive, but we will eventually break above there longer term. We have a nice uptrend line that we been following, so therefore I am a buyer and not a seller. There are a lot of potential headlines crossing the marketplace from the negotiation between the EU and the UK, so that could be influential as well.