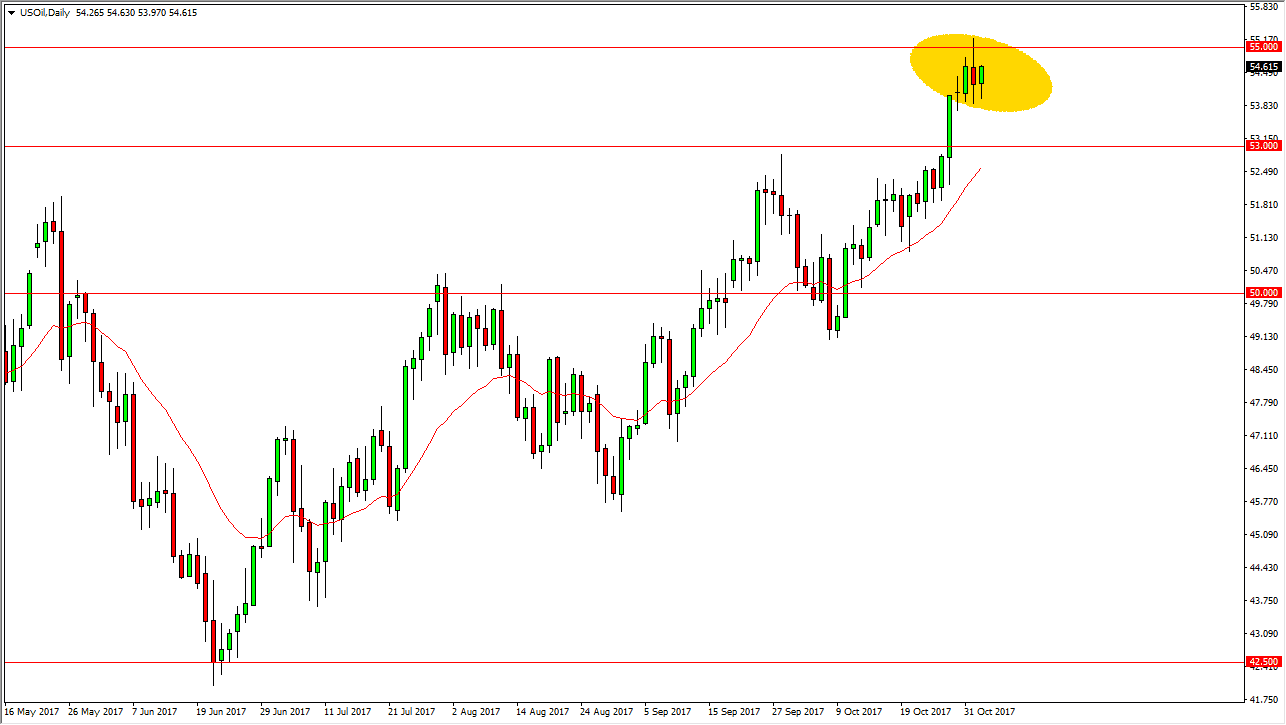

WTI Crude Oil

The WTI Crude Oil market initially fell during the trading session on Thursday, but found support underneath to turn around and form a positive candle. The $55 level above has been rather resistive, so I think we need to wait until the jobs number comes out before we can put money to work. At this point, I believe that a move above the $55 level sends this market looking for the $57.50 level next. Alternately, if we break down below the $54 handle, I then think that the market goes looking towards the $53 level, and then possibly the $50 level after that. Expect a lot of volatility, and of course pay attention to the US dollar, as it can give you an idea as to where the oil market may move as it tends to go in different directions.

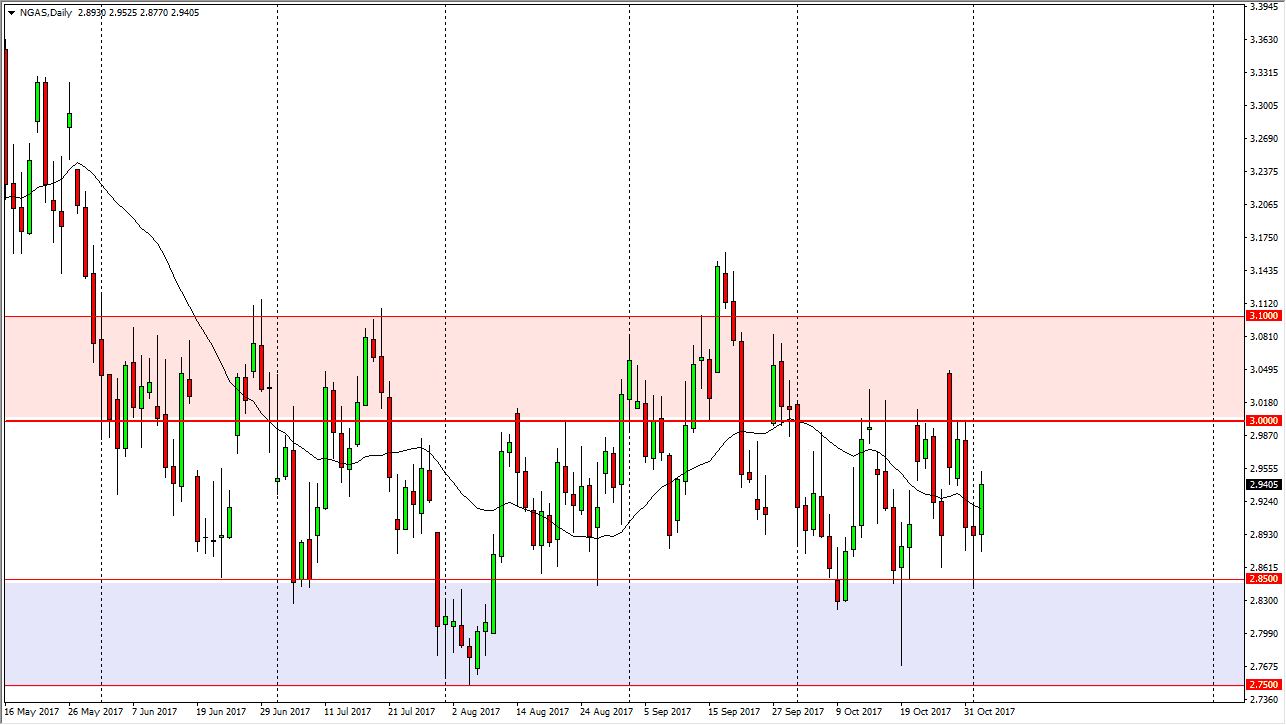

Natural Gas

Natural gas markets initially pulled back slightly during the day but then exploded to the upside. I think that there is a massive amount of resistance at the $3.00 level, as US fracking companies dump supply back into the market when we get to that area. I think there is a significant zone of resistance that extends to the $3.10 level above, so I’m waiting for some type of exhaustion to start selling again. The $2.85 level underneath should be supportive, as it has proven itself to be several times in the past. The $2.75 level underneath is also supportive, so I think a short-term traders may pick up this market if we pull back. Ultimately though, I prefer to sell this market on signs of exhaustion above, as it makes much more sense. Longer-term, I think the natural gas has a significant amount of problems to deal with, once that they can get past.